BE4.5 (LO 2, 3) Stacy Corporation had income from operations of an unusual and infrequent pretax loss of $770,000 from a volcano eruption, interest revenue of $17,000, and a write-down on buildings of $53,000. The corporation's tax rate is 30%. Prepare a partial income statement for Stacy beginning with Income from operations. The corporation had 5,000,000 shares of common stock outstanding during 2020. BE4.6 (LO 4) During 2020, Williamson Company changed from FIFO to weighted-average inven- cory pricing. Pretax income in 2019 and 2018 (Williamson's first year of operations) under FIFO wa: 5160,000 and $180,000, respectively. Pretax income using weighted-average pricing in the prior year vould have been $145,000 in 2019 and $170,000 in 2018. In 2020, Williamson reported pretax incom using weighted-average pricing) of $180,000. Show comparative income statements for Williamsor eginning with "Income before income tax," as presented on the 2020 income statement. (The tax ra a all 000. In it years is 30%.)

BE4.5 (LO 2, 3) Stacy Corporation had income from operations of an unusual and infrequent pretax loss of $770,000 from a volcano eruption, interest revenue of $17,000, and a write-down on buildings of $53,000. The corporation's tax rate is 30%. Prepare a partial income statement for Stacy beginning with Income from operations. The corporation had 5,000,000 shares of common stock outstanding during 2020. BE4.6 (LO 4) During 2020, Williamson Company changed from FIFO to weighted-average inven- cory pricing. Pretax income in 2019 and 2018 (Williamson's first year of operations) under FIFO wa: 5160,000 and $180,000, respectively. Pretax income using weighted-average pricing in the prior year vould have been $145,000 in 2019 and $170,000 in 2018. In 2020, Williamson reported pretax incom using weighted-average pricing) of $180,000. Show comparative income statements for Williamsor eginning with "Income before income tax," as presented on the 2020 income statement. (The tax ra a all 000. In it years is 30%.)

Chapter5: Corporations: Earnings & Profits And Dividend Distributions

Section: Chapter Questions

Problem 26P

Related questions

Question

I need help with these brief exercises 4 and 5 for this assignment in accounting.

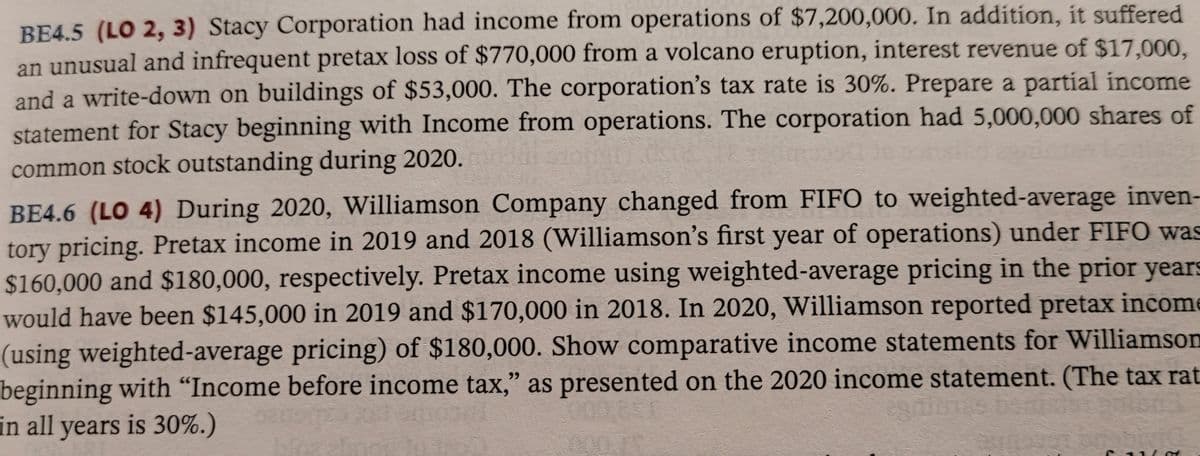

Transcribed Image Text:BE4.5 (LO 2, 3) Stacy Corporation had income from operations of $7,200,000. In addition, it suffered

an unusual and infrequent pretax loss of $770,000 from a volcano eruption, interest revenue of $17,000,

and a write-down on buildings of $53,000. The corporation's tax rate is 30%. Prepare a partial income

statement for Stacy beginning with Income from operations. The corporation had 5,000,000 shares of

common stock outstanding during 2020.

BE4.6 (LO 4) During 2020, Williamson Company changed from FIFO to weighted-average inven-

tory pricing. Pretax income in 2019 and 2018 (Williamson's first year of operations) under FIFO was

$160,000 and $180,000, respectively. Pretax income using weighted-average pricing in the prior years

would have been $145,000 in 2019 and $170,000 in 2018. In 2020, Williamson reported pretax income

(using weighted-average pricing) of $180,000. Show comparative income statements for Williamson

beginning with “Income before income tax," as presented on the 2020 income statement. (The tax rat

in all years is 30%.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you