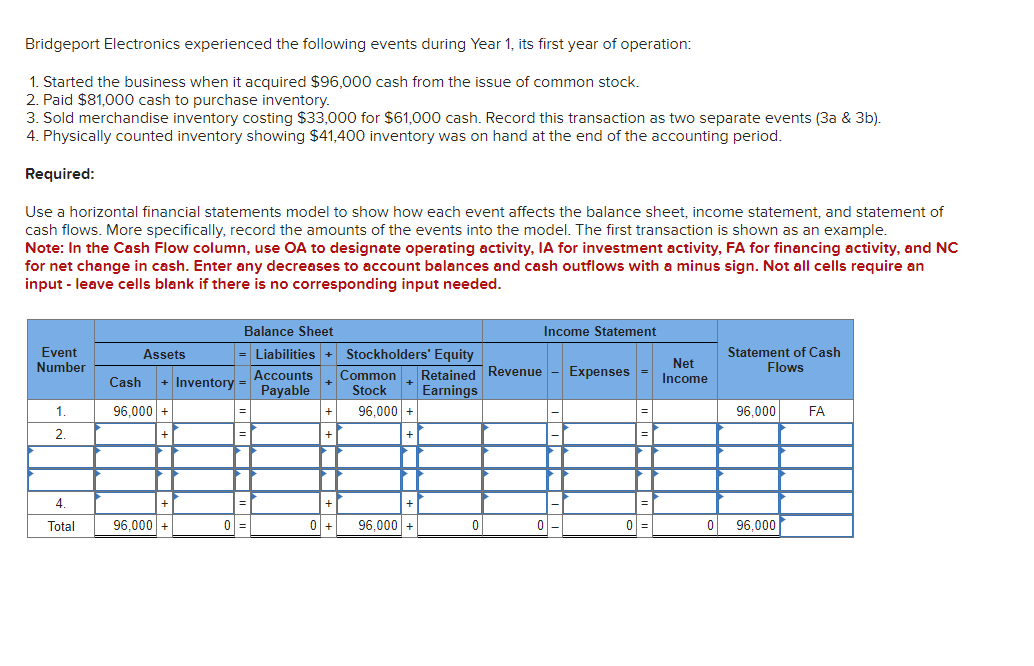

Bridgeport Electronics experienced the following events during Year 1, its first year of operation: 1. Started the business when it acquired $96,000 cash from the issue of common stock. 2. Paid $81,000 cash to purchase inventory. 3. Sold merchandise inventory costing $33,000 for $61,000 cash. Record this transaction as two separate events (3a & 3b). 4. Physically counted inventory showing $41,400 inventory was on hand at the end of the accounting period. Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. The first transaction is shown as an example. Note: In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require an input - leave cells blank if there is no corresponding input needed.

Bridgeport Electronics experienced the following events during Year 1, its first year of operation: 1. Started the business when it acquired $96,000 cash from the issue of common stock. 2. Paid $81,000 cash to purchase inventory. 3. Sold merchandise inventory costing $33,000 for $61,000 cash. Record this transaction as two separate events (3a & 3b). 4. Physically counted inventory showing $41,400 inventory was on hand at the end of the accounting period. Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. The first transaction is shown as an example. Note: In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require an input - leave cells blank if there is no corresponding input needed.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 1MP

Related questions

Question

100%

m01

Transcribed Image Text:Bridgeport Electronics experienced the following events during Year 1, its first year of operation:

1. Started the business when it acquired $96,000 cash from the issue of common stock.

2. Paid $81,000 cash to purchase inventory.

3. Sold merchandise inventory costing $33,000 for $61,000 cash. Record this transaction as two separate events (3a & 3b).

4. Physically counted inventory showing $41,400 inventory was on hand at the end of the accounting period.

Required:

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. The first transaction is shown as an example.

Note: In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC

for net change in cash. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require an

input - leave cells blank if there is no corresponding input needed.

Event

Number

1.

2.

4.

Total

Assets

+ Inventory

Cash

96,000 +

+

96,000 +

Balance Sheet

= Liabilities + Stockholders' Equity

Accounts Common

Retained

Payable Stock Earnings

96,000 +

0 =

0

+

+

+

+

96.000 +

0

Income Statement

Revenue - Expenses

-

0

Net

Income

Statement of Cash

Flows

96,000 FA

0 96,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning