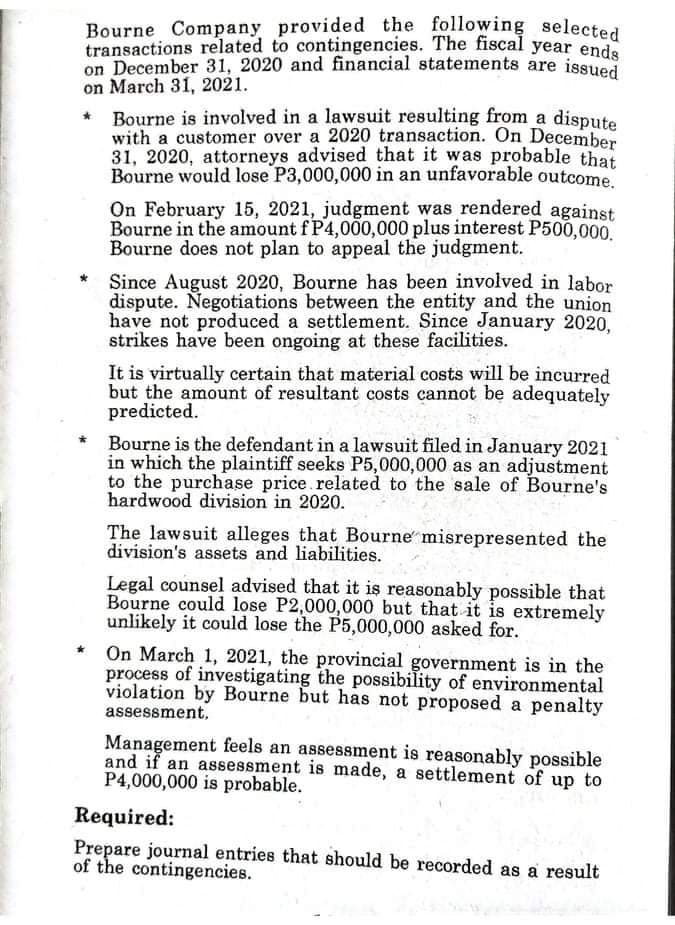

Bourne Company provided the following selected transactions related to contingencies. The fiscal year ende on December 31, 2020 and financial statements are issued on March 31, 2021. Bourne is involved in a lawsuit resulting from a dispute with a customer over a 2020 transaction. On December 31, 2020, attorneys advised that it was probable that Bourne would lose P3,000,000 in an unfavorable outcome. On February 15, 2021, judgment was rendered against Bourne in the amount f P4,000,000 plus interest P500,000. Bourne does not plan to appeal the judgment. Since August 2020, Bourne has been involved in labor dispute. Negotiations between the entity and the union have not produced a settlement. Since January 2020, strikes have been ongoing at these facilities. It is virtually certain that material costs will be incurred but the amount of resultant costs cannot be adequately predicted. Bourne is the defendant in a lawsuit filed in January 2021 in which the plaintiff seeks P5,000,000 as an adjustment to the purchase price.related to the sale of Bourne's hardwood division in 2020. The lawsuit alleges that Bourne misrepresented the division's assets and liabilities. Legal counsel advised that it is reasonably possible that Bourne could lose P2,000,000 but that it is extremely unlikely it could lose the P5,000,000 asked for. On March 1, 2021, the provincial government is in the process of investigating the possibility of environmental violation by Bourne but has not proposed a penalty assessment, Management feels an assessment is reasonably possible and if an assessment is made, a settlement of up to P4,000,000 is probable. Required: Prepare journal entries that should be recorded as a result of the contingencies.

Dividend Valuation

Dividend refers to a reward or cash that a company gives to its shareholders out of the profits. Dividends can be issued in various forms such as cash payment, stocks, or in any other form as per the company norms. It is usually a part of the profit that the company shares with its shareholders.

Dividend Discount Model

Dividend payments are generally paid to investors or shareholders of a company when the company earns profit for the year, thus representing growth. The dividend discount model is an important method used to forecast the price of a company’s stock. It is based on the computation methodology that the present value of all its future dividends is equivalent to the value of the company.

Capital Gains Yield

It may be referred to as the earnings generated on an investment over a particular period of time. It is generally expressed as a percentage and includes some dividends or interest earned by holding a particular security. Cases, where it is higher normally, indicate the higher income and lower risk. It is mostly computed on an annual basis and is different from the total return on investment. In case it becomes too high, indicates that either the stock prices are going down or the company is paying higher dividends.

Stock Valuation

In simple words, stock valuation is a tool to calculate the current price, or value, of a company. It is used to not only calculate the value of the company but help an investor decide if they want to buy, sell or hold a company's stocks.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images