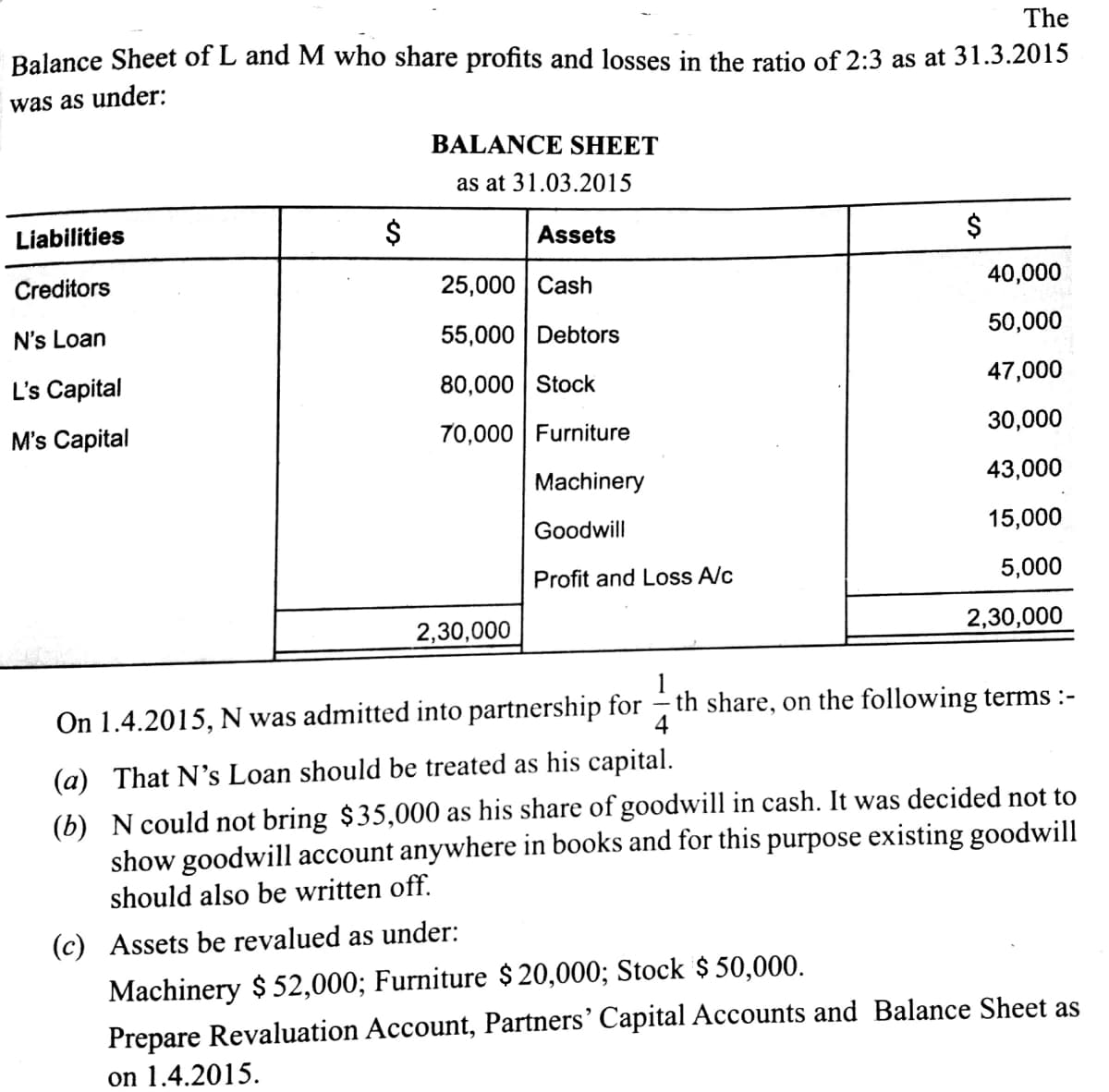

Balance Sheet of L and M who share profits and losses in the ratio of 2:3 as at 31.3.2015 vas as under: BALANCE SHEET as at 31.03.2015 Liabilities $ Assets $ Creditors 25,000 Cash 40,000 d's Loan 55,000 | Debtors 50,000 's Capital 80,000 Stock 47,000 I's Capital 70,000 | Furniture 30,000 Machinery 43,000 Goodwill 15,000 Profit and Loss A/c 5,000 2,30,000 2,30,000 1 On 1.4.2015, N was admitted into partnership for – th share, on the following terms :- 4 (a) That N's Loan should be treated as his capital. (b) N could not bring $35,000 as his share of goodwill in cash. It was decided not to show goodwill account anywhere in books and for this purpose existing goodwill should also be written off. (c) Assets be revalued as under: Machinery $ 52,000; Furniture $ 20,000; Stock $ 50,000. Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet as

Balance Sheet of L and M who share profits and losses in the ratio of 2:3 as at 31.3.2015 vas as under: BALANCE SHEET as at 31.03.2015 Liabilities $ Assets $ Creditors 25,000 Cash 40,000 d's Loan 55,000 | Debtors 50,000 's Capital 80,000 Stock 47,000 I's Capital 70,000 | Furniture 30,000 Machinery 43,000 Goodwill 15,000 Profit and Loss A/c 5,000 2,30,000 2,30,000 1 On 1.4.2015, N was admitted into partnership for – th share, on the following terms :- 4 (a) That N's Loan should be treated as his capital. (b) N could not bring $35,000 as his share of goodwill in cash. It was decided not to show goodwill account anywhere in books and for this purpose existing goodwill should also be written off. (c) Assets be revalued as under: Machinery $ 52,000; Furniture $ 20,000; Stock $ 50,000. Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet as

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 89E: Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and...

Related questions

Question

Transcribed Image Text:The

Balance Sheet of L and M who share profits and losses in the ratio of 2:3 as at 31.3.2015

was as under:

BALANCE SHEET

as at 31.03.2015

Liabilities

$

Assets

$

Creditors

25,000 | Cash

40,000

N's Loan

55,000 | Debtors

50,000

L's Capital

80,000 Stock

47,000

M's Capital

70,000 | Furniture

30,000

Machinery

43,000

Goodwill

15,000

Profit and Loss A/c

5,000

2,30,000

2,30,000

On 1.4.2015, N was admitted into partnership for

th share, on the following terms :-

(a) That N's Loan should be treated as his capital.

(b) N could not bring $35,000 as his share of goodwill in cash. It was decided not to

show goodwill account anywhere in books and for this purpose existing goodwill

should also be written off.

(c) Assets be revalued as under:

Machinery $ 52,000; Furniture $ 20,000; Stock $ 50,000.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet as

on 1.4.2015.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning