bon. The company S20 million at a rate of 6% compounded yearly. Determine the before tax cost of capital for the company. Thus, calculate the Weighted Average Cost of Capital or WAC.

bon. The company S20 million at a rate of 6% compounded yearly. Determine the before tax cost of capital for the company. Thus, calculate the Weighted Average Cost of Capital or WAC.

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1jM

Related questions

Question

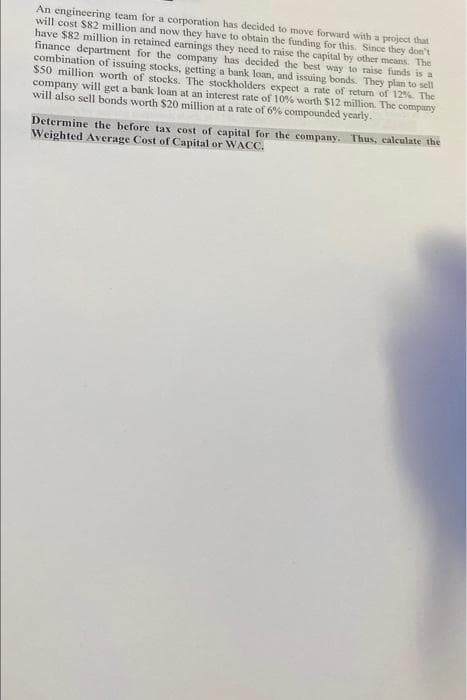

Transcribed Image Text:An engineering team for a corporation has decided to move forward with a project that

will cost $82 million and now they have to obtain the funding for this. Since they don't

have $82 million in retained earnings they need to raise the capital by other means. The

finance department for the company has decided the best way to raise funds is a

combination of issuing stocks, getting a bank loan, and issuing bonds. They plan to sell

$50 million worth of stocks. The stockholders expect a rate of return of 12% The

company will get a bank loan at an interest rate of 10% worth $12 million. The company

will also sell bonds worth $20 million at a rate of 6% compounded yearly.

Determine the before tax cost of capital for the company. Thus, calculate the

Weighted Average Cost of Capital or WACC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT