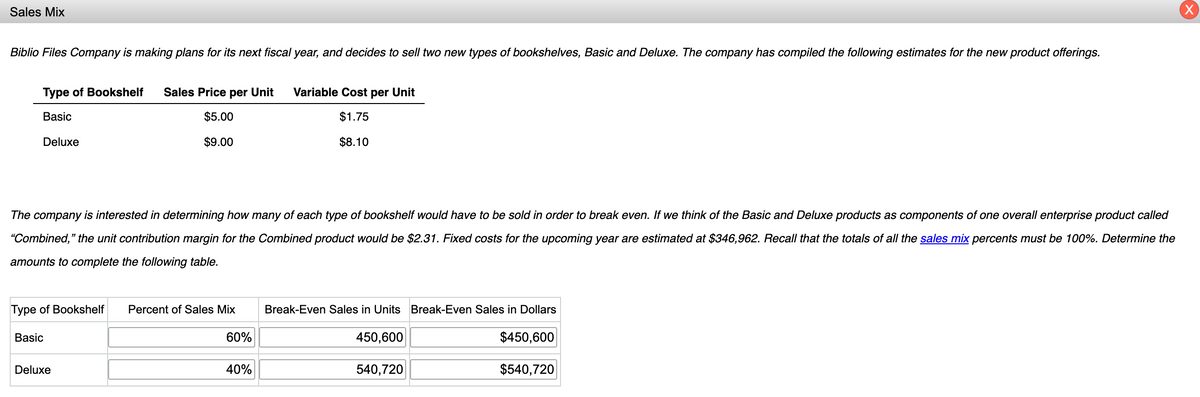

Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings. Type of Bookshelf Sales Price per Unit Variable Cost per Unit Basic $5.00 $1.75 Deluxe $9.00 $8.10 The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called "Combined," the unit contribution margin for the Combined product would be $2.31. Fixed costs for the upcoming year are estimated at $346,962. Recall that the totals of all the sales mix percents must be 100%. Determine the amounts to complete the following table. Type of Bookshelf Percent of Sales Mix Break-Even Sales in Units Break-Even Sales in Dollars Basic 60% 450,600 $450,600 Deluxe 40% 540,720 $540,720

Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings. Type of Bookshelf Sales Price per Unit Variable Cost per Unit Basic $5.00 $1.75 Deluxe $9.00 $8.10 The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called "Combined," the unit contribution margin for the Combined product would be $2.31. Fixed costs for the upcoming year are estimated at $346,962. Recall that the totals of all the sales mix percents must be 100%. Determine the amounts to complete the following table. Type of Bookshelf Percent of Sales Mix Break-Even Sales in Units Break-Even Sales in Dollars Basic 60% 450,600 $450,600 Deluxe 40% 540,720 $540,720

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 84PSA

Related questions

Question

Transcribed Image Text:Sales Mix

(X)

Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings.

Туре of Bookshelf

Sales Price per Unit

Variable Cost per Unit

Basic

$5.00

$1.75

Deluxe

$9.00

$8.10

The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called

"Combined," the unit contribution margin for the Combined product would be $2.31. Fixed costs for the upcoming year are estimated at $346,962. Recall that the totals of all the sales mix percents must be 100%. Determine the

amounts to complete the following table.

Type of Bookshelf

Percent of Sales Mix

Break-Even Sales in Units Break-Even Sales in Dollars

Basic

60%

450,600

$450,600

Deluxe

40%

540,720

$540,720

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning