Bramble Corporation had the following stockholders' equity accounts on January 1, 2022: Common Stock ($4 par) $440,000, Paid-in Capital in Excess of Par-Common Stock $210,000, and Retained Earnings s110.000. In 2022, the company had the following treasury stock transactions. Mar. 1 Purchased 7,000 shares at 58 per share. June 1 Sold 1,000 shares at $13 per share Sept. 1 Sold 1.000 shares at $11 per share Dec 1 Sold 1.000 shares at 57 per share. Bramble Corporation uses the cost method of accounting for treasury stock. In 2022, the company reported net income of $25.000. (a) Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2022. for net income. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit >

Bramble Corporation had the following stockholders' equity accounts on January 1, 2022: Common Stock ($4 par) $440,000, Paid-in Capital in Excess of Par-Common Stock $210,000, and Retained Earnings s110.000. In 2022, the company had the following treasury stock transactions. Mar. 1 Purchased 7,000 shares at 58 per share. June 1 Sold 1,000 shares at $13 per share Sept. 1 Sold 1.000 shares at $11 per share Dec 1 Sold 1.000 shares at 57 per share. Bramble Corporation uses the cost method of accounting for treasury stock. In 2022, the company reported net income of $25.000. (a) Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2022. for net income. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

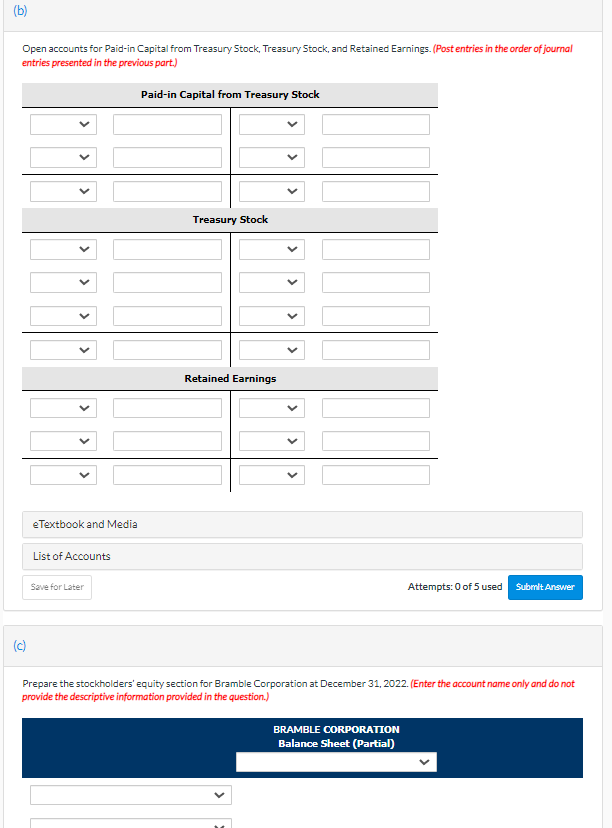

Transcribed Image Text:(b)

Open accounts for Paid-in Capital from Treasury Stock, Treasury Stock, and Retained Earnings. (Post entries in the order of journal

entries presented in the previous part.)

Paid-in Capital from Treasury Stock

Treasury Stock

Retained Earnings

eTextbook and Media

List of Accounts

Save for Later

Attempts: 0 of 5 used

Submit Answer

(c)

Prepare the stockholders' equity section for Bramble Corporation at December 31, 2022. (Enter the account name only and do not

provide the descriptive information provided in the question.)

BRAMBLE CORPORATION

Balance Sheet (Partial)

>

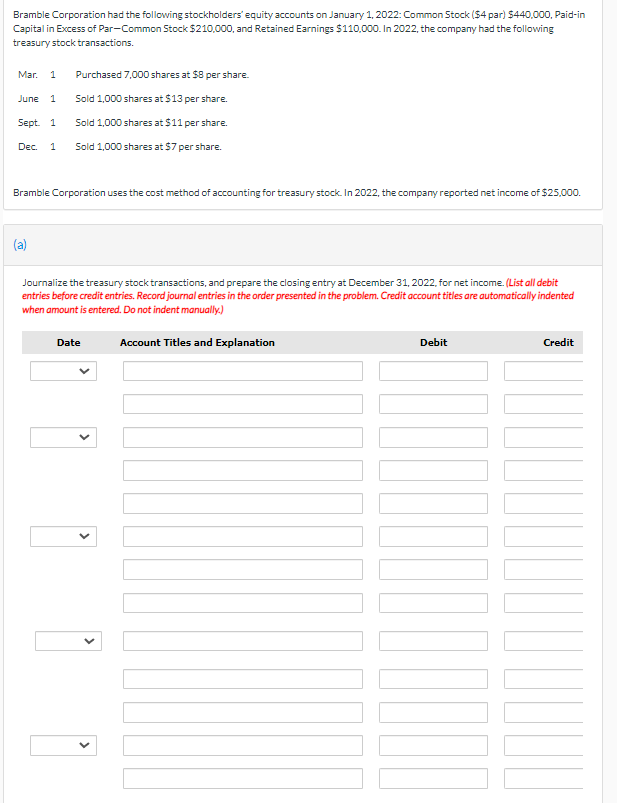

Transcribed Image Text:Bramble Corporation had the following stockholders' equity accounts on January 1, 2022: Common Stock (54 par) 5440,000, Paid-in

Capital in Excess of Par-Common Stock $210,000, and Retained Earnings $110,000. In 2022, the company had the following

treasury stock transactions.

Mar. 1

Purchased 7,000 shares at $8 per share.

June 1

Sold 1,000 shares at $13 per share.

Sept. 1

Sold 1,000 shares at $11 per share.

Dec.

Sold 1,000 shares at $7 per share.

Bramble Corporation uses the cost method of accounting for treasury stock. In 2022, the company reported net income of $25,000.

(a)

Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2022, for net income. (List all debit

entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented

when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

>

Expert Solution

Step 1

Treasury stock refers to such shares which were previously outstanding which have been bought back from stakeholders/shareholders by the company.

As a result, the total shares outstanding of the company decreases.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning