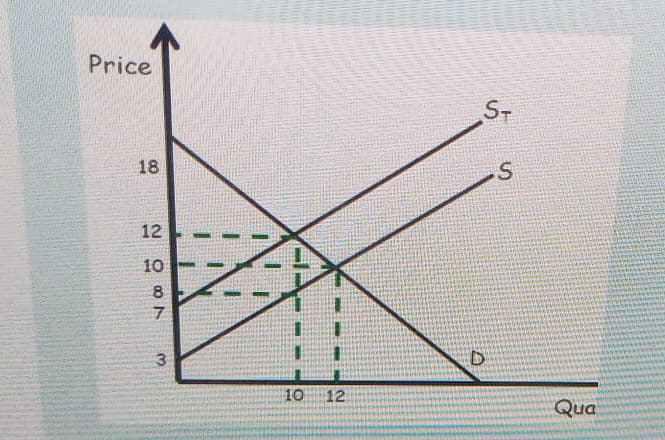

Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and ST is the supply curve after tax. For the market for cigarettes without the tax, indicate: (i) Price paid by consumers (ii) Price paid by producers (iii) Quantity of cigarettes sold (iv) Buyer's reservation price (v) Seller's reservation price

Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and ST is the supply curve after tax. For the market for cigarettes without the tax, indicate: (i) Price paid by consumers (ii) Price paid by producers (iii) Quantity of cigarettes sold (iv) Buyer's reservation price (v) Seller's reservation price

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 18RQ: What is deflation?

Related questions

Question

Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions. D is the

(i)

(ii) Price paid by producers

(iii) Quantity of cigarettes sold

(iv) Buyer's reservation price

(v) Seller's reservation price

Transcribed Image Text:Price

S-

18

12

10

8

7

3.

10

12

Qua

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax