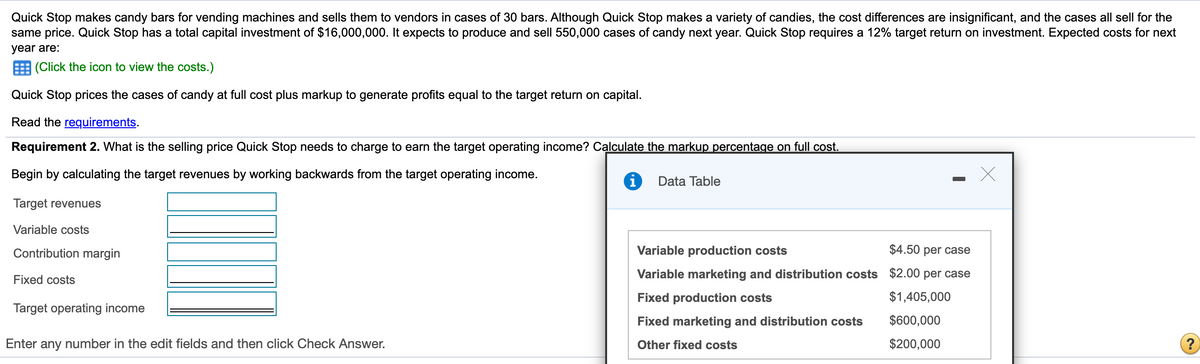

Quick Stop makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Quick Stop makes a variety of candies, the cost differences are insignificant, and the cases all sell for the same price. Quick Stop has a total capital investment of $16,000,000. It expects to produce and sell 550,000 cases of candy next year. Quick Stop requires a 12% target return on investment. Expected costs for next year are: (Click the icon to view the costs.) Quick Stop prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital. Read the requirements. Requirement 2. What is the selling price Quick Stop needs to charge to earn the target operating income? Calculate the markup percentage on full cost. Begin by calculating the target revenues by working backwards from the target operating income. Data Table Target revenues Variable costs Contribution margin Variable production costs $4.50 per case Variable marketing and distribution costs $2.00 per case Fixed costs Fixed production costs $1,405,000 Target operating income Fixed marketing and distribution costs $600,000 Enter any number in the edit fields and then click Check Answer. Other fixed costs $200,000

Quick Stop makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Quick Stop makes a variety of candies, the cost differences are insignificant, and the cases all sell for the same price. Quick Stop has a total capital investment of $16,000,000. It expects to produce and sell 550,000 cases of candy next year. Quick Stop requires a 12% target return on investment. Expected costs for next year are: (Click the icon to view the costs.) Quick Stop prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital. Read the requirements. Requirement 2. What is the selling price Quick Stop needs to charge to earn the target operating income? Calculate the markup percentage on full cost. Begin by calculating the target revenues by working backwards from the target operating income. Data Table Target revenues Variable costs Contribution margin Variable production costs $4.50 per case Variable marketing and distribution costs $2.00 per case Fixed costs Fixed production costs $1,405,000 Target operating income Fixed marketing and distribution costs $600,000 Enter any number in the edit fields and then click Check Answer. Other fixed costs $200,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 10E: Schylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22...

Related questions

Question

can you help me

Transcribed Image Text:Quick Stop makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Quick Stop makes a variety of candies, the cost differences are insignificant, and the cases all sell for the

same price. Quick Stop has a total capital investment of $16,000,000. It expects to produce and sell 550,000 cases of candy next year. Quick Stop requires a 12% target return on investment. Expected costs for next

year are:

(Click the icon to view the costs.)

Quick Stop prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital.

Read the requirements.

Requirement 2. What is the selling price Quick Stop needs to charge to earn the target operating income? Calculate the markup percentage on full cost.

Begin by calculating the target revenues by working backwards from the target operating income.

Data Table

Target revenues

Variable costs

Contribution margin

Variable production costs

$4.50 per case

Variable marketing and distribution costs $2.00 per case

Fixed costs

Fixed production costs

$1,405,000

Target operating income

Fixed marketing and distribution costs

$600,000

Enter any number in the edit fields and then click Check Answer.

Other fixed costs

$200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College