BEFORE the imposition of the tax, the quantity traded in this market is [ Select ] the buyers pay ( Select ] and the sellers receive ( Select] AFTER the imposition of the tax, the quantity traded is (Select ) ; the buyers pay [ Select ] v and the sellers receive [ Select) BEFORE the imposition of the tax, consumer surplus was [ Select ] and producer surplus was ( Select] therefore, total surplus was [ Select ] AFTER the imposition of the tax, consumer surplus is. [Select ] producer surplus is ( Select] , government tax revenue is ( Select ] ; therefore, now the total surplus is ( Select ) and deadweight loss is [ Select ] The burden of the per unit tax on the buyers is ( Select ] The burden of the tax on the sellers is [ Select] Since the demand curve is ( Select] v the supply curve, the burden of the tax falls ( Select )

BEFORE the imposition of the tax, the quantity traded in this market is [ Select ] the buyers pay ( Select ] and the sellers receive ( Select] AFTER the imposition of the tax, the quantity traded is (Select ) ; the buyers pay [ Select ] v and the sellers receive [ Select) BEFORE the imposition of the tax, consumer surplus was [ Select ] and producer surplus was ( Select] therefore, total surplus was [ Select ] AFTER the imposition of the tax, consumer surplus is. [Select ] producer surplus is ( Select] , government tax revenue is ( Select ] ; therefore, now the total surplus is ( Select ) and deadweight loss is [ Select ] The burden of the per unit tax on the buyers is ( Select ] The burden of the tax on the sellers is [ Select] Since the demand curve is ( Select] v the supply curve, the burden of the tax falls ( Select )

Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter4: Demand And Demand: Applications And Extensions

Section: Chapter Questions

Problem 5CQ

Related questions

Question

Transcribed Image Text:P

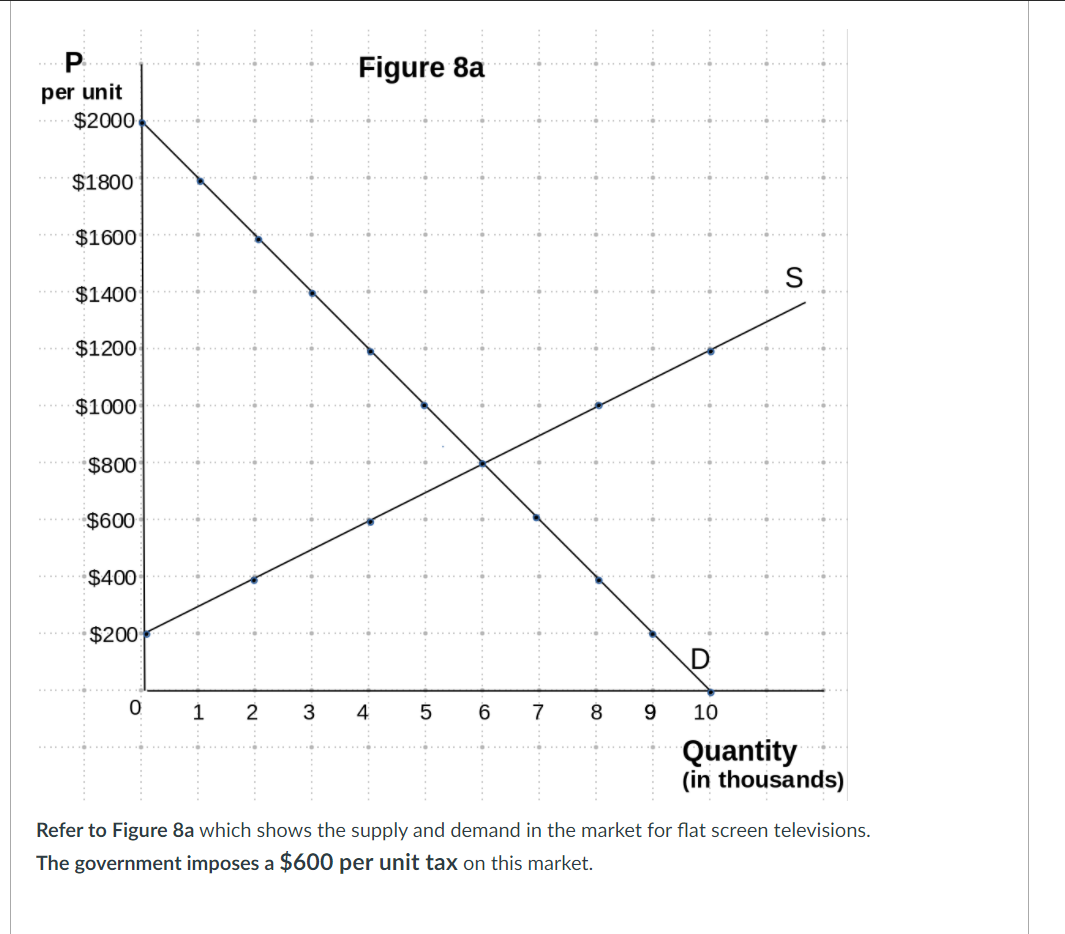

Figure 8a

per unit

$2000

$1800

$1600

$1400

$1200

$1000

$800

$600

$400

$200

2

4

7

8

9.

10

Quantity

(in thousands)

Refer to Figure 8a which shows the supply and demand in the market for flat screen televisions.

The government imposes a $600 per unit tax on this market.

![D

2

3

4

6

7

8

9

10

Quantity

(in thousands)

Refer to Figure 8a which shows the supply and demand in the market for flat screen televisions.

The government imposes a $600 per unit tax on this market.

BEFORE the imposition of the tax, the quantity traded in this market is

[ Select ]

the buyers pay [Select ]

and the

sellers receive [ Select]

AFTER the imposition of the tax, the quantity traded is (Select ]

; the buyers pay

[ Select ]

and the sellers receive

[ Select ]

BEFORE the imposition of the tax, consumer surplus was

[ Select ]

v and producer surplus was

[ Select ]

therefore, total

surplus was

[ Select]

AFTER the imposition of the tax, consumer surplus is. [ Select ]

, producer surplus is [ Select]

government tax revenue

is [ Select ]

; therefore, now the total surplus is [Select]

v and deadweight loss is [Select ]

The burden of the per unit tax on the buyers is [Select]

The burden of the tax on the sellers is [ Select ]

Since the demand curve is [ Select]

v the supply curve, the burden of the tax falls [Select ]](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb40fa447-d3c2-41e2-8596-d1d31b5ac1d4%2F49b3264b-772d-4b6a-8d01-cbef5c3b3a4f%2F422r9j_processed.png&w=3840&q=75)

Transcribed Image Text:D

2

3

4

6

7

8

9

10

Quantity

(in thousands)

Refer to Figure 8a which shows the supply and demand in the market for flat screen televisions.

The government imposes a $600 per unit tax on this market.

BEFORE the imposition of the tax, the quantity traded in this market is

[ Select ]

the buyers pay [Select ]

and the

sellers receive [ Select]

AFTER the imposition of the tax, the quantity traded is (Select ]

; the buyers pay

[ Select ]

and the sellers receive

[ Select ]

BEFORE the imposition of the tax, consumer surplus was

[ Select ]

v and producer surplus was

[ Select ]

therefore, total

surplus was

[ Select]

AFTER the imposition of the tax, consumer surplus is. [ Select ]

, producer surplus is [ Select]

government tax revenue

is [ Select ]

; therefore, now the total surplus is [Select]

v and deadweight loss is [Select ]

The burden of the per unit tax on the buyers is [Select]

The burden of the tax on the sellers is [ Select ]

Since the demand curve is [ Select]

v the supply curve, the burden of the tax falls [Select ]

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning