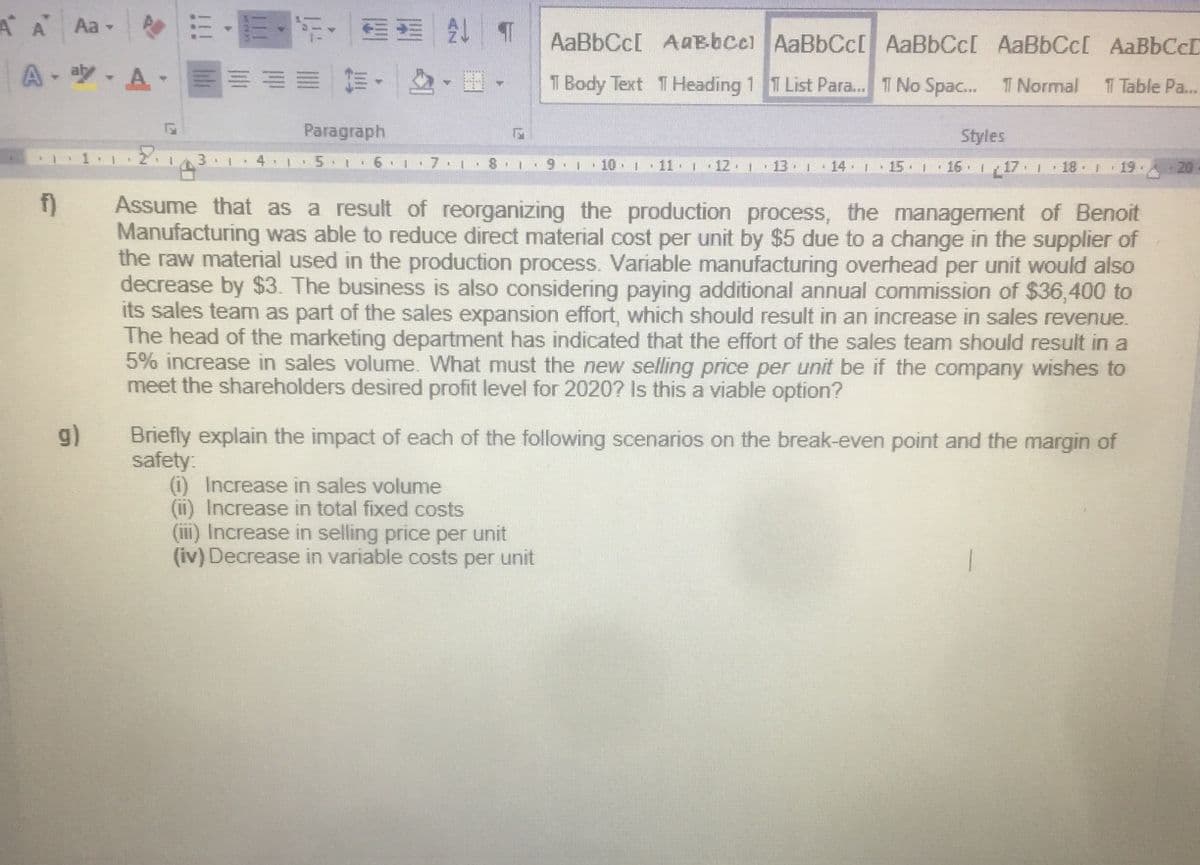

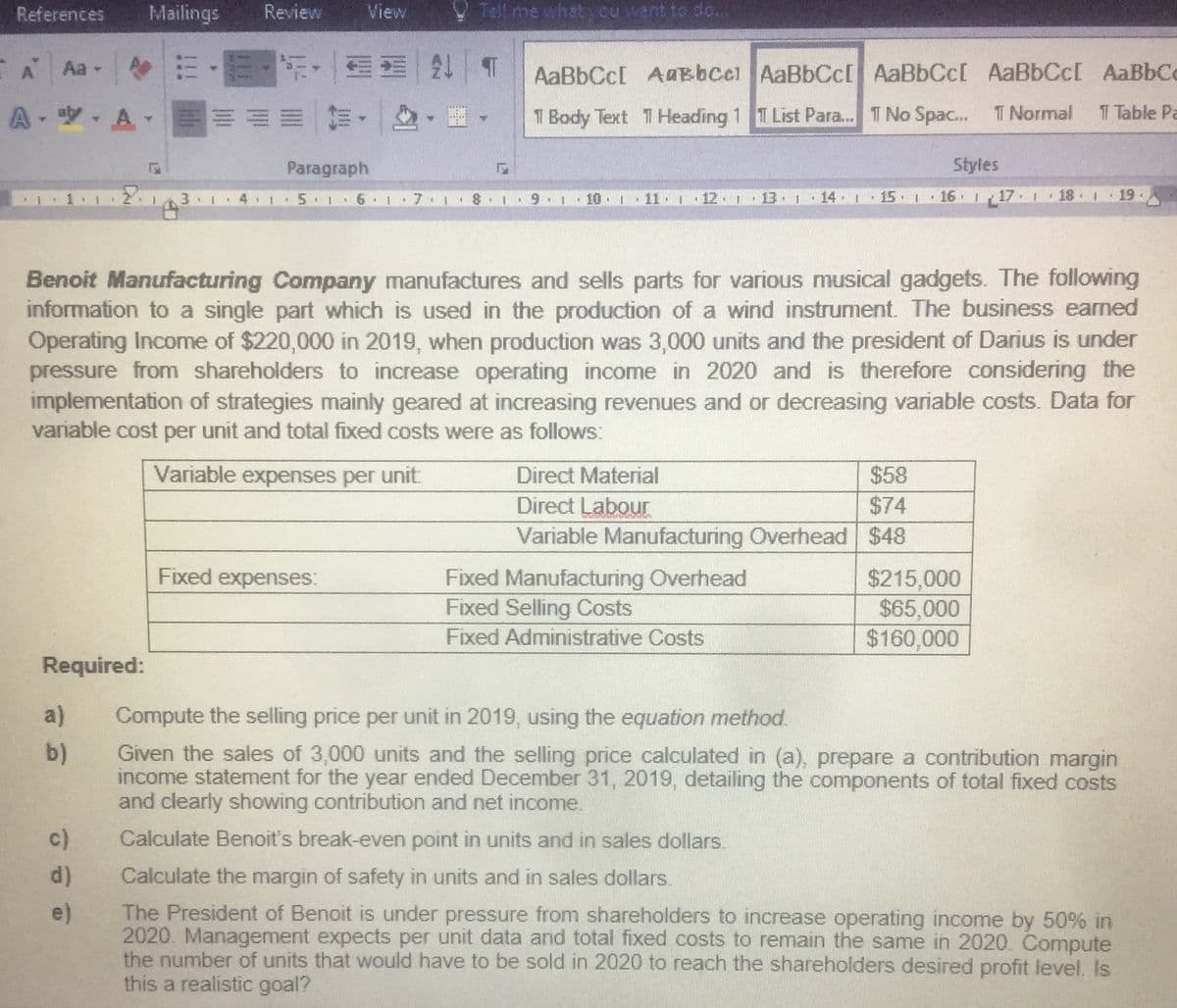

Benoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for variable cost per unit and total fixed costs were as follows: Variable expenses per unit: Direct Material $58 Direct Labour $74 Variable Manufacturing Overhead $48 Fixed expenses: Fixed Manufacturing Overhead Fixed Selling Costs $215,000 $65,000 $160,000 Fixed Administrative Costs Required: a) Compute the selling price per unit in 2019, using the equation method. Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income statement for the year ended December 31, 2019, detailing the components of total fixed costs and clearly showing contribution and net income. b) c) Calculate Benoit's break-even point in units and in sales dollars.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Please answer the attached

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images