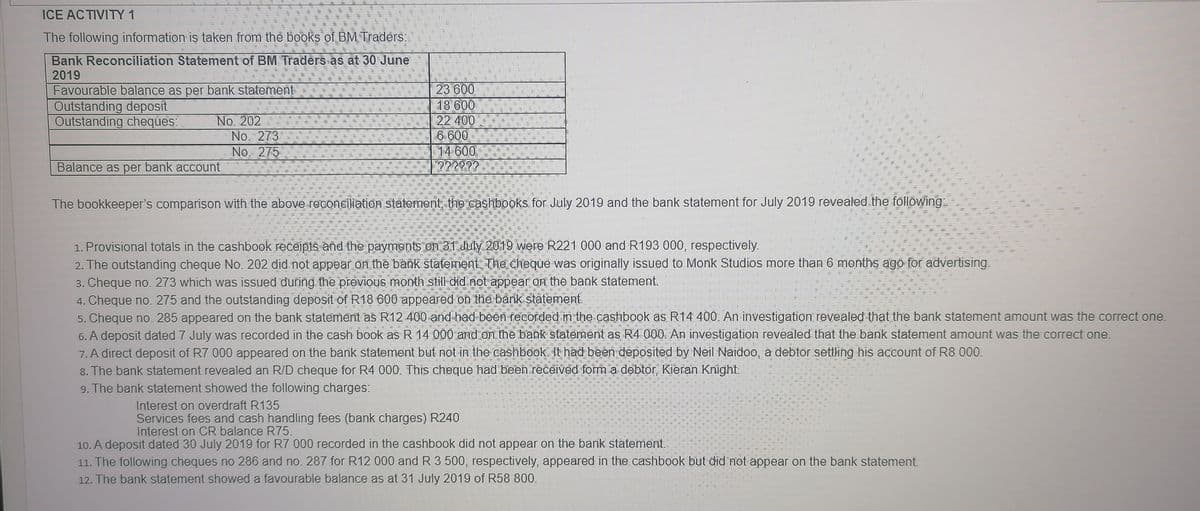

ICE ACTIVITY 1 The following information is taken from thế books of BM Tradérs: Bank Reconciliation Statement of BM Traders as at 30 June 2019 Favourable balance as per bank statement Outstanding deposit Outstanding cheques: 23 600 18 600 22 400 6.600 14 600 22202 No. 202 No. 273 No. 275 Balance as per bank account The bookkeeper's comparison with the above reconciiation statement, the cashbooks for July 2019 and the bank statement for July 2019 revealed the following. 1. Provisional totals in the cashbook receipis and the payments on 31 ly 2019 were R221 000 and R193 000, respectively. 2. The outstanding cheque No. 202 did not appear on the bank stafement. The cheque was originally issued to Monk Studios more than 6 months ago for advertising. 3. Cheque no. 273 which was issued during the previous month still did.not appear on the bank statement. 4. Cheque no. 275 and the outstanding deposit of R18 600 appeared on the bank statement. 5. Cheque no. 285 appeared on the bank statement as R12 400 and had-been recorded in the cashbook as R14 400. An investigation revealed that the bank statement amount was the correct one. 6. A deposit dated 7 July was recorded in the cash book as R 14 000 and on the bank statement as R4 000. An investigation revealed that the bank statement amount was the correct one. 7. A direct deposit of R7 000 appeared on the bank statement but not in the cashbook. It had been déposited by Neil Naidoo, a debtor settling his account of R8 000. 8. The bank statement revealed an R/D cheque for R4 000. This cheque had been received form a debtor, Kieran Knight 9. The bank statement showed the following charges: Interest on overdraft R135 Services fees and cash handling fees (bank charges) R240 Interest on CR balance R75. 10. A deposit dated 30 July 2019 for R7 000 recorded in the cashbook did not appear on the bank statement 11. The following cheques no 286 and no. 287 for R12 000 and R 3 500, respectively, appeared 12. The bank statement showed a favourable balance as at 31 July 2019 of R58 800. the cashbook but did not appear on the bank statement.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Use the information taken from BM traders to complete the following:

1.the bank account for huly 2019 (note that you need to calculate the opening balance of the bank account on 1 july 2019). Balance the account.

2.the

Step by step

Solved in 3 steps with 2 images