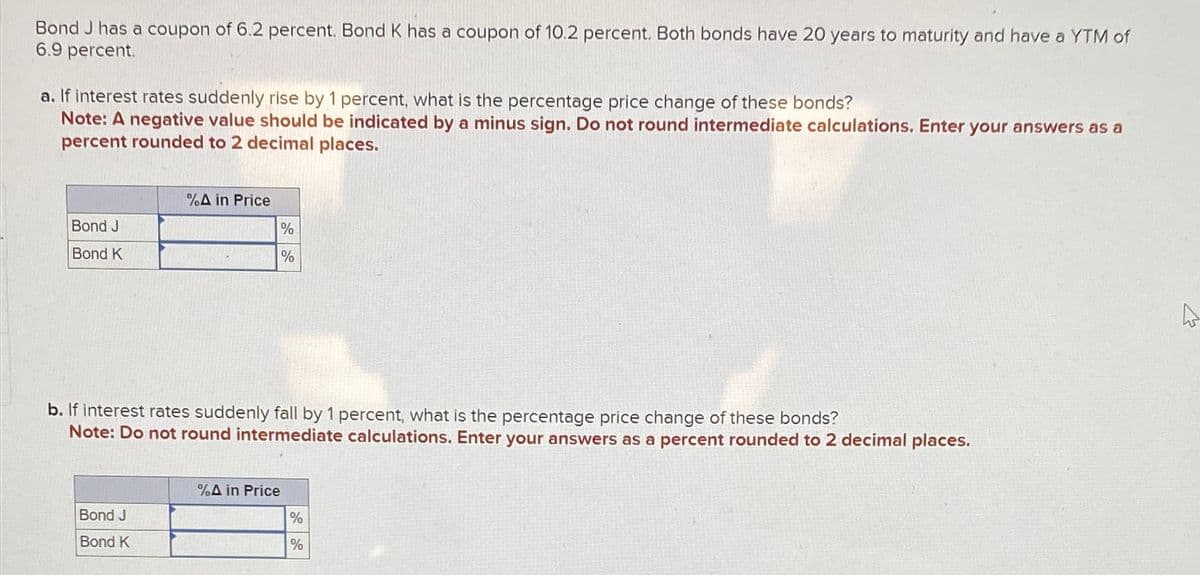

Bond J has a coupon of 6.2 percent. Bond K has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of 6.9 percent. a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Bond J Bond K %A in Price % % b. If interest rates suddenly fall by 1 percent, what is the percentage price change of these bonds? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. %A in Price Bond J % Bond K %

Bond J has a coupon of 6.2 percent. Bond K has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of 6.9 percent. a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Bond J Bond K %A in Price % % b. If interest rates suddenly fall by 1 percent, what is the percentage price change of these bonds? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. %A in Price Bond J % Bond K %

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 6DTM

Related questions

Question

Bond j has a coupon of 6.2 percent. Bond k has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of 6.9 percent. a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. \table[[,%delta in Price],[Bond j,,%

Transcribed Image Text:Bond J has a coupon of 6.2 percent. Bond K has a coupon of 10.2 percent. Both bonds have 20 years to maturity and have a YTM of

6.9 percent.

a. If interest rates suddenly rise by 1 percent, what is the percentage price change of these bonds?

Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a

percent rounded to 2 decimal places.

Bond J

Bond K

%A in Price

%

%

b. If interest rates suddenly fall by 1 percent, what is the percentage price change of these bonds?

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.

%A in Price

Bond J

%

Bond K

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,