Wermham-Mifflin is considering launching a new line of septagonal-shaped paper. You have the following information: • Revenues due to the sale of the new product are expected to be $95 million annually. Of this, 77% will be by cash with the remainder sold on credit. Credit sales are expected to start being repaid after 2 years. • Total paper production costs will increase from the current level of $20 million annually to $51 million annually after the product launch. • Hyper-aggressive sales agent Dwight Schrute will be reassigned from other projects to sell the new product line. Customers of those other products will be relieved and sales will increase by $18 million annually. • The project will make use of an existing paper mill, built last year at a cost of $43 million. The mill is being depreciated using prime cost over a useful life of twenty-seven years. • However, due to this decision, machinery in the mill will need to be retrofit at a cost of $27 million at t=0. The retrofit machinery has a useful life of sixteen years. • Wernham-Mifflin currently pays taxes at an overall tax rate of 38% and a marginal rate of 44%. What is the incremental cash flow from the project for the first year (at t=1)? O a $31.77 million Ob. $29.22 million

Wermham-Mifflin is considering launching a new line of septagonal-shaped paper. You have the following information: • Revenues due to the sale of the new product are expected to be $95 million annually. Of this, 77% will be by cash with the remainder sold on credit. Credit sales are expected to start being repaid after 2 years. • Total paper production costs will increase from the current level of $20 million annually to $51 million annually after the product launch. • Hyper-aggressive sales agent Dwight Schrute will be reassigned from other projects to sell the new product line. Customers of those other products will be relieved and sales will increase by $18 million annually. • The project will make use of an existing paper mill, built last year at a cost of $43 million. The mill is being depreciated using prime cost over a useful life of twenty-seven years. • However, due to this decision, machinery in the mill will need to be retrofit at a cost of $27 million at t=0. The retrofit machinery has a useful life of sixteen years. • Wernham-Mifflin currently pays taxes at an overall tax rate of 38% and a marginal rate of 44%. What is the incremental cash flow from the project for the first year (at t=1)? O a $31.77 million Ob. $29.22 million

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

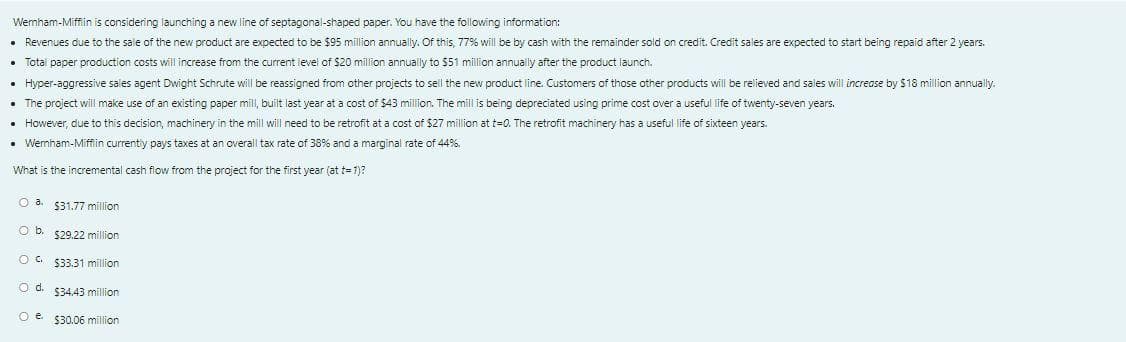

Transcribed Image Text:Wemham-Miffin is considering launching a new line of septagonal-shaped paper. You have the following information:

• Revenues due to the sale of the new product are expected to be $95 million annually. Of this, 77% will be by cash with the remainder sold on credit. Credit sales are expected to start being repaid after 2 years.

• Total paper production costs will increase from the current level of $20 million annually to $51 million annually after the product launch.

• Hyper-aggressive sales agent Dwight Schrute will be reassigned from other projects to sell the new product line. Customers of those other products will be relieved and sales will increase by $18 million annually.

• The project will make use of an existing paper mill, built last year at a cost of $43 million. The mill is being depreciated using prime cost over a useful life of twenty-seven years.

• However, due to this decision, machinery in the mill will need to be retrofit at a cost of $27 million at t=0. The retrofit machinery has a useful life of sixteen years.

• Wernham-Mifflin currently pays taxes at an overall tax rate of 38% and a marginal rate of 44%.

What is the incremental cash flow from the project for the first year (at t= 1)?

$31.77 million

Ob.

$29.22 million

OG $33.31 million

O d. 534,43 million

O e $30.06 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning