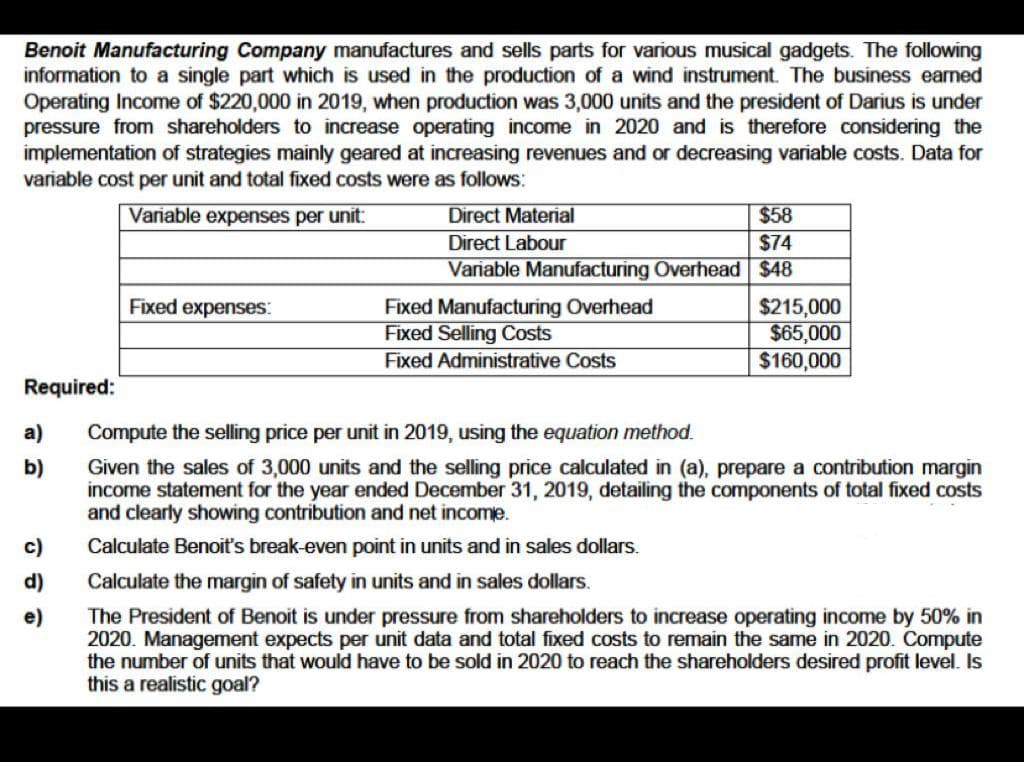

Benoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for variable cost per unit and total fixed costs were as follows: Variable expenses per unit: Direct Material $58 Direct Labour Variable Manufacturing Overhead $48 $74 Fixed expenses: Fixed Manufacturing Overhead Fixed Selling Costs $215,000 $65,000 $160,000 Fixed Administrative Costs Required: a) Compute the selling price per unit in 2019, using the equation method. b) Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income statement for the year ended December 31, 2019, detailing the components of total fixed costs and clearly showing contribution and net income. c) Calculate Benoit's break-even point in units and in sales dollars.

Benoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following information to a single part which is used in the production of a wind instrument. The business earned Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under pressure from shareholders to increase operating income in 2020 and is therefore considering the implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for variable cost per unit and total fixed costs were as follows: Variable expenses per unit: Direct Material $58 Direct Labour Variable Manufacturing Overhead $48 $74 Fixed expenses: Fixed Manufacturing Overhead Fixed Selling Costs $215,000 $65,000 $160,000 Fixed Administrative Costs Required: a) Compute the selling price per unit in 2019, using the equation method. b) Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin income statement for the year ended December 31, 2019, detailing the components of total fixed costs and clearly showing contribution and net income. c) Calculate Benoit's break-even point in units and in sales dollars.

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 4EB: Roper Furniture manufactures office furniture and tracks cost data across their process. The...

Related questions

Question

Please assist with questions A& B

Please type so i can see clearly

Transcribed Image Text:Benoit Manufacturing Company manufactures and sells parts for various musical gadgets. The following

information to a single part which is used in the production of a wind instrument. The business earned

Operating Income of $220,000 in 2019, when production was 3,000 units and the president of Darius is under

pressure from shareholders to increase operating income in 2020 and is therefore considering the

implementation of strategies mainly geared at increasing revenues and or decreasing variable costs. Data for

variable cost per unit and total fixed costs were as follows:

Variable expenses per unit:

Direct Material

$58

Direct Labour

$74

Variable Manufacturing Overhead $48

Fixed expenses:

Fixed Manufacturing Overhead

Fixed Selling Costs

$215,000

$65,000

$160,000

Fixed Administrative Costs

Required:

a)

Compute the selling price per unit in 2019, using the equation method.

b)

Given the sales of 3,000 units and the selling price calculated in (a), prepare a contribution margin

income statement for the year ended December 31, 2019, detailing the components of total fixed costs

and clearly showing contribution and net income.

c)

Calculate Benoit's break-even point in units and in sales dollars.

d)

Calculate the margin of safety in units and in sales dollars.

The President of Benoit is under pressure from shareholders to increase operating income by 50% in

2020. Management expects per unit data and total fixed costs to remain the same in 2020. Compute

the number of units that would have to be sold in 2020 to reach the shareholders desired profit level. Is

this a realistic goal?

e)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning