Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 8P

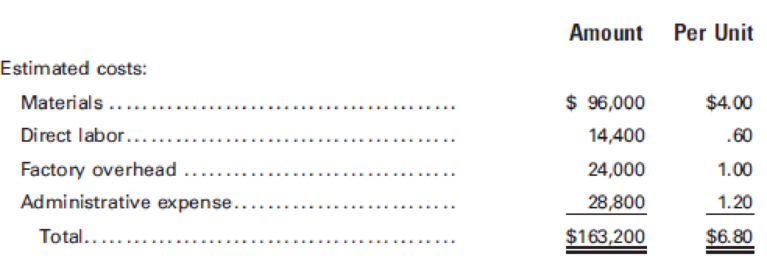

The production of a new product required Zion Manufacturing Co. to lease additional plant facilities. Based on studies, the following data have been made available: Estimated annual sales—24,000 units

Selling expenses are expected to be 5% of sales, and net income is to amount to $2.00 per unit.

Required:

- 1. Calculate the selling price per unit. (Hint: Let “X” equal the selling price and express selling expense as a percentage of “X.”)

- 2. Prepare an absorption costing income statement for the year ended December 31, 2016.

- 3. Calculate the break-even point expressed in dollars and in units, assuming that administrative expense and factory overhead are all fixed but other costs are fully variable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ionic Charge is a newly organized manufacturing company that plans to manufacture 60,000 units per year of a new prodect. The following estimates have been made of the company's costs and expenses other than income taxes

Fixed

Variable per unit

Manufacturing costs

Direct Materials

$25

Direct Labor

$15

Manufacturing overhead

$500,000

8

Period Costs

Selling expenses

2

Admin expenses

$300,000

Totals

$800,000

$50

A. What should the company establish as the sales price per unit if it sets a target of earning an operating income of $700,000 by producing and selling 60,000 units during the first year of operations.

SOWSEY Company is considering the addition of a new product to its current product lines. The expected cost and revenue data for the new product are as follows:

Annual Sales

2,500 units

Selling Price per unit

P304

Variable Costs per unit:

Production

P125

Selling

P49

Avoidable fixed costs per year:

Production

P50,000

Selling

P75,000

Allocated common corporate costs per year

P55,000

If the new product is added, the combined contribution margin of the other existing products lines is expected to drop P65,000 per year. Total common corporate costs would be unaffected by the decision of whether to add the new product. What is the lowest selling price per unit that could be charged for the new product line and still make an additional P2 income per unit?

Sparrow Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $8.00 a unit. The unit cost for Sparrow Co. to make the part is $9.00, which includes $0.60 of fixed costs. If 4,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it?

a.$12,000 decrease

b.$4,000 increase

c.$20,000 decrease

d.$1,600 increase

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardMorrill Company produces two different types of gauges: a density gauge and a thickness gauge. The segmented income statement for a typical quarter follows. Includes depreciation. The density gauge uses a subassembly that is purchased from an external supplier for 25 per unit. Each quarter, 2,000 subassemblies are purchased. All units produced are sold, and there are no ending inventories of subassemblies. Morrill is considering making the subassembly rather than buying it. Unit-level variable manufacturing costs are as follows: No significant non-unit-level costs are incurred. Morrill is considering two alternatives to supply the productive capacity for the subassembly. 1. Lease the needed space and equipment at a cost of 27,000 per quarter for the space and 10,000 per quarter for a supervisor. There are no other fixed expenses. 2. Drop the thickness gauge. The equipment could be adapted with virtually no cost and the existing space utilized to produce the subassembly. The direct fixed expenses, including supervision, would be 38,000, 8,000 of which is depreciation on equipment. If the thickness gauge is dropped, sales of the density gauge will not be affected. Required: 1. Should Morrill Company make or buy the subassembly? If it makes the subassembly, which alternative should be chosen? Explain and provide supporting computations. 2. Suppose that dropping the thickness gauge will decrease sales of the density gauge by 10 percent. What effect does this have on the decision? 3. Assume that dropping the thickness gauge decreases sales of the density gauge by 10 percent and that 2,800 subassemblies are required per quarter. As before, assume that there are no ending inventories of subassemblies and that all units produced are sold. Assume also that the per-unit sales price and variable costs are the same as in Requirement 1. Include the leasing alternative in your consideration. Now, what is the correct decision?arrow_forwardDeuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income statement for the year, before any special orders, is as follows: Fixed costs included in the forecasted income statement are $400,000 in manufacturing cost of goods sold and $200,000 in selling expenses. A new client placed a special order with Deuce, offering to buy 1,000 tennis rackets for $100.00 each. The company will incur no additional selling expenses if it accepts the special order. Assuming that Deuce has sufficient capacity to manufacture 1,000 more tennis rackets, by what amount would differential income increase (decrease) as a result of accepting the special order? (Hint: First compute the variable cost per unit relevant to this decision.)arrow_forward

- Gelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs per gas grill are 225, and the average price per gas grill is 600. Required: 1. How many gas grills must Gelbart Company sell to break even? 2. If Gelbart Company sells 46,775 gas grills in a year, what is the operating income? 3. If Gelbart Companys variable costs increase to 240 per grill while the price and fixed costs remain unchanged, what is the new break-even point?arrow_forwardWellington, Inc., reports the following contribution margin income statement for the month of May. The company has the opportunity to purchase new machinery that will reduce its variable cost per unit by $10 but will increase fixed costs by 20%. Prepare a projected contribution margin income statement for Wellington, Inc., assuming it purchases the new equipment. Assume sales level remains unchanged.arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forward

- Emerald Island Company is considering building a manufacturing plant in County Kerry. Predicting sales of 100,000 units, Emerald Isle estimates the following expenses: An Irish firm that specializes in marketing will be engaged to sell the manufactured product and will receive a commission of 10% of the sales price. None of the U.S. home office expense will be allocated to the Irish facility. Required: 1. If the unit sales price is 2, how many units must be sold to break even? (Hint: First compute the variable cost per unit.) 2. Calculate the margin of safety ratio. 3. Calculate the contribution margin ratio.arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forwardA company has prepared the following statistics regarding its production and sales at different capacity levels. Total costs: 1. At what point is break-even reached in sales dollars? In units? (Hint: Use the capacity level to determine the number of units.) 2. If the company is operating at 60% capacity, should it accept an offer from a customer to buy 10,000 units at 3 per unit?arrow_forward

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardMarkham Farms reports the following contribution margin income statement for the month of August. The company has the opportunity to purchase new machinery that will reduce its variable cost per unit by $2 but will increase fixed costs by 15%. Prepare a projected contribution margin income statement for Markham Farm assuming it purchases the new equipment. Assume sales level remains unchanged.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License