Beg. Inventory 50% Complete as to Assembly materials; 20% complete 3,000 as to Conversion units 45,000 Transferred In during the year units 40,000 Transferred to Packaging Department units 4,000 Ending Inventory 80% complete units Cost Data: Transferred-In Materials Conversion Current Period P 1,240,800 P 97,020 P 236,470 Work in Process, beginning 82,200 6,660 11,930 nage product are identified on inspection when the Assembly process is 70% complete, Issembly materials has been added at this point of the process. The normal rejection

Beg. Inventory 50% Complete as to Assembly materials; 20% complete 3,000 as to Conversion units 45,000 Transferred In during the year units 40,000 Transferred to Packaging Department units 4,000 Ending Inventory 80% complete units Cost Data: Transferred-In Materials Conversion Current Period P 1,240,800 P 97,020 P 236,470 Work in Process, beginning 82,200 6,660 11,930 nage product are identified on inspection when the Assembly process is 70% complete, Issembly materials has been added at this point of the process. The normal rejection

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter6: Process Costing

Section: Chapter Questions

Problem 45E: Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent...

Related questions

Question

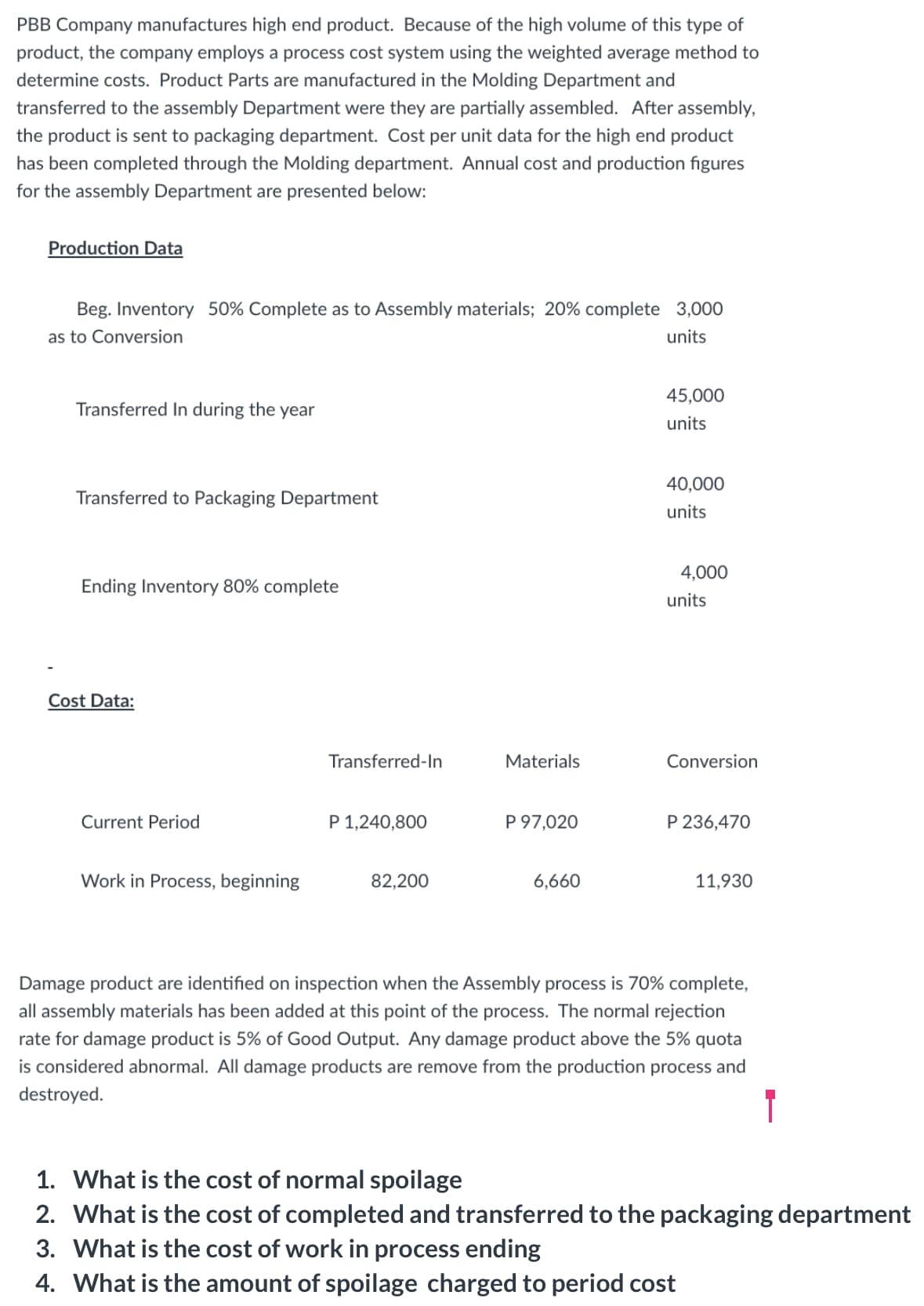

Transcribed Image Text:PBB Company manufactures high end product. Because of the high volume of this type of

product, the company employs a process cost system using the weighted average method to

determine costs. Product Parts are manufactured in the Molding Department and

transferred to the assembly Department were they are partially assembled. After assembly,

the product is sent to packaging department. Cost per unit data for the high end product

has been completed through the Molding department. Annual cost and production figures

for the assembly Department are presented below:

Production Data

Beg. Inventory 50% Complete as to Assembly materials; 20% complete 3,000

as to Conversion

units

45,000

Transferred In during the year

units

40,000

Transferred to Packaging Department

units

4,000

Ending Inventory 80% complete

units

Cost Data:

Transferred-In

Materials

Conversion

Current Period

P 1,240,800

P 97,020

P 236,470

Work in Process, beginning

82,200

6,660

11,930

Damage product are identified on inspection when the Assembly process is 70% complete,

all assembly materials has been added at this point of the process. The normal rejection

rate for damage product is 5% of Good Output. Any damage product above the 5% quota

is considered abnormal. All damage products are remove from the production process and

destroyed.

1. What is the cost of normal spoilage

2. What is the cost of completed and transferred to the packaging department

3. What is the cost of work in process ending

4. What is the amount of spoilage charged to period cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning