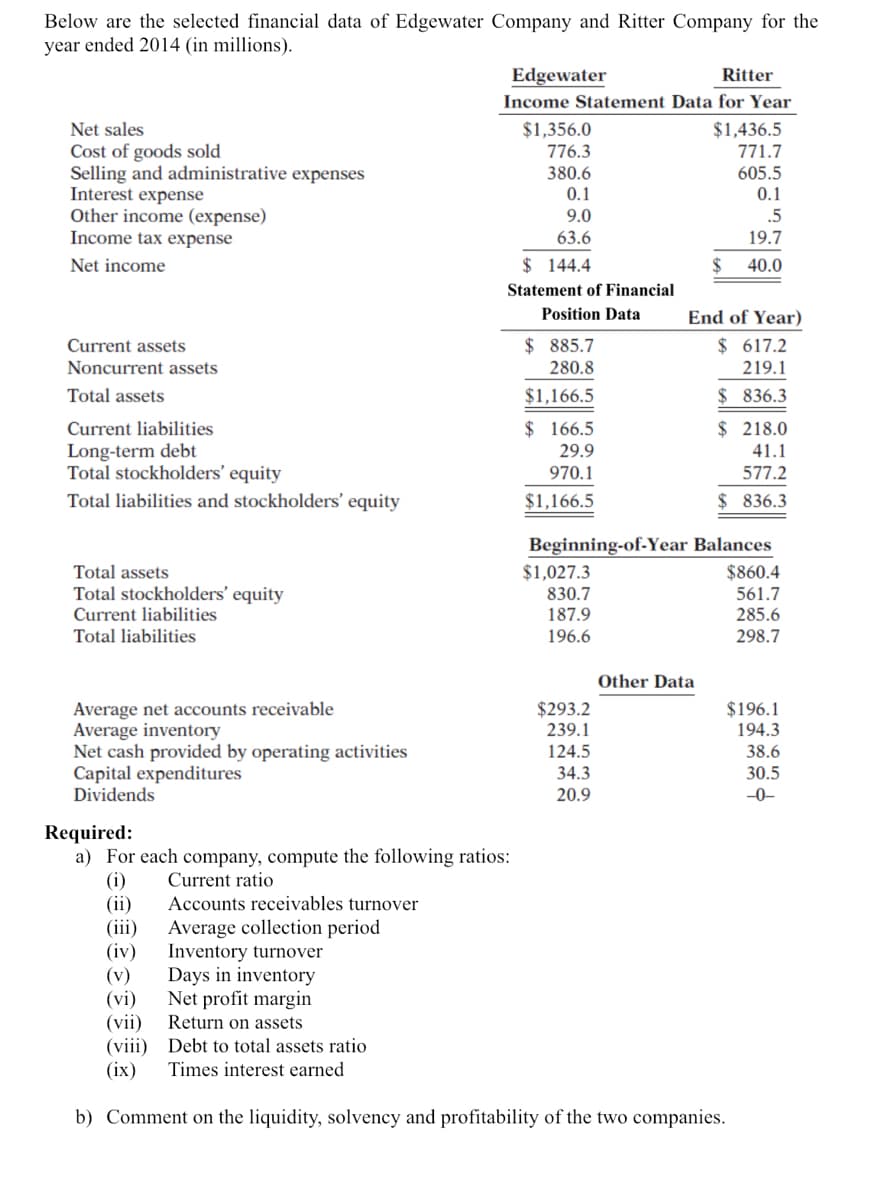

Below are the selected financial data of Edgewater Company and Ritter Company for the year ended 2014 (in millions). Edgewater Income Statement Data for Year Ritter Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense $1,356.0 $1,436.5 771.7 776.3 380.6 605.5 0.1 .5 0.1 9.0 63.6 19.7 Net income $ 144.4 $ 40.0 Statement of Financial Position Data End of Year) $ 617.2 219.1 $ 836.3 $ 218.0 $ 885.7 280.8 Current assets Noncurrent assets Total assets $1,166.5 $ 166.5 29.9 Current liabilities Long-term debt Total stockholders' equity 41.1 970.1 577.2 Total liabilities and stockholders' equity $1,166.5 $ 836.3 Beginning-of-Year Balances Total assets $1,027.3 $860.4 Total stockholders' equity Current liabilities Total liabilities 830.7 187.9 561.7 285.6 196.6 298.7 Other Data Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends $293.2 239.1 $196.1 194.3 124.5 38.6 34.3 30.5 20.9 -0- Required: a) For each company, compute the following ratios: (i) (ii) (iii) Current ratio Accounts receivables turnover Average collection period

Below are the selected financial data of Edgewater Company and Ritter Company for the year ended 2014 (in millions). Edgewater Income Statement Data for Year Ritter Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense $1,356.0 $1,436.5 771.7 776.3 380.6 605.5 0.1 .5 0.1 9.0 63.6 19.7 Net income $ 144.4 $ 40.0 Statement of Financial Position Data End of Year) $ 617.2 219.1 $ 836.3 $ 218.0 $ 885.7 280.8 Current assets Noncurrent assets Total assets $1,166.5 $ 166.5 29.9 Current liabilities Long-term debt Total stockholders' equity 41.1 970.1 577.2 Total liabilities and stockholders' equity $1,166.5 $ 836.3 Beginning-of-Year Balances Total assets $1,027.3 $860.4 Total stockholders' equity Current liabilities Total liabilities 830.7 187.9 561.7 285.6 196.6 298.7 Other Data Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends $293.2 239.1 $196.1 194.3 124.5 38.6 34.3 30.5 20.9 -0- Required: a) For each company, compute the following ratios: (i) (ii) (iii) Current ratio Accounts receivables turnover Average collection period

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

hi i need help. tq

Transcribed Image Text:Below are the selected financial data of Edgewater Company and Ritter Company for the

year ended 2014 (in millions).

Edgewater

Ritter

Income Statement Data for Year

Net sales

$1,356.0

776.3

Cost of goods sold

Selling and administrative expenses

Interest expense

Other income (expense)

Income tax expense

$1,436.5

771.7

605.5

0.1

.5

380.6

0.1

9.0

63.6

19.7

Net income

$ 144.4

40.0

Statement of Financial

Position Data

End of Year)

$ 885.7

$ 617.2

219.1

Current assets

Noncurrent assets

280.8

Total assets

$1,166.5

$ 836.3

$ 166.5

$ 218.0

Current liabilities

Long-term debt

Total stockholders' equity

29.9

41.1

970.1

577.2

Total liabilities and stockholders' equity

$1,166.5

$ 836.3

Beginning-of-Year Balances

$1,027.3

Total assets

$860.4

Total stockholders' equity

830.7

561.7

Current liabilities

187.9

285.6

Total liabilities

196.6

298.7

Other Data

Average net accounts receivable

Average inventory

Net cash provided by operating activities

Capital expenditures

Dividends

$293.2

$196.1

194.3

239.1

124.5

38.6

34.3

30.5

20.9

-0-

Required:

a) For each company, compute the following ratios:

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

(viii) Debt to total assets ratio

(ix)

Current ratio

Accounts receivables turnover

Average collection period

Inventory turnover

Days in inventory

Net profit margin

Return on assets

Times interest earned

b) Comment on the liquidity, solvency and profitability of the two companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College