One of the methods to evaluate a project is by estimating the Net Present value of that particular project. In order to do so, the working capital is included in the capital budgeting analysis and it will be then recovered at the end of a project’s life. Consider the following scenarios. You will need to use the data provided to solve the question. Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. a. Estimate the annual depreciation that the company needs to pay from year 1 to year 3.

One of the methods to evaluate a project is by estimating the Net Present value of that particular project. In order to do so, the working capital is included in the capital budgeting analysis and it will be then recovered at the end of a project’s life. Consider the following scenarios. You will need to use the data provided to solve the question. Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. a. Estimate the annual depreciation that the company needs to pay from year 1 to year 3.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.1MBA

Related questions

Question

One of the methods to evaluate a project is by estimating the Net Present value of that particular project. In order to do so, the working capital is included in the capital budgeting analysis and it will be then recovered at the end of a project’s life.

Consider the following scenarios. You will need to use the data provided to solve the question.

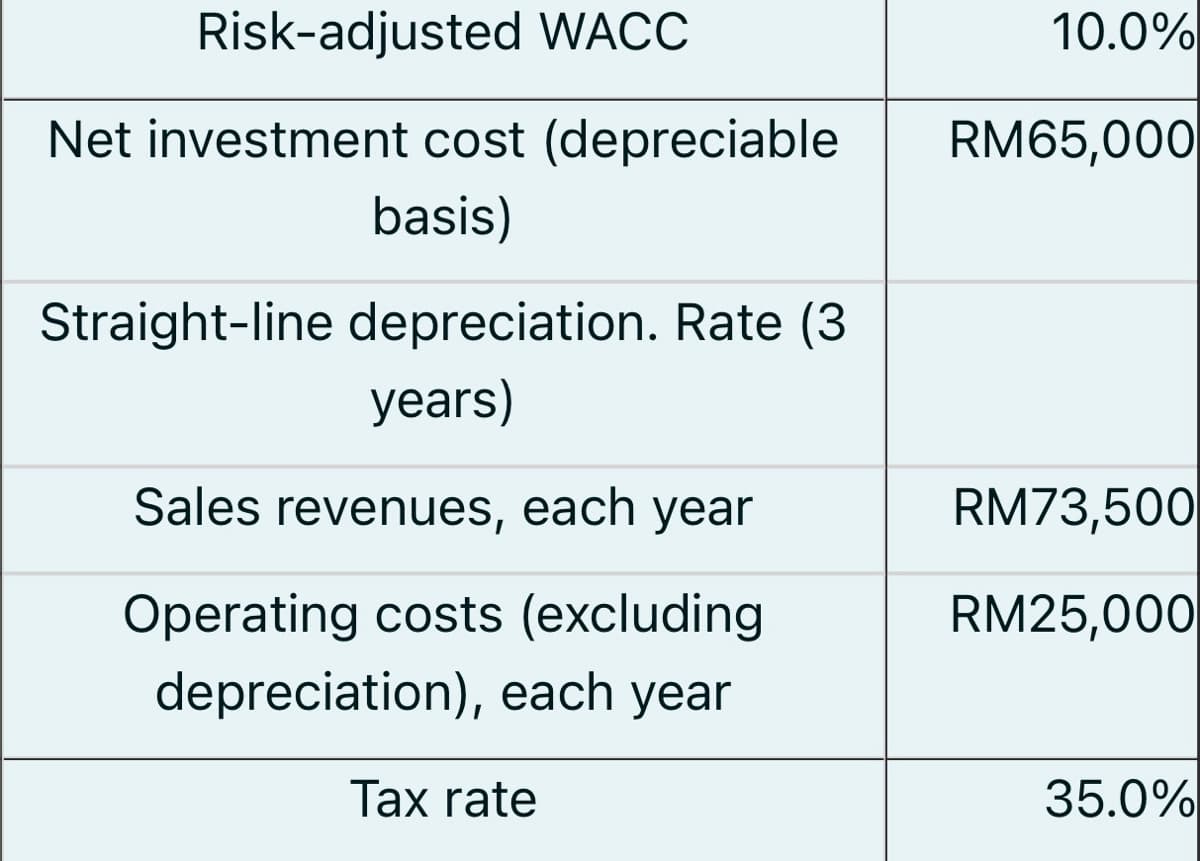

Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life.

a.

Estimate the annual depreciation that the company needs to pay from year 1 to year 3.

Transcribed Image Text:Risk-adjusted WACC

10.0%

Net investment cost (depreciable

RM65,000

basis)

Straight-line depreciation. Rate (3

years)

Sales revenues, each year

RM73,500

Operating costs (excluding

RM25,000

depreciation), each year

Tax rate

35.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning