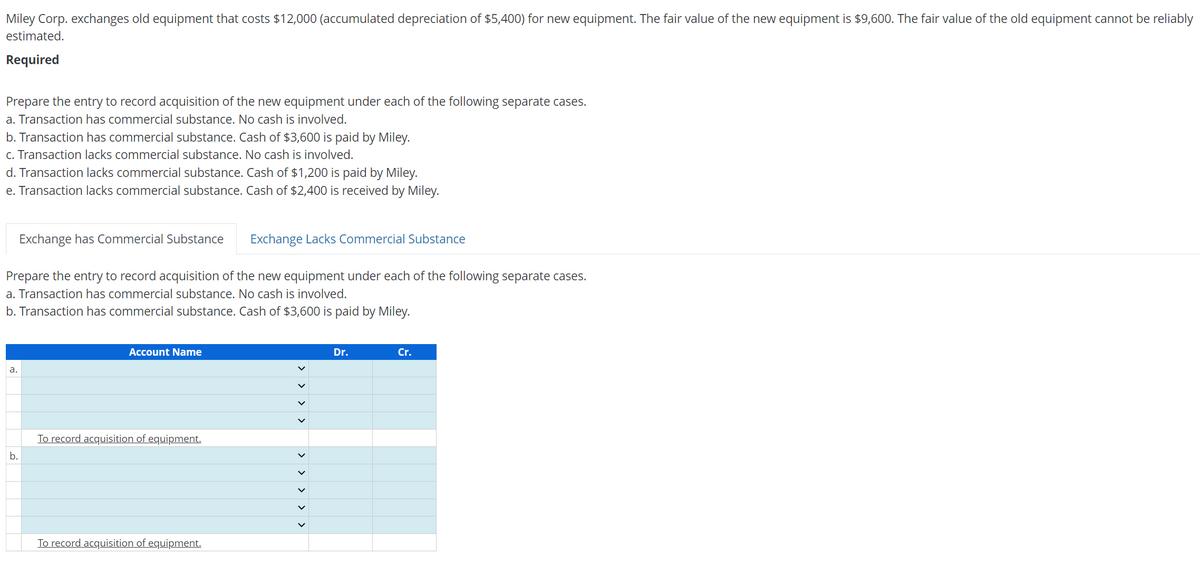

Miley Corp. exchanges old equipment that costs $12,000 (accumulated depreciation of $5,400) for new equipment. The fair value of the new equipment is $9,600. The fair value of the old equipment cannot be reliably estimated. Required Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $3,600 is paid by Miley. c. Transaction lacks commercial substance. No cash is involved. d. Transaction lacks commercial substance. Cash of $1,200 is paid by Miley. e. Transaction lacks commercial substance. Cash of $2,400 is received by Miley. Exchange has Commercial Substance Exchange Lacks Commercial Substance Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $3,600 is paid by Miley.

Miley Corp. exchanges old equipment that costs $12,000 (accumulated depreciation of $5,400) for new equipment. The fair value of the new equipment is $9,600. The fair value of the old equipment cannot be reliably estimated. Required Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $3,600 is paid by Miley. c. Transaction lacks commercial substance. No cash is involved. d. Transaction lacks commercial substance. Cash of $1,200 is paid by Miley. e. Transaction lacks commercial substance. Cash of $2,400 is received by Miley. Exchange has Commercial Substance Exchange Lacks Commercial Substance Prepare the entry to record acquisition of the new equipment under each of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $3,600 is paid by Miley.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter12: Auditing Long-lived Assets And Merger And Acquisition Activity

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

Subject : Accounting

Transcribed Image Text:Miley Corp. exchanges old equipment that costs $12,000 (accumulated depreciation of $5,400) for new equipment. The fair value of the new equipment is $9,600. The fair value of the old equipment cannot be reliably

estimated.

Required

Prepare the entry to record acquisition of the new equipment under each of the following separate cases.

a. Transaction has commercial substance. No cash is involved.

b. Transaction has commercial substance. Cash of $3,600 is paid by Miley.

c. Transaction lacks commercial substance. No cash is involved.

d. Transaction lacks commercial substance. Cash of $1,200 is paid by Miley.

e. Transaction lacks commercial substance. Cash of $2,400 is received by Miley.

Exchange has Commercial Substance Exchange Lacks Commercial Substance

Prepare the entry to record acquisition of the new equipment under each of the following separate cases.

a. Transaction has commercial substance. No cash is involved.

b. Transaction has commercial substance. Cash of $3,600 is paid by Miley.

a.

b.

Account Name

To record acquisition of equipment.

To record acquisition of equipment.

> > > > >

Dr.

Cr.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT