Big Beautiful Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2024. To answer this question, you gather the following data: Data Table s to two decimal places, X.XX.) Net Accounts Receivables 140,000 124,000 Merchandise Inventory 217,000 272,000 Total Assets 530,000 565,000 Total Current Liabilities 288,000 205,000 Long-term Notes Payable 40,000 50,000 Income from Operations 165,000 158,000 Clear All Check Answer Interest Expense 55,000 41,000

Big Beautiful Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2024. To answer this question, you gather the following data: Data Table s to two decimal places, X.XX.) Net Accounts Receivables 140,000 124,000 Merchandise Inventory 217,000 272,000 Total Assets 530,000 565,000 Total Current Liabilities 288,000 205,000 Long-term Notes Payable 40,000 50,000 Income from Operations 165,000 158,000 Clear All Check Answer Interest Expense 55,000 41,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.8E

Related questions

Question

100%

All requirements if possible

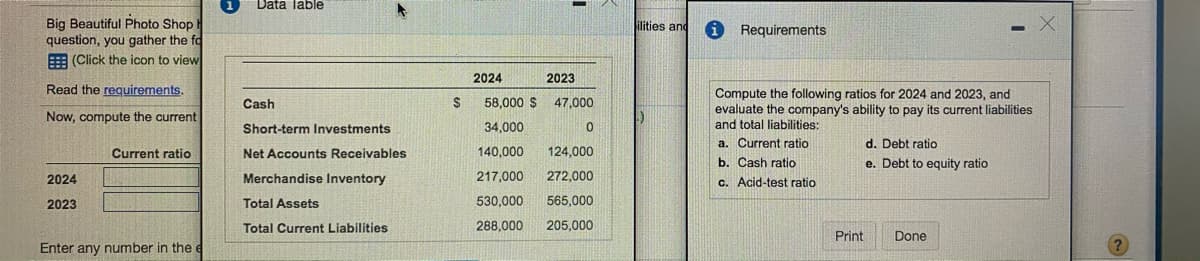

Transcribed Image Text:Data Table

Big Beautiful Photo Shop

question, you gather the fo

E (Click the icon to view

ilities and

Requirements

2024

2023

Read the requirements.

Compute the following ratios for 2024 and 2023, and

evaluate the company's ability to pay its current liabilities

and total liabilities:

Cash

58,000 $ 47,000

Now, compute the current

Short-term Investments

34,000

a. Current ratio

d. Debt ratio

Current ratio

Net Accounts Receivables

140,000

124,000

b. Cash ratio

e. Debt to equity ratio

Merchandise Inventory

217,000

272,000

2024

C. Acid-test ratio

2023

Total Assets

530,000

565,000

Total Current Liabilities

288,000

205,000

Print

Done

Enter any number in the e

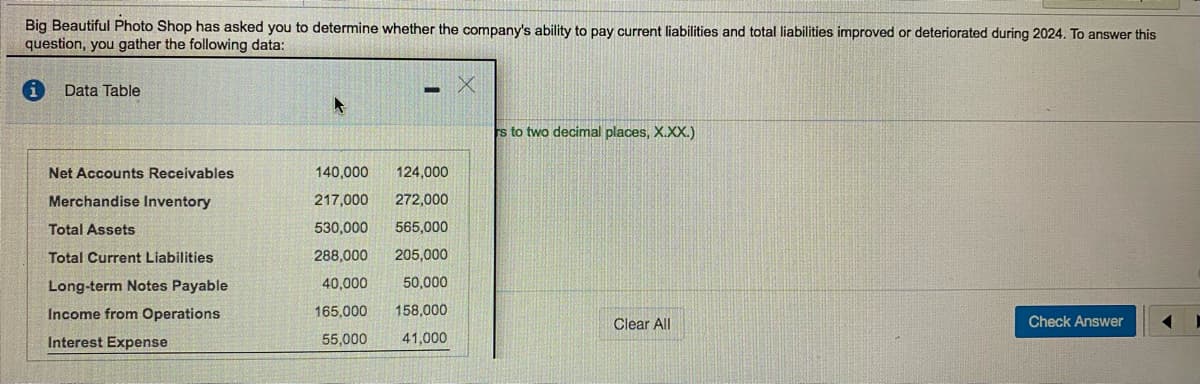

Transcribed Image Text:Big Beautiful Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2024. To answer this

question, you gather the following data:

Data Table

rs to two decimal places, X.XX.)

Net Accounts Receivables

140,000

124,000

Merchandise Inventory

217,000

272,000

Total Assets

530,000

565,000

Total Current Liabilities

288,000

205,000

Long-term Notes Payable

40,000

50,000

Income from Operations

165,000

158,000

Clear All

Check Answer

Interest Expense

55,000

41,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning