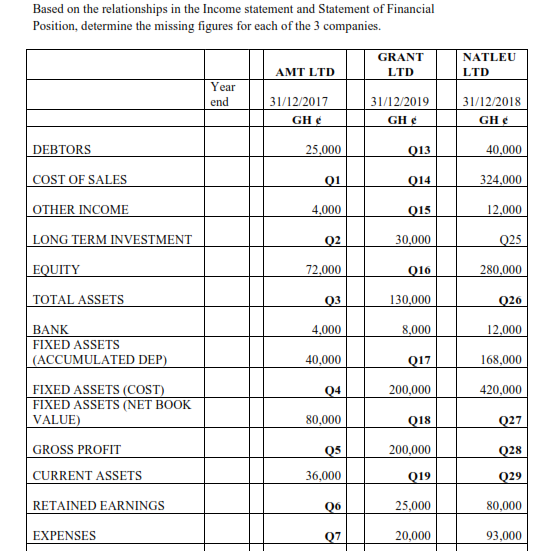

Based on the relationships in the Income statement and Statement of Financial Position, determine the missing figures for each of the 3 companies. GRANT NATLEU AMT LTD LTD LTD Year end 31/12/2017 31/12/2019 31/12/2018 GH e GH e GH e DEBTORS 25,000 013 40,000 COST OF SALES 014 324,000 OTHER INCOME 4,000 015 12,000 LONG TERM INVESTMENT Q2 30,000 Q25 EQUITY 72,000 Q16 280,000 TOTAL ASSETS Q3 130,000 Q26 BANK FIXED ASSETS (ACCUMULATED DEP) 4,000 8,000 12,000 40,000 Q17 168,000 FIXED ASSETS (COST) FIXED ASSETS (NET BOOK VALUE) Q4 200,000 420,000 80,000 Q18 Q27 GROSS PROFIT Q5 200,000 Q28 CURRENT ASSETS 36,000 Q19 Q29 RETAINED EARNINGS Q6 25,000 80,000 EXPENSES 07 20,000 93,000

Based on the relationships in the Income statement and Statement of Financial Position, determine the missing figures for each of the 3 companies. GRANT NATLEU AMT LTD LTD LTD Year end 31/12/2017 31/12/2019 31/12/2018 GH e GH e GH e DEBTORS 25,000 013 40,000 COST OF SALES 014 324,000 OTHER INCOME 4,000 015 12,000 LONG TERM INVESTMENT Q2 30,000 Q25 EQUITY 72,000 Q16 280,000 TOTAL ASSETS Q3 130,000 Q26 BANK FIXED ASSETS (ACCUMULATED DEP) 4,000 8,000 12,000 40,000 Q17 168,000 FIXED ASSETS (COST) FIXED ASSETS (NET BOOK VALUE) Q4 200,000 420,000 80,000 Q18 Q27 GROSS PROFIT Q5 200,000 Q28 CURRENT ASSETS 36,000 Q19 Q29 RETAINED EARNINGS Q6 25,000 80,000 EXPENSES 07 20,000 93,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

Transcribed Image Text:Based on the relationships in the Income statement and Statement of Financial

Position, determine the missing figures for each of the 3 companies.

GRANT

NATLEU

AMT LTD

LTD

LTD

Year

end

31/12/2017

31/12/2019

31/12/2018

GH e

GH e

GH e

DEBTORS

25,000

013

40,000

COST OF SALES

014

324,000

OTHER INCOME

4,000

015

12,000

LONG TERM INVESTMENT

Q2

30,000

Q25

EQUITY

72,000

Q16

280,000

TOTAL ASSETS

Q3

130,000

Q26

BANK

FIXED ASSETS

(ACCUMULATED DEP)

4,000

8,000

12,000

40,000

Q17

168,000

FIXED ASSETS (COST)

FIXED ASSETS (NET BOOK

VALUE)

Q4

200,000

420,000

80,000

Q18

Q27

GROSS PROFIT

Q5

200,000

Q28

CURRENT ASSETS

36,000

Q19

Q29

RETAINED EARNINGS

Q6

25,000

80,000

EXPENSES

07

20,000

93,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning