Bank reconciliation using: a. Bank to book method; b.Book to bank method; and c.Adjusted balance method

Bank reconciliation using: a. Bank to book method; b.Book to bank method; and c.Adjusted balance method

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 16CE

Related questions

Question

100%

Provide solution on the following requirements.

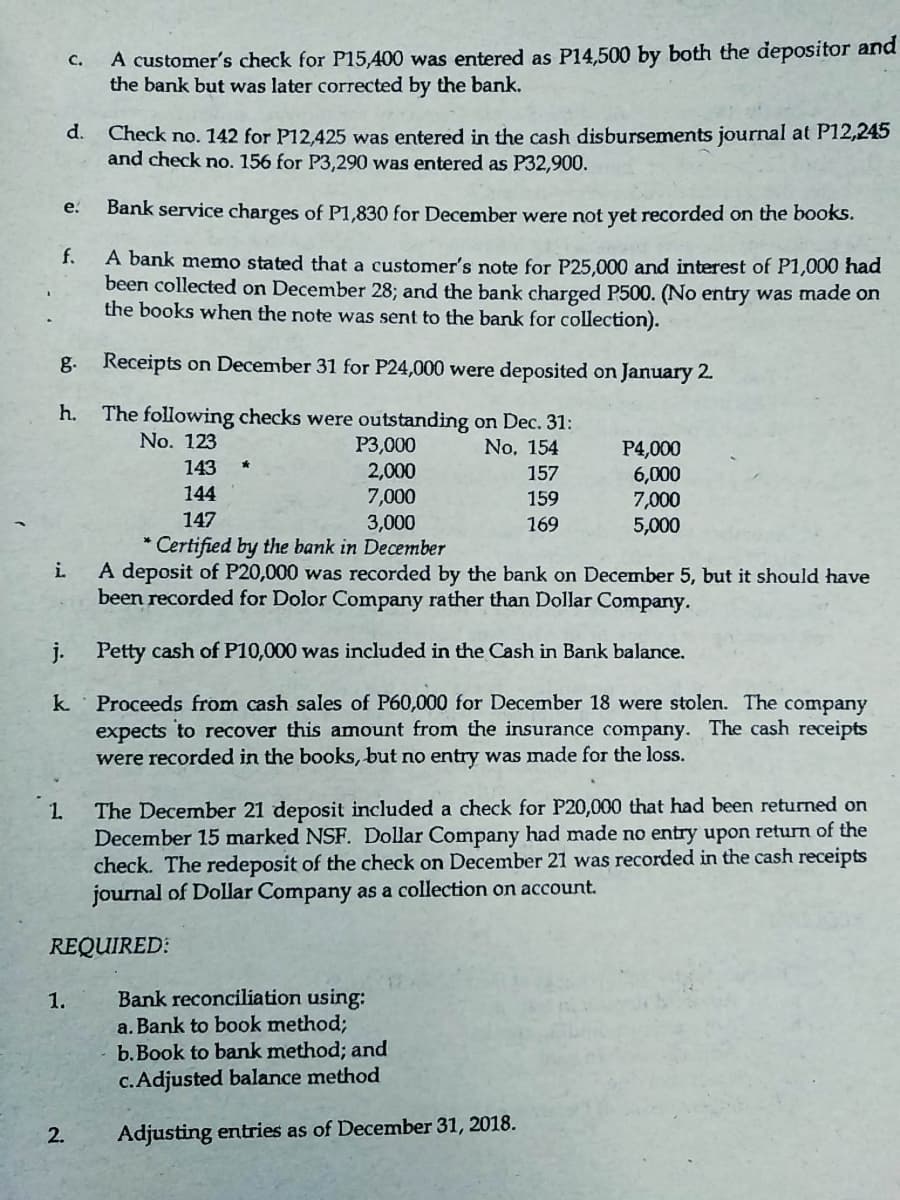

Transcribed Image Text:A customer's check for P15,400 was entered as P14,500 by both the depositor and

the bank but was later corrected by the bank.

C.

d.

Check no. 142 for P12,425 was entered in the cash disbursements journal at P12,245

and check no. 156 for P3,290 was entered as P32,900.

e.

Bank service charges of P1,830 for December were not yet recorded on the books.

f.

A bank memo stated that a customer's note for P25,000 and interest of P1,000 had

been collected on December 28; and the bank charged P500. (No entry was made on

the books when the note was sent to the bank for collection).

g.

Receipts on December 31 for P24,000 were deposited on January 2.

h.

The following checks were outstanding on Dec. 31:

No. 123

Р3,000

2,000

7,000

No. 154

P4,000

6,000

7,000

5,000

143

157

144

159

147

3,000

169

* Certified by the bank in December

A deposit of P20,000 was recorded by the bank on December 5, but it should have

been recorded for Dolor Company rather than Dollar Company.

i.

j. Petty cash of P10,000 was included in the Cash in Bank balance.

k. Proceeds from cash sales of P60,000 for December 18 were stolen. The company

expects to recover this amount from the insurance company. The cash receipts

were recorded in the books, but no entry was made for the loss.

The December 21 deposit included a check for P20,000 that had been returned on

December 15 marked NSF. Dollar Company had made no entry upon return of the

check. The redeposit of the check on December 21 was recorded in the cash receipts

journal of Dollar Company as a collection on account.

1.

REQUIRED:

Bank reconciliation using:

a. Bank to book method;

b.Book to bank method; and

c.Adjusted balance method

1.

2.

Adjusting entries as of December 31, 2018.

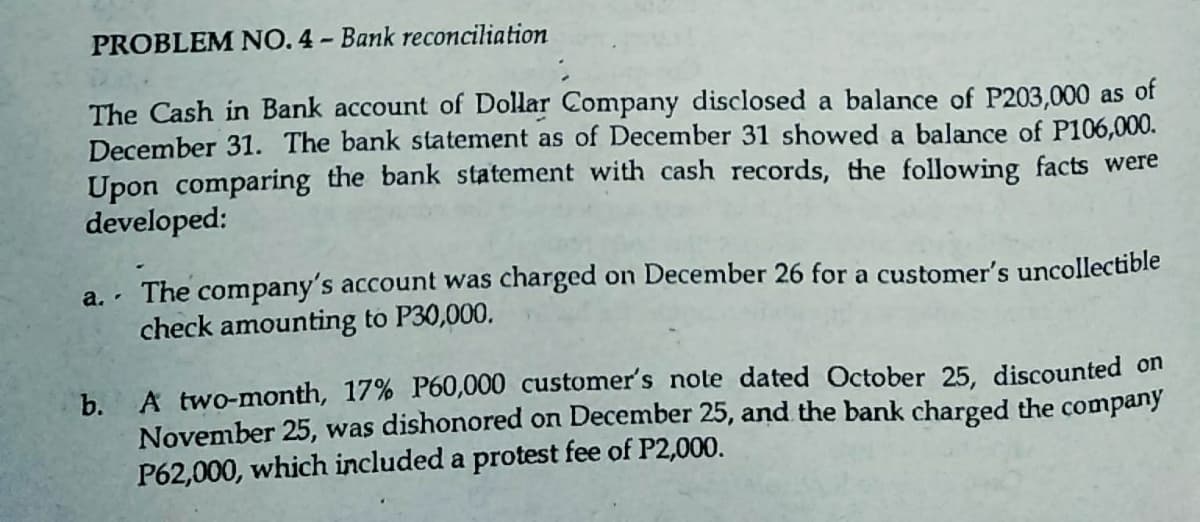

Transcribed Image Text:PROBLEM NO. 4 - Bank reconciliation

The Cash in Bank account of Dollar Company disclosed a balance of P203,000 as of

December 31. The bank statement as of December 31 showed a balance of P106,000.

Upon comparing the bank statement with cash records, the following facts were

developed:

a. . The company's account was charged on December 26 for a customer's uncollectible

check amounting to P30,000.

A two-month, 17% P60,000 customer's note dated October 25, discounted on

b.

November 25, was dishonored on December 25, and the bank charged the company

P62,000, which included a protest fee of P2,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning