Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets $ 90,000 136,000 62,000 210,000 Cash Accounts receivable Inventory Plant and equipment, net of depreciation Total assets $498,000 Liabilities and Stockholders' Equity Accounts payable $ 71,100 327,000 99,900 Common stock Retained earnings $498,000 Total liabilities and stockholders' equity ech's managers have made the following additional assumptions and estimates: . Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively. . All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65 in the month following the sale. All of the accounts receivable at June 30 will be collected in July. E. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month followim the purchase. All of the accounts payable at June 30 will be paid in July. 1. Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation exper and the remaining $55,000 relates to expenses that are paid in the month they are incurred. 5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The compar its own stock during the quarter ended September 30.

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets $ 90,000 136,000 62,000 210,000 Cash Accounts receivable Inventory Plant and equipment, net of depreciation Total assets $498,000 Liabilities and Stockholders' Equity Accounts payable $ 71,100 327,000 99,900 Common stock Retained earnings $498,000 Total liabilities and stockholders' equity ech's managers have made the following additional assumptions and estimates: . Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively. . All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65 in the month following the sale. All of the accounts receivable at June 30 will be collected in July. E. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month followim the purchase. All of the accounts payable at June 30 will be paid in July. 1. Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation exper and the remaining $55,000 relates to expenses that are paid in the month they are incurred. 5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The compar its own stock during the quarter ended September 30.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

100%

![[The following information applies to the questions displayed below.]

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar

year. The company's balance sheet as of June 30th is shown below:

Beech Corporation

Balance Sheet

June 30

Assets

$ 90,000

136,000

62,000

Cash

Accounts receivable

Inventory

Plant and equipment, net of depreciation

210,000

Total assets

$498,000

Liabilities and Stockholders' Equity

Accounts payable

$ 71,100

327,000

99,900

Common stock

Retained earnings

$498,000

Total liabilities and stockholders' equity

Beech's managers have made the following additional assumptions and estimates:

1. Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively.

2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65%

in the month following the sale. All of the accounts receivable at June 30 will be collected in July.

3. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The

company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following

the purchase. All of the accounts payable at June 30 will be paid in July.

4. Monthly selling and administrative expenses are always $60,00O. Each month $5,000 of this total amount is depreciation expense

and the remaining $55,000 relates to expenses that are paid in the month they are incurred.

5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company

does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe44ae214-cf2d-4904-b0ba-adbb4991fe6c%2F299a067d-281c-4bd4-b119-b5237d93a911%2Fk6rnc07_processed.jpeg&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar

year. The company's balance sheet as of June 30th is shown below:

Beech Corporation

Balance Sheet

June 30

Assets

$ 90,000

136,000

62,000

Cash

Accounts receivable

Inventory

Plant and equipment, net of depreciation

210,000

Total assets

$498,000

Liabilities and Stockholders' Equity

Accounts payable

$ 71,100

327,000

99,900

Common stock

Retained earnings

$498,000

Total liabilities and stockholders' equity

Beech's managers have made the following additional assumptions and estimates:

1. Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively.

2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65%

in the month following the sale. All of the accounts receivable at June 30 will be collected in July.

3. Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The

company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following

the purchase. All of the accounts payable at June 30 will be paid in July.

4. Monthly selling and administrative expenses are always $60,00O. Each month $5,000 of this total amount is depreciation expense

and the remaining $55,000 relates to expenses that are paid in the month they are incurred.

5. The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30. The company

does not plan to issue any common stock or repurchase its own stock during the quarter ended September 30.

Transcribed Image Text:Check my work

!

Required information

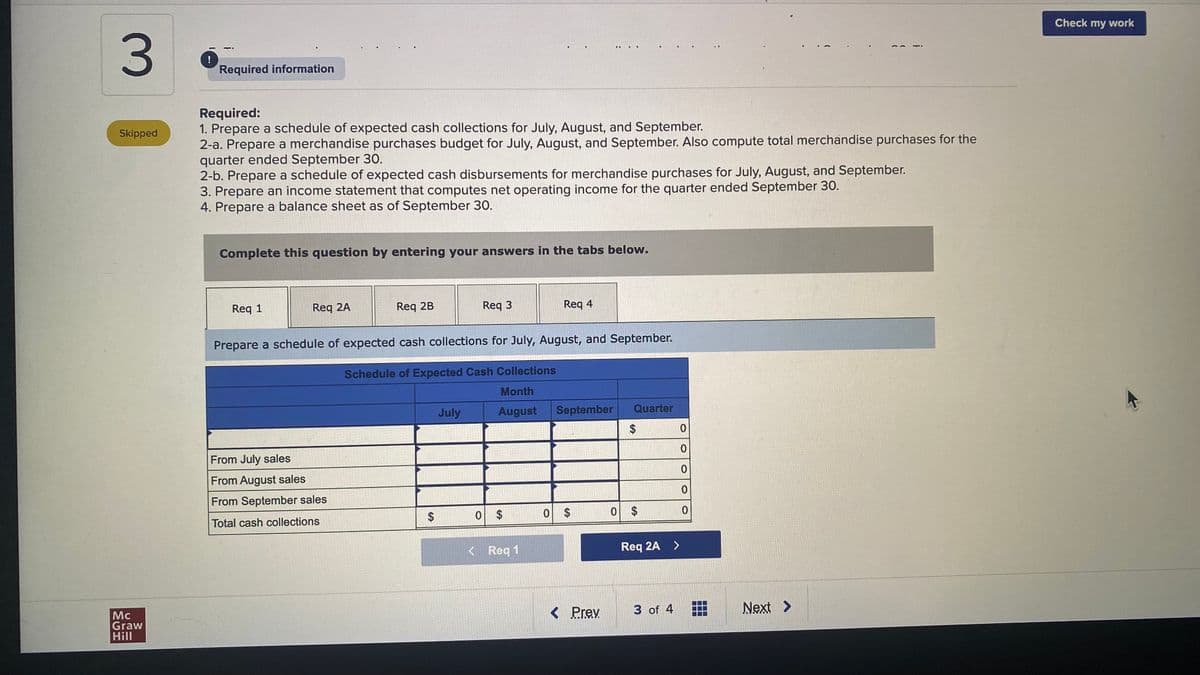

Required:

1. Prepare a schedule of expected cash collections for July, August, and September.

2-a. Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the

quarter ended September 30.

2-b. Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September.

3. Prepare an income statement that computes net operating income for the quarter ended September 30.

4. Prepare a balance sheet as of September 30.

Skipped

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

Req 3

Req 4

Prepare a schedule of expected cash collections for July, August, and September.

Schedule of Expected Cash Collections

Month

July

August

September

Quarter

2$

From July sales

From August sales

From September sales

Total cash collections

0 $

0 $

0 $

< Req 1

Req 2A >

Mc

Graw

Hill

< Prev

3 of 4

Next >

%24

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College