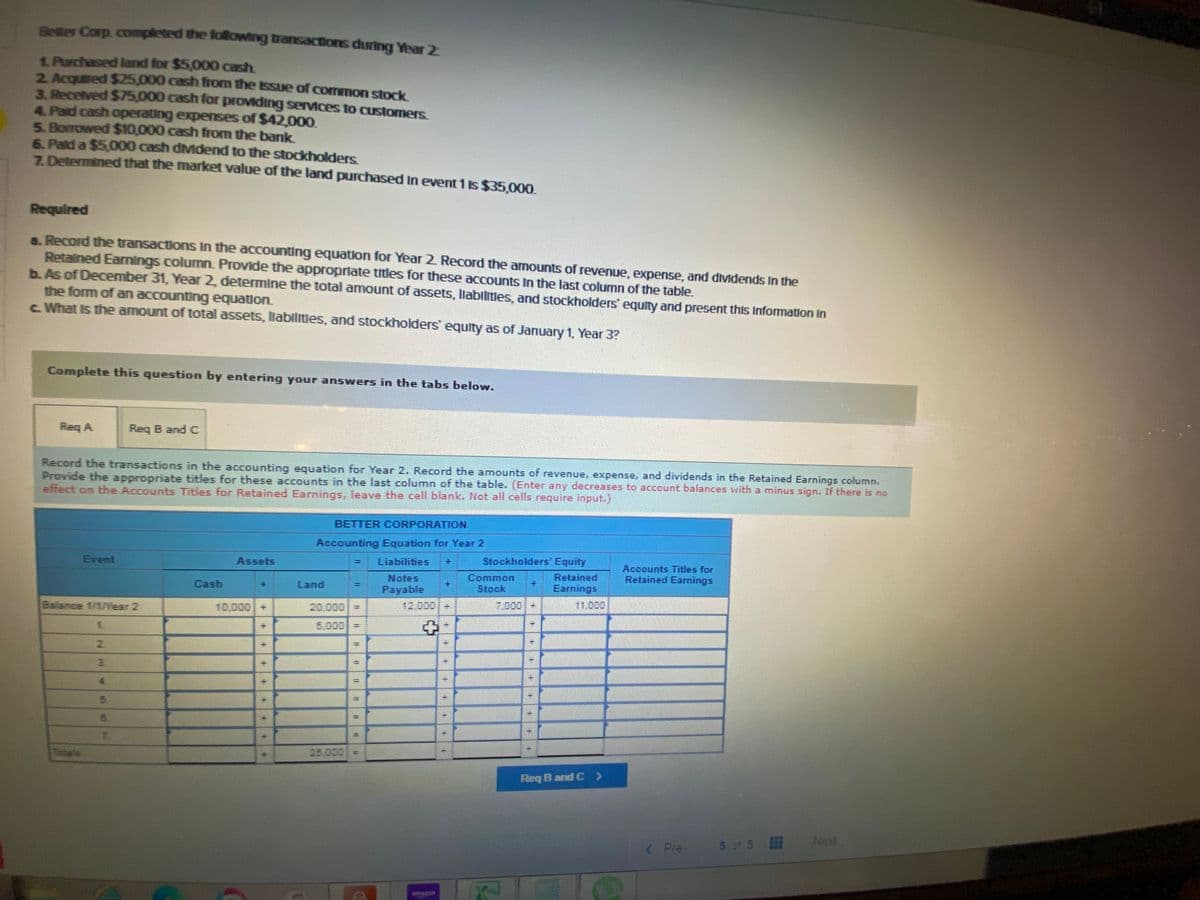

Belter Corp completed the folowing transactions during Year2 SPurchased land for $5,000 cash 2. Acqutred S25,000 cash from the tssue of common stock Pecotved S75,000 cash for providing services to customers 4. Paid cash operating expenses of $42,000. S. Borrowed $0,000 cash from the bank 6. Patd a $5,000 cash diMidend to the stockholders Z. Determined that the market value of the land purchased in event 1s$35,000. Required Record the transactions in the accounting equation for Year 2 Record the amounts of revenue, expense, and đivMdends In the Retained Earnings column. Provide the appropriate ttles for these accounts In the last column of the table. b. As of December 31, Year 2, determine the total amount of assets, llabilities, and stockholders' equity and present this Information in the form of an accounting equation. C What is the amount of total assets, labilities, and stockholders equity as of January 1, Year 3? Complete this question by entering your answers in the tabs below. Reg A Reg B and C Record the transactions in the accounting equation for Year 2. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells require input.) BETTER CORPORATION Accounting Equation for Year 2 Event Assets Liabilities Stockholders' Equity %3D Accounts Titles for Retained Earnings Notes Common Retained Cash ·] Land +] Payable Stock Earnings Balance 1/1/Year 2 10,000+ 12.000+ 7,000- 20,000 5.000- 11.000 1. 2. 3. %3D 4. TO 5. 7. Tetals 25.000 Req Band C>

Belter Corp completed the folowing transactions during Year2 SPurchased land for $5,000 cash 2. Acqutred S25,000 cash from the tssue of common stock Pecotved S75,000 cash for providing services to customers 4. Paid cash operating expenses of $42,000. S. Borrowed $0,000 cash from the bank 6. Patd a $5,000 cash diMidend to the stockholders Z. Determined that the market value of the land purchased in event 1s$35,000. Required Record the transactions in the accounting equation for Year 2 Record the amounts of revenue, expense, and đivMdends In the Retained Earnings column. Provide the appropriate ttles for these accounts In the last column of the table. b. As of December 31, Year 2, determine the total amount of assets, llabilities, and stockholders' equity and present this Information in the form of an accounting equation. C What is the amount of total assets, labilities, and stockholders equity as of January 1, Year 3? Complete this question by entering your answers in the tabs below. Reg A Reg B and C Record the transactions in the accounting equation for Year 2. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells require input.) BETTER CORPORATION Accounting Equation for Year 2 Event Assets Liabilities Stockholders' Equity %3D Accounts Titles for Retained Earnings Notes Common Retained Cash ·] Land +] Payable Stock Earnings Balance 1/1/Year 2 10,000+ 12.000+ 7,000- 20,000 5.000- 11.000 1. 2. 3. %3D 4. TO 5. 7. Tetals 25.000 Req Band C>

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5PA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Question

100%

Transcribed Image Text:Beller Corp. completed the following transactions during Year 2

1 Purchased land for $5,000 cash

2. Acqutred $25,000 cash from the issue of common stock

3. Received S75,000 cash for providing services to customers.

4. Paid cash operating expenses of $42,000.

5. Borrowed $10,000 cash from the bank

6. Pald a $5,000 cash diMidend to the stockholders.

7. Determined that the market value of the land purchased In event1 Is $35,000.

Required

a. Record the transactions In the accounting equation for Year 2 Record the amounts of revenue, expense, and dividends In the

Retained Eamings column. Provide the appropriate titles for these accounts In the last column of the table.

b. As of December 31, Year 2, determine the total amount of assets, llabiltities, and stockholders' equity and present this Information in

the form of an accounting equation.

c. What Is the amount of total assets, llabilitles, and stockholders' equity as of January 1. Year 3?

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Record the transactions in the accounting equation for Year 2. Record the amounts of revenue, expense, and dividends in the Retained Earnings column.

Provide the appropriate titles for these accounts in the last column of the table. (Enter any decreases to account balances with a minus sign. If there is no

effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells require input.)

BETTER CORPORATION

Accounting Equation for Year 2

Event

Assets

Liabilities

Stockholders Equity

Common

Stock

Retained

Earnings

Accounts Titles for

Retained Earnings

Notes

Cash

Land

Payable

Balance 1/1/Year 2

10,000

20,000

12,000

7.000 +

11,000

5.000

2.

3.

7.

Tatals

25.000

Req B and C>

< Prev

5 of 5

Next

キ

手

%3D

%3D

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning