Beginning inventory, purchases, and sales for Item FK7 are as follows: Sept. 1 Inventory 115 units at $255 10 Sale 100 units 18 Purchase 110 units at $260 27 Sale 105 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30. a. Cost of merchandise sold on September 27 b. Inventory on September 30

Beginning inventory, purchases, and sales for Item FK7 are as follows: Sept. 1 Inventory 115 units at $255 10 Sale 100 units 18 Purchase 110 units at $260 27 Sale 105 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30. a. Cost of merchandise sold on September 27 b. Inventory on September 30

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 3PEA: Beginning inventory, purchases, and sales for Item Gidget are as follows: Assuming a perpetual...

Related questions

Topic Video

Question

Transcribed Image Text:Me How

Calculator

Print Item

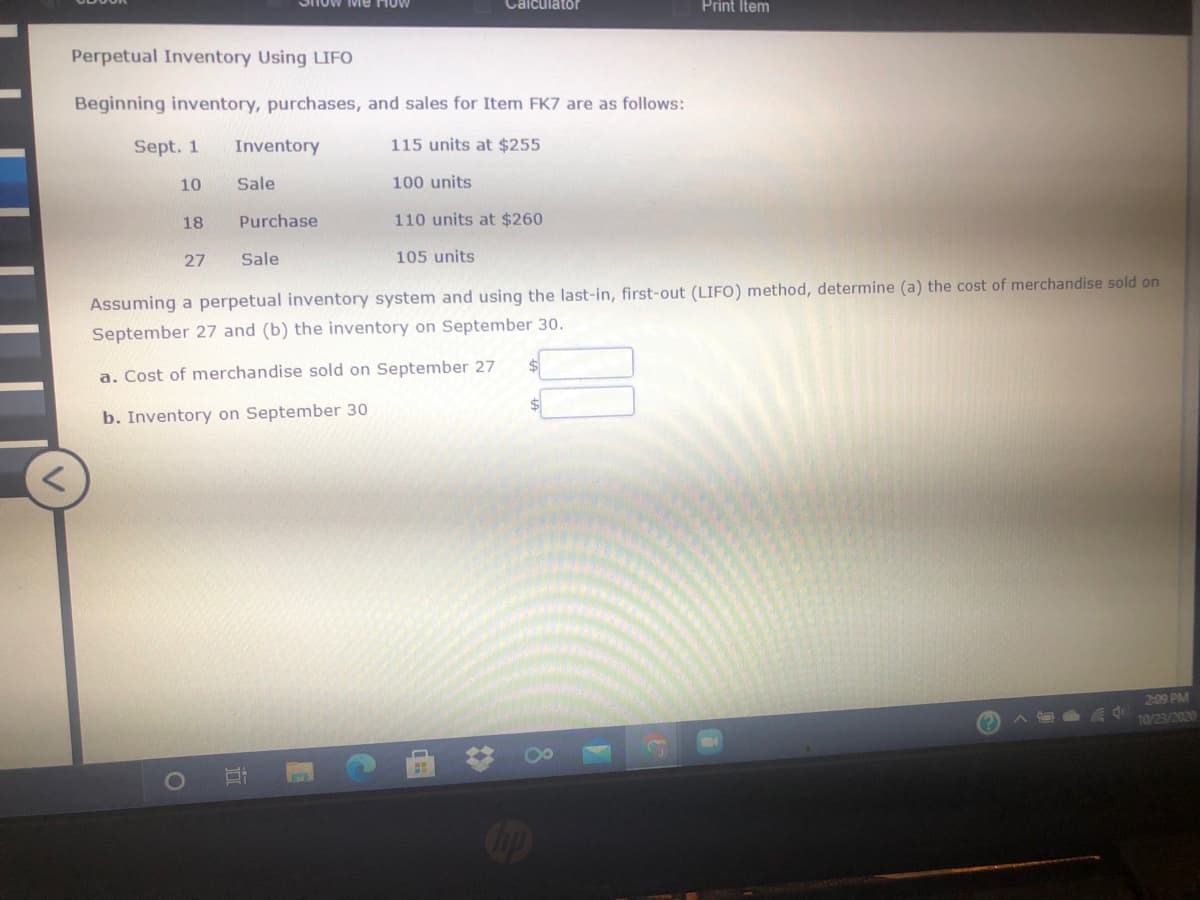

Perpetual Inventory Using LIFO

Beginning inventory, purchases, and sales for Item FK7 are as follows:

Sept. 1

Inventory

115 units at $255

10

Sale

100 units

18

Purchase

110 units at $260

27

Sale

105 units

Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on

September 27 and (b) the inventory on September 30.

a. Cost of merchandise sold on September 27

$4

b. Inventory on September 30

2:09 PM

10/23/2020

Cop

8.

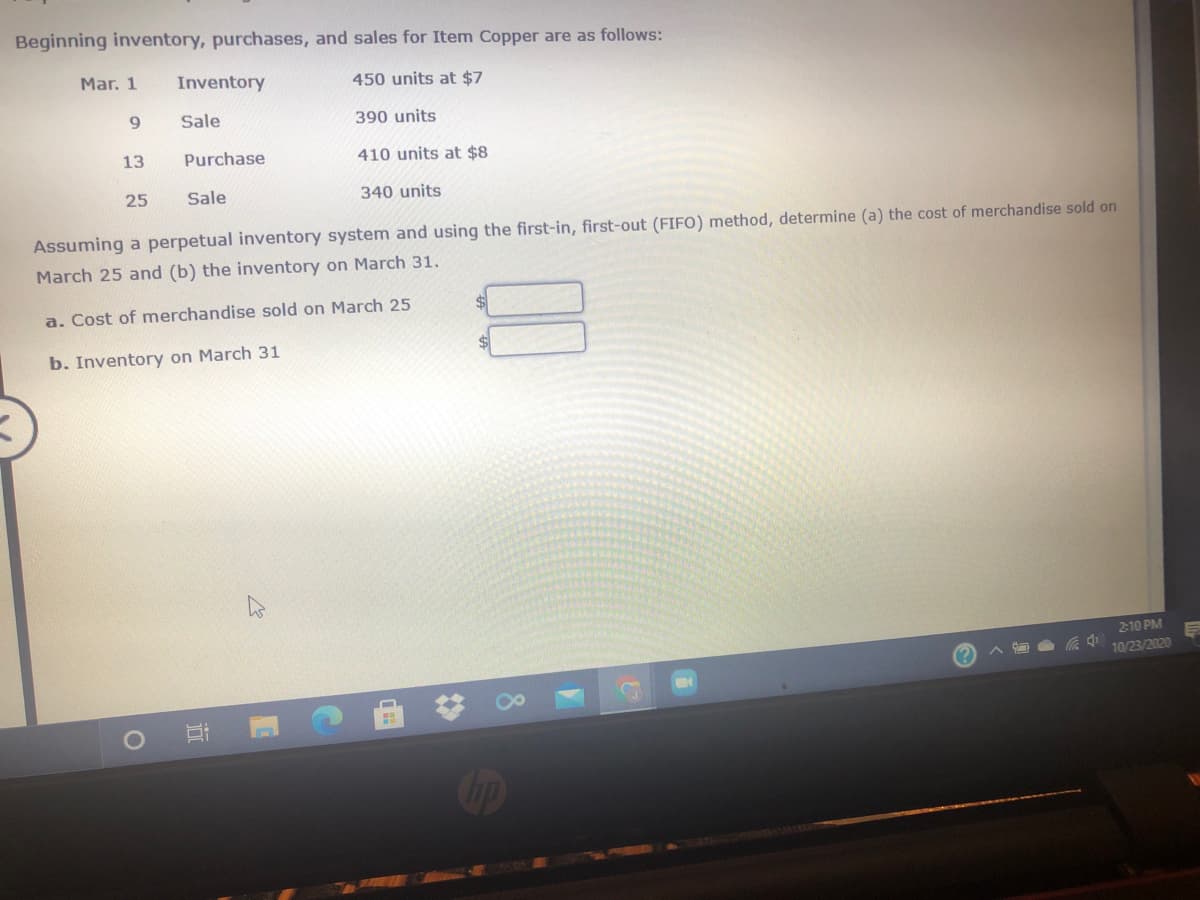

Transcribed Image Text:Beginning inventory, purchases, and sales for Item Copper are as follows:

Mar. 1

Inventory

450 units at $7

Sale

390 units

13

Purchase

410 units at $8

25

Sale

340 units

Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on

March 25 and (b) the inventory on March 31.

a. Cost of merchandise sold on March 25

b. Inventory on March 31

2:10 PM

A

10/23/2020

op

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning