Book Value Fair Value Book Value Fair Value $285,000 320,000 $ 40,000 430,000 $ 40,000 434,000 Current assets $210,000 Loan payable to Bower Other liabilities Equipment (net of depreciation). 225,000 Arnold, capital. Bower, capital . Chambers, capital. 50,000 Vacant land. Other assets. 60,000 15,000 85,000 10,000 100,000 60,000 Total assets.. $680,000 $530,000 Total liabilities $680,000 $474,000

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

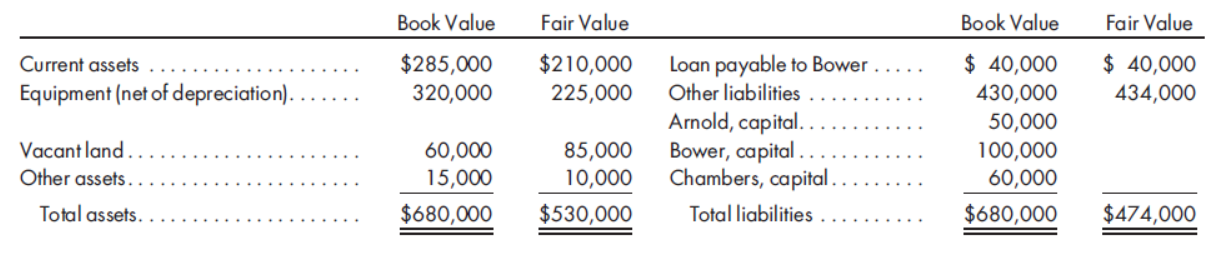

Arnold (A), Bower (B), and Chambers (C) are partners in a small manufacturing firm whose net assets are as follows: (attached)

The

a. Salaries to A, B, and C of $30,000, $30,000, and $40,000, respectively.

b. Bonus to A of 10% of net income after the bonus.

c. Remaining amounts are allocated according to

Unfortunately, the business finds itself in difficult times: Annual profits remain flat at approximately $132,000, additional capital is needed to finance equipment which is necessary to stay competitive, and all of the partners realize that they could make more money working for someone else, with a lot fewer headaches.

Chambers has identified Dawson (D) as an individual who might be willing to acquire an interest in the partnership. Dawson is proposing to acquire a 30% interest in the capital of the partnership and a revised partnership agreement, which calls for the allocation of profits as follows:

a. Salaries to A, B, C, and D of $30,000, $30,000, $40,000, and $30,000, respectively.

b. Bonus to D of $20,000 if net income exceeds $250,000.

c. Remaining amounts are allocated according to profit and loss percentages of 30%, 10%, 30%, and 30% for A, B, C, and D, respectively.

An alternative to admitting a new partner is to liquidate the partnership. Net personal assets of the partners are as follows:

Arnold Bower Chambers

Personal assets. . . . . . . . . . . . . . . . .$240,000 $530,000 $300,000

Personal liabilities . . . . . . . . . . . . . . 228,000 150,000 200,000

Assuming that you are Bower’s personal CPA, you have been asked to provide your client with your opinions regarding the alternatives facing the partnership.

1. Bower does not believe it would be worth it to him to admit a new partner unless his allocation of income increased by at least $10,000 over that which existed under the original partnership agreement. What would the average annual profit of the new partnership have to be in order for Bower to accept the idea of admitting a new partner?

2. Given the net assets of the original partnership, what is the suggested purchase price that Dawson should pay for a 30% interest in the partnership?

3. Assume that the original partnership was liquidated and Bower received a business vehicle, with a fair value of $15,000 and a net book value of $20,000, as part of his liquidation proceeds. Partners with a deficit capital balance will only contribute their net personal assets. How much additional cash would Bower receive if the partnership were liquidated?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps