Forecasted Statements and Ratios

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers.

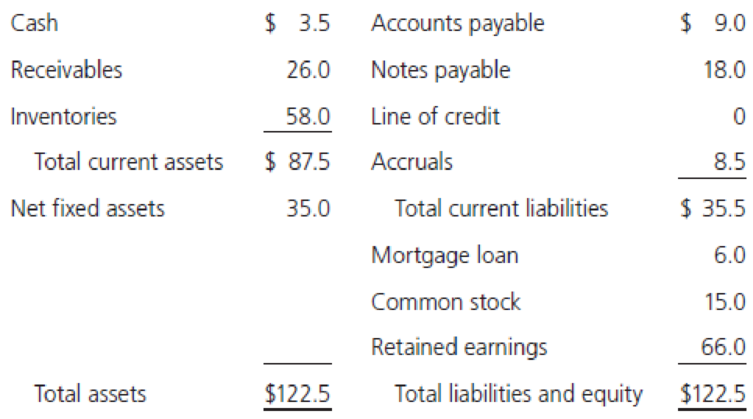

Upton’s

Sales for 2018 were $350 million, and net income for the year was $10.5 million, so the firm’s profit margin was 3.0%. Upton paid dividends of $4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 40%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2019.

- a. If sales are projected to increase by $70 million, or 20%, during 2019, use the AFN equation to determine Upton’s projected external capital requirements.

- b. Using the AFN equation, determine Upton’s self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds?

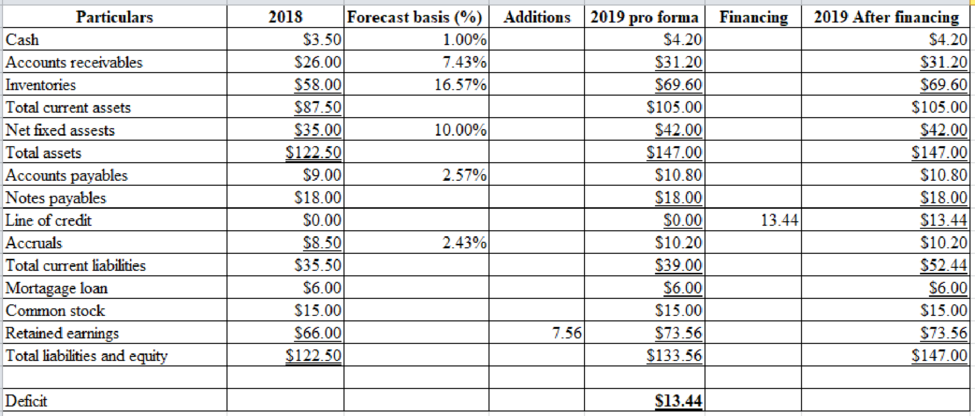

- c. Use the forecasted financial statement method to

forecast Upton’s balance sheet for December 31, 2019. Assume that all additional external capital is raised as a line of credit at the end of the year and is reflected (because the debt is added at the end of the year, there will be no additional interest expense due to the new debt). Assume Upton’s profit margin and dividend payout ratio will be the same in 2019 as they were in 2018. What is the amount of the line of credit reported on the 2019 forecasted balance sheets? (Hint: You don’t need toforecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2019 addition toretained earnings for the balance sheet without actually constructing a full income statement.)

a)

To determine: Company U’s projected external capital requirements.

Explanation of Solution

Calculation of company’s horizon value at year 3:

Therefore, AFN is $13.44 million.

b)

To determine: Self-supporting growth rate of Company U.

Explanation of Solution

Calculation of self-supporting growth rate:

Therefore, self-supporting growth rate is 6.38%.

c)

To construct: Balance sheet of Company U for December 31, 2019.

Explanation of Solution

Given information:

Forecasted sales is $420 million,

Profit margin is 3% ($10.5/$350),

Calculation of pay-out ratio:

Hence, pay-out ratio is 40%.

Calculation of net income:

Hence, net income is $12.6

The additional investment in assets is identical to the change in total assets because there are not short-term investments,

The additional financing from the increase in spontaneous liabilities and from the reinvested earnings is,

Calculation of financing surplus (deficit):

Therefore, financing deficit is -$13.44

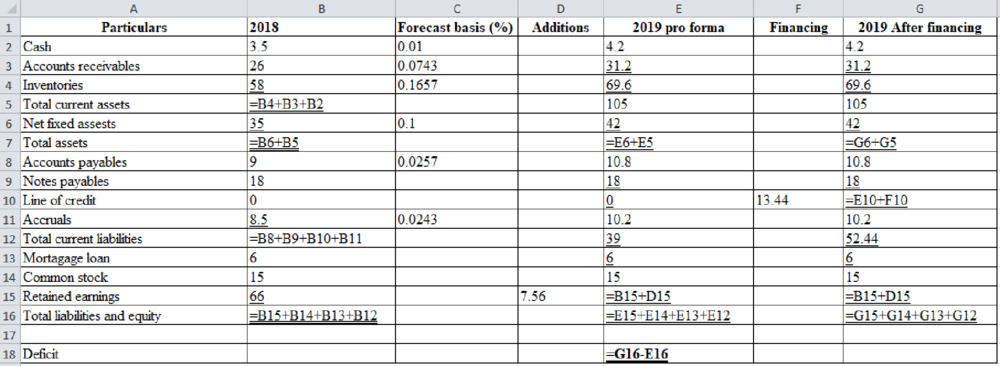

Excel workings:

Excel spread sheet:

Want to see more full solutions like this?

Chapter 9 Solutions

Intermediate Financial Management (MindTap Course List)

- Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Uptons balance sheet as of December 31, 2019, is shown here (millions of dollars): Sales for 2019 were 350 million, and net income for the year was 10.5 million, so the firms profit margin was 3.0%. Upton paid dividends of 4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. a. If sales are projected to increase by 70 million, or 20%, during 2020, use the AFN equation to determine Uptons projected external capital requirements. b. Using the AFN equation, determine Uptons self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds? c. Use the forecasted financial statement method to forecast Uptons balance sheet for December 31, 2020. Assume that all additional external capital is raised as a line of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Assume Uptons profit margin and dividend payout ratio will be the same in 2020 as they were in 2019. What is the amount of the line of credit reported on the 2020 forecasted balance sheets? (Hint: You dont need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2020 addition to retained earnings for the balance sheet without actually constructing a full income statement.)arrow_forwardNeiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forwardSuppose that Psy Ops Industries currently has the balance sheet shown below, and that sales for the year just ended were $4.4 million. The firm also has a profit margin of 20 percent, a retention ratio of 25 percent, and expects sales of $7.4 million next year. Assets Liabilities and Equity Current assets $ 1,980,000 Current liabilities $ 1,672,000 Fixed assets 3,700,000 Long-term debt 1,800,000 Equity 2,208,000 Total assets $ 5,680,000 Total liabilities and equity $ 5,680,000 If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales, what amount of additional funds will Psy Ops need from external sources to fund the expected growth? Note: Enter your answer in dollars not in millions. Negative amount should be indicated by a minus sign.arrow_forward

- Barry’s Superstore wishes to prepare financial plans. Use the financial statements on the next page and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for next year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost of Goods Sold. (6) A new machine costing $15,000 will be purchased next year. (7) Accounts payable will increase by 5%. (8) Unearned Revenue will be earned. (9) Notes Payable would decrease by $5000. (10) Short-Term Investments and common stock will remain unchanged. Requirement: a. Prepare a pro forma income statement for the year ended December 31, 2021, using the percent-of-sales method. Tax Rate is expected to be 15%. b. Prepare a pro forma balance…arrow_forwardBarry’s Superstore wishes to prepare financial plans. Use the financial statements on the next page and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for next year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost of Goods Sold. (6) A new machine costing $15,000 will be purchased next year. (7) Accounts payable will increase by 5%. (8) Unearned Revenue will be earned. (9) Notes Payable would decrease by $5000. (10) Short-Term Investments and common stock will remain unchanged. Requirement: Prepare a pro forma income statement for the year ended December 31, 2021, using the percent-of-sales method. Tax Rate is expected to be 15%. Prepare a pro forma balance…arrow_forwardProfitability ratios: Cisco Systems has total assets of $35.594 billion, total debt of $9.678 billion, and net sales of $22.045 billion. Its net profit margin for the year is 20 percent, while the operating profit margin is 30 percent. What are Cisco’s net income, EBIT ROA, ROA, and ROE?arrow_forward

- Adenta Ltd (Adenta) assembles telecommunication equipment and sells to wholesalers and retailers. The following ratios relate to the average figures for Adenta’s industry for the year ended 31 December, 2018: Return on capital employed 20.10% Gross profit margin 32% Net profit (before tax) margin 12.50% Current ratio 1.6:1 Acid-test ratio 0.9:1 Inventory turnover period 46 days Trade receivable collection period 45 days Debt-to-equity ratio 40% Dividen yield 6% Dividendcover 3 times Adenta’s financial statements for the year to 31 December, 2018 are set out below: Statement of Profit or Loss for the year ended 31 December, 2018 Sales 48,500 Cost of…arrow_forwardLeverage Ratios Grammatico Company has just completed its third year of operations. The income statement is as follows: Sales $ 2,460,000Less: Cost of goods sold 1,410,000Gross profit margin $ 1,050,000Less: Selling and administrative expenses 710,000Operating income $ 340,000Less: Interest expense 140,000Income before taxes $ 200,000Less: Income taxes 68,000Net income $ 132,000Selected information from the balance sheet is as follows: Current liabilities $1,000,000Long-term liabilities 1,500,000Total liabilities $2,500,000Common stock $4,000,000Retained earnings 750,000Total stockholders' equity $4,750,000Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio.fill in the blank 12. Compute the debt ratio.fill in the blank 23. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammatico’s industry are as…arrow_forwardProfitability ratios Your boss has asked you to calculate the profitability ratios of Triptych Food Corp. and make comments on its second-year performance as compared with its first-year performance. The following shows Triptych Food Corp.’s income statement for the last two years. The company had assets of $7,050 million in the first year and $11,278 million in the second year. Common equity was equal to $3,750 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Triptych Food Corp. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 3,810 3,000 Operating costs except depreciation and amortization 1,365 1,268 Depreciation and amortization 191 120 Total Operating Costs 1,556 1,388 Operating Income (or EBIT) 2,254 1,612 Less: Interest 304 169 Earnings before…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,