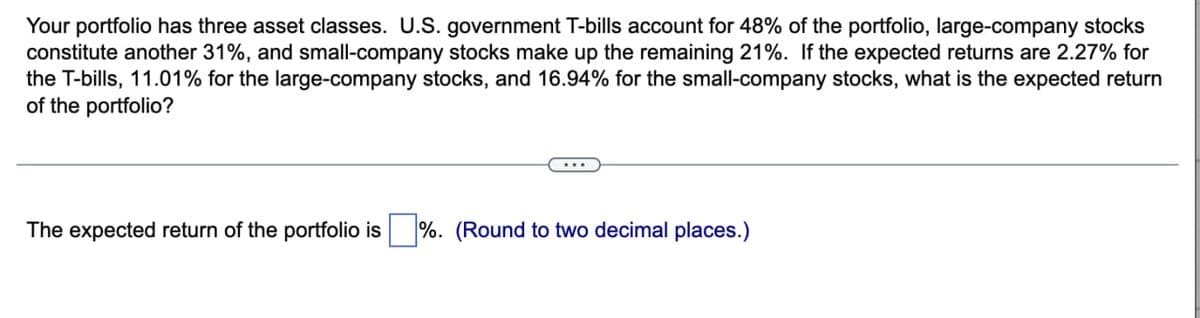

Your portfolio has three asset classes. U.S. government T-bills account for 48% of the portfolio, large-company stocks constitute another 31%, and small-company stocks make up the remaining 21%. If the expected returns are 2.27% for the T-bills, 11.01% for the large-company stocks, and 16.94% for the small-company stocks, what is the expected return of the portfolio? The expected return of the portfolio is %. (Round to two decimal places.)

Q: K-Life financial services Limited uses risk-adjusted return on capital (RAROC) to measure…

A: Let's examine the computations and offer a more thorough justification. 1. Credit to the…

Q: 1+ M- 9 Show Atten Current Attempt in Progress Lisa Anderson deposits $3,400 in her bank today. a. *…

A: 1. **Initial Deposit and Interest Rate**: Lisa Anderson initiates her financial endeavor by…

Q: None

A: Part 2: Explanation:Step 1: Generating random normal variables is crucial for simulating the…

Q: 1 Given the following conditional value table, deter- mine the appropriate decision under…

A: When considering decisions under uncertainty, various criteria can guide the choice-making process.…

Q: Tim buys an apartment that costs $750,000 with an 85% LTV mortgage. Tim got a 30 year, 3/1 ARM with…

A: Step 1: Calculate Loan Points CostLoan points are a one-time upfront fee paid to the lender,…

Q: Hedge May 20th: Producer plans to sell corn in early November. Currently the December corn futures…

A: Step 1:May 20th:The producer plans to sell corn in early November, indicating they have a long cash…

Q: Baghiben

A: Bond equivalent yield =( (1+r)^(79/365) -1)*365/79Bond equivalent yield =…

Q: Equipment has a book value of $4, 300 at the end of a project, but it can be sold for $5,400. What…

A: To calculate the cash flow for capital budgeting purposes at the end of the project, you need to…

Q: At the beginning of each month, Francisco deposits $7,500 into an investment account. If the…

A: Part 2: Explanation:Step 1: Calculate the number of months in 3 years.3 years = 3 * 12 months = 36…

Q: Using the data in the following table,, consider a portfolio that maintains a 50% weight on stock A…

A: Here's the solution:

Q: Are the answers to A & B correct? Could I get some help on the multiple choice (B&C)?

A: Let us discuss the computations and factors that are involved in more depth. 1. NPV and IRR…

Q: Could you check these answers and help me with the IRR?

A: Your answers for the NPV are correct:NPV with mitigation: $416.60 millionNPV without mitigation:…

Q: Using a required rate of return equal to 10 percent, compute the modified internal rate of return…

A:

Q: Required: Zeda Incorporated, a U.S. MNC, is considering making a fixed direct investment in Denmark.…

A: let's calculate the present value of each repayment using the appropriate discount rate:Convert the…

Q: IIII. 4. The following table shows the rate of returns for large company stocks and Treasury bills…

A: Part 2: Explanation:Step 1: Calculating the risk premium for each year- For each year, subtract the…

Q: The price of an Australian Savings Bond (ASB) with no expiration date is originally $1,000 and has a…

A: The objective of this question is to calculate the interest rate yield to a new buyer of the…

Q: Consider the following countinuous compunding LIBOR spot rates: 3M (2,2% pa.), 6M (2,3% pa.), 9M…

A: Libor rates:LIBOR rates, often referred to as the bedrock of global finance, are pivotal benchmarks…

Q: eBook Problem Walk-Through A.9% semiannual coupon bond matures in 6 years. The bond has a face value…

A: Given information: Face value (FV) = $1,000 Current Yield = 8.8289% Coupon rate (CR) = 9% Annual…

Q: Increasing the down payment on a mortgage reduces both the size of the monthly payments and the…

A: In the first case, the loan amount-loan-down payment is 243,000-52,000=191,000 The monthly payment…

Q: 45. You are evaluating a stock selling for $30 per share. Over the investment period (1 year) you…

A: Step 1: Step 2: Step 3: Step 4:

Q: A firm with a WACC of 10% is considering the following mutually exclusive projects: 1 2 3 5 + ㅓ…

A:

Q: During a 12-month period, a company is permitted to issue new securities through crowdfunding up to…

A: A corporation may offer up to $5 million in new securities through crowdfunding in a 12-month…

Q: Project S requires an initial outlay at t=0 of $12,000, and its expected cash flows would be $4,000…

A: Project S:Initial outlay (at t=0) = $12,000Annual cash flow (A) = $4,000Time (n) =5 yearsRate (i)…

Q: a firm's bonds have a maturity of 14 years with a $1,000 face value, have an 8% semiannual coupon,…

A: Part 2: Explanation:Step 1: Calculate the present value of the bond's future cash flows to determine…

Q: please answer these two

A: Qn 1: LED vs Incandescent Bulb - Break-Even CostHere's the corrected approach to find the break-even…

Q: Better Mousetraps has developed a new trap. It can go into production for an initial investment in…

A: Step 1:1. All cash flows are in millions of dollars Initial Investment5.4million…

Q: Bird's Eye Treehouses Inc. has determined that a majority of its customers are located in the…

A: 2. Recalculate Present Value and NPV:Follow steps 7 and 8 from part 1 using the new annual net cash…

Q: You are considering starting a walk-in clinic. Your financial projections for the first year of…

A:

Q: An oil-drilling company must choose between two mutually exclusive extraction projects, and each…

A: The scenario presented outlines a decision-making process for an all-drilling company faced with two…

Q: 6. Create a spreadsheet modeling trajectories of geometric Brownian motion starting at 50 with…

A: The objective of the question is to create a spreadsheet model for geometric Brownian motion and use…

Q: Bhupatbhai

A: The objective of the question is to calculate the initial deposit insurance assessment rate for two…

Q: Corporate Finance You begin working at an investment bank with a group of analysts, and you are all…

A: Using a 40% Growth Rate for Amazon's DCF Model: A Critical Assessment There are drawbacks to the…

Q: how start trading in share market

A: There is no denying the share market's attraction. Many are drawn to this field by the possibility…

Q: Keith holds a portfolio that is invested equally in three stocks (wDwD = wAwA = wIwI = 1/3). Each…

A: The objective of the question is to determine whether the stocks DET, AIL, and INO are in…

Q: Judy's Boutique just paid an annual dividend of $3.13 on its common stock. The firm increases its…

A: The cost of equity represents the rate of return that investors require from a company's stock in…

Q: Returns earned over a given time period are called realized returns. Historical data on realized…

A: let's break down the calculations and ideas step by step.1. **Normal Realized Return (Cruel…

Q: Project L requires an initial outlay at t = 0 of $40,000, its expected cash inflows are $12,000 per…

A: Calculate the project's NPV using Excel as follows:Formula sheet:Note:To understand the calculation…

Q: Calculating Present Values) A5- year annuity of ten $7,000 semiannual payments will begin 8 years…

A: Step 1: Calculate the present value of the annuity 5 years from now.Present value of the annuity 5…

Q: Problem 13-05 Charlotte's Clothing issued a 7 percent bond with a maturity date of 18 years. Six…

A: Answer image:

Q: Nikulbhai

A: Step 1: The calculation of current yield, yield to maturity, and effective annual yield AB1Face…

Q: You are holding call options on a stock. The stock’s beta is 0.65, and you are concerned that the…

A: To hedge your market exposure given the current situation, you can use the concept of beta hedging.…

Q: You are given the following data for a listed company as follows: Options Traded on Legal and…

A: Long straddle:A long straddle strategy in finance involves purchasing both a call option and a put…

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Step 1: To complete the missing amounts in the income statement, here is its detailed solution:…

Q: You may attempt this question 2 more times for credit An airline is considering a project of…

A: Answer to Part 1:To calculate the net present value (NPV) of the project, we need to discount the…

Q: Raghubhai

A: Step 1: ABCDE1Solution: 2 3StateProbabilityReturn AReturn BReturn…

Q: None

A: step 1.step 2.

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: The objective of the question is to calculate the Net Present Value (NPV) and Internal Rate of…

Q: None

A: Analyzing the investment's performance over the four-year period involves two crucial metrics: the…

Q: Please show how to solve this problem using excel and please show the spreadsheet formulas.…

A: Part 2: Explanation:Step 1: Calculate the Monthly Interest RateThe annual interest rate is 7.5%. To…

Q: To vacation with his family, Mr. Velasco obtains a loan of $60,000 to be paid in 7 monthly…

A: Let's create an amortization table for Mr. Velasco's loan. Here are the details:Loan amount:…

Step by step

Solved in 2 steps

- Your portfolio has three asset classes. U. S government T bills account for 47% of the portfolio, large company stocks constitute another 33%, and small company stocks make up the remaining 20%. If teh expected returns are 2.41% for the T-bills, 11.41% for the large company stocks, and 17.15% for the small company stocks, what is the expected return on the portfolio?An analyst wants to evaluate Portfolio X, consisting entirely of U.S. common stocks, using both the Treynor and Sharpe measures of portfolio performance. The following table provides the average annual rate of return for Portfolio X, the market portfolio (as measured by the Standard and Poor’s 500 Index), and U.S. Treasury bills (T-bills) during the past eight years. Rate Annual Averageof Return STANDARD DEVIATION OF RETURN BETA Portfolio X 10 13 0.40 S&P 500 12 10 1.00 T-bills 7 n/a n/a n/a = not applicable Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Round your answers for the Treynor measure to one decimal place and for the Sharpe measure to three decimal places. Treynor measure Sharpe measure Portfolio X 7.5 S&P 500 5An analyst wants to evaluate Portfolio X consisting entirely of US common stocks, using both the Treynor and Sharpe measures of the portfolio performance. The following table provides the average annual rate of return for the portfolio X the market portfolio (as measured by the Standard & Poor's 500 index) and US Treasury billds (Tbills) during the past eight years Average Return Standard deviation Beta Portfolio X 10% 18% 0.6 S & P 500 12% 13% 1 T bills 6% n/a n/a a. Calculate both the Treynor measure and the Sharpe measure for both Portfolio X and the S&P 500. Briefly explain whether portfolio X underperformed, equalled, or outperformed the S&P 500 on a risk-adjusted basis using both the Treynor measure and the Sharpe measure. b. Based on the performance of…

- Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 12% and 16%, respectively. The beta of A is .7, while that of B is 1.4. The T-bill rate is currently 5%, whereas the expected rate of return of the S&P 500 index is 13%. The standard deviation of portfolio A is 12% annually, that of B is 31%, and that of the S&P 500 index is 18%.a. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain.b. If instead you could invest only in T-bills and one of these portfolios, which would you choose?Consider a portfolio with stocks A, B, and C. The total value of the portfolio is $245,000 and it is fully invested in these 3 stocks. $85,653 is invested in A and $69,552 is invested in B. The Betas of stocks A, B, and C are 1.2, .8, and 1.62, respectively. What is the Beta of the portfolio overall?You have recommended a portfolio comprising of 65 percent in a bond index and 35 percent in a stock index to one of your clients. The bond index has a return of 15% and a standard deviation of 12% per year and the stock index has a return of 20% and standard deviation of 16% per year. The correlation between the bond index and the stock index 37. 1. What is the expected return and standard deviation of this portfolio?

- Suppose you owned a portfolio consisting of $250,000 of long-term U.S. government bonds. Would your portfolio be riskless? Explain. What is the least risky security you can think of? Explain. Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, a correlation coefficient with the market of −0.3, and a beta coefficient of −0.5. Stock B has an expected return of 12%, a standard deviation of returns of 10%, a 0.7 correlation with the market, and a beta coefficient of 1.0. Which security is riskier? Why?The figures below show plots of monthly rates of return on three stocks versus those of the market index. The beta and standard deviation of each stock is given beside the plot. Consider a well-diversified portfolio composed of stocks with the same beta and standard deviation as Ford. What are the beta and standard deviation of this portfolio’s return? The standard deviation of the market portfolio’s return is 20%. Use the capital asset pricing model to estimate the expected return on each stock. The risk-free rate is 4%, and the market risk premium is 8%.Based on current dividend yields and expected capital gains, the expected rates or return on portfolios A and B are 12% and 18%, respectively. The beta of A is 0.7 while that of B is 1.6. The T-bill rate is currently 4% while the expected rate of return of the S&P500 Index is 13%. The standard deviation of portfolio A is 14% annually, while that of B is 26%, and that of the index is 15%. If you currently hold a market-index portfolio, would you chose to add either of these portfolios to your holdings?

- A portfolio consists of assets with the following expected returns (refer to image): a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? b. What is the expected return on the portfolio if the investor puts 50 percent of available funds in technology stocks, 10 percent in pharmaceutical stocks, 24 percent in utility stocks, and 16 percent in the savings account?Fremont Enterprises has an expected return of 14% and Laurelhurst News has an expected return of 19%. If you put 44% of your portfolio in Laurelhurst and 56% in Fremont, what is the expected return of your portfolio? The expected return on the portfolio is \%. (Rounded to two decimal places.)Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 11 % and 14 %, respectively. The beta of A is 0.8 % while that of B is 1.5. The T-bill is currently 6 %, while the expected rate of return of the S&P 500 index is 12 %. The standard deviation of portfolio A is 10 % annually, while that of B is 31 % , and that of the index is 20 %: If you currently hold a market index portfolio, would you choose to add either of these portfolios to your holdings? Explain. If instead you could invest only in bills and one of these portfolios, which would you choose, and why? Investor Y, who put K1 in large stocks (the S & P 500 portfolio) on December 31, 1925, and re-invested all dividends in that portfolio, would have ended on December 31, 2003, with K1992.80.