Exploring Finance: Coupon Bonds.

Conceptual Overview: Explore the value of fixed-interest coupon bonds of different terms.

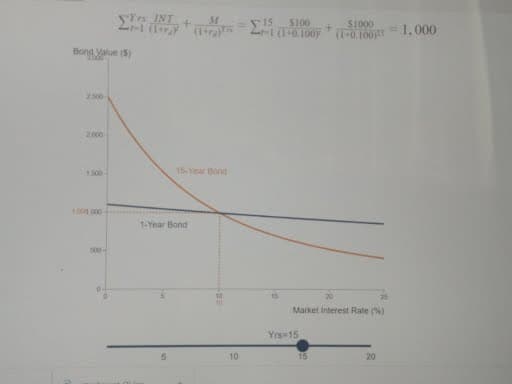

This graph shows the value of 10% coupon bonds of different terms across differing market interest rates. Each bond pays INT = $100 at the end of each year and returns M = $1,000 at maturity. For comparison, the blue line depicts the value of a one-year bond. The term of the other bond in years may be changed using the slider. Drag on the graph to change the current market interest rate (rd) at which the bond (orange curve) is evaluated.

|

3. What is the value of a 10-year 10% $1,000 bond when the market interest rate is 10%?

4. For a 10% $1,000 coupon bond, when the market interest rate is greater than 10%, the

5. For a 10%, $1,000 coupon bond, a longer term bond (say, 15 years) is:

|

Trending now

This is a popular solution!

Step by step

Solved in 2 steps