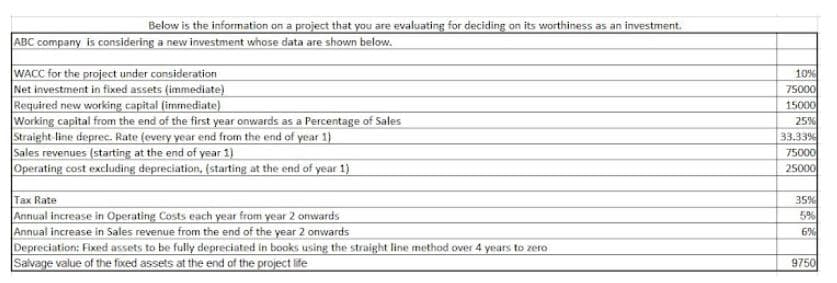

Below is the information on a project that you are evaluating for deciding on its worthiness as an investment. ABC company is considering a new investment whose data are shown below. WACC for the project under consideration Net investment in fixed assets (immediate) Required new working capital (immediate) Working capital from the end of the first year onwards as a Percentage of Sales Straight line deprec. Rate (every year end from the end of year 1) Sales revenues (starting at the end of year 1) Operating cost excluding depreciation, (starting at the end of year 1) 10% 75000 15000 25% 33.33% 75000 25000 Tax Rate Antual increase in Operating Costs each year from year 2 onwards Annual increase in Sales revenue from the end of the year 2 onwards Depreciation: Fixed assets to be fully depreciated in books using the straight line method over 4 years to zero Salvage value of the fixed assets at the end of the project life 35% 5% 6% 9750

Below is the information on a project that you are evaluating for deciding on its worthiness as an investment. ABC company is considering a new investment whose data are shown below. WACC for the project under consideration Net investment in fixed assets (immediate) Required new working capital (immediate) Working capital from the end of the first year onwards as a Percentage of Sales Straight line deprec. Rate (every year end from the end of year 1) Sales revenues (starting at the end of year 1) Operating cost excluding depreciation, (starting at the end of year 1) 10% 75000 15000 25% 33.33% 75000 25000 Tax Rate Antual increase in Operating Costs each year from year 2 onwards Annual increase in Sales revenue from the end of the year 2 onwards Depreciation: Fixed assets to be fully depreciated in books using the straight line method over 4 years to zero Salvage value of the fixed assets at the end of the project life 35% 5% 6% 9750

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 3PB: Net present value method, present value index, and analysis for a service company First United Bank...

Related questions

Question

Transcribed Image Text:Below is the information on a project that you are evaluating for deciding on its worthiness as an investment.

ABC company is considering a new investment whose data are shown below.

WACC for the project under consideration

Net investment in fixed assets (immediate)

Required new working capital (immediate)

Working capital from the end of the first year onwards as a Percentage of Sales

Straight line deprec. Rate (every year end from the end of year 1}

Sales revenues (starting at the end of year 1)

Operating cost excluding depreciation, (starting at the end of year 1)

10%

75000

15000

25%

33.33%

75000

25000

Tax Rate

Annual increase in Operating Costs each year from year 2 onwards

Annual increase in Sales revenue from the end of the year 2 onwards

Depreciation: Fixed assets to be fully depreciated in books using the straight line method over 4 years to zero

Salvage value of the fixed assets at the end of the project life

35%

6%

9750

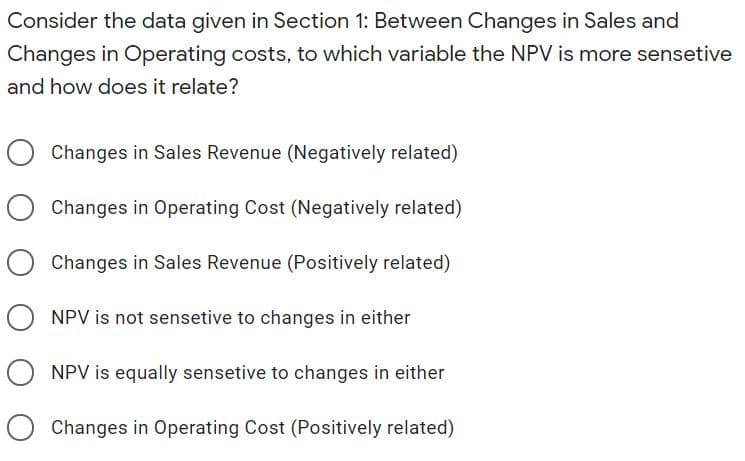

Transcribed Image Text:Consider the data given in Section 1: Between Changes in Sales and

Changes in Operating costs, to which variable the NPV is more sensetive

and how does it relate?

Changes in Sales Revenue (Negatively related)

Changes in Operating Cost (Negatively related)

Changes in Sales Revenue (Positively related)

O NPV is not sensetive to changes in either

NPV is equally sensetive to changes in either

O Changes in Operating Cost (Positively related)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College