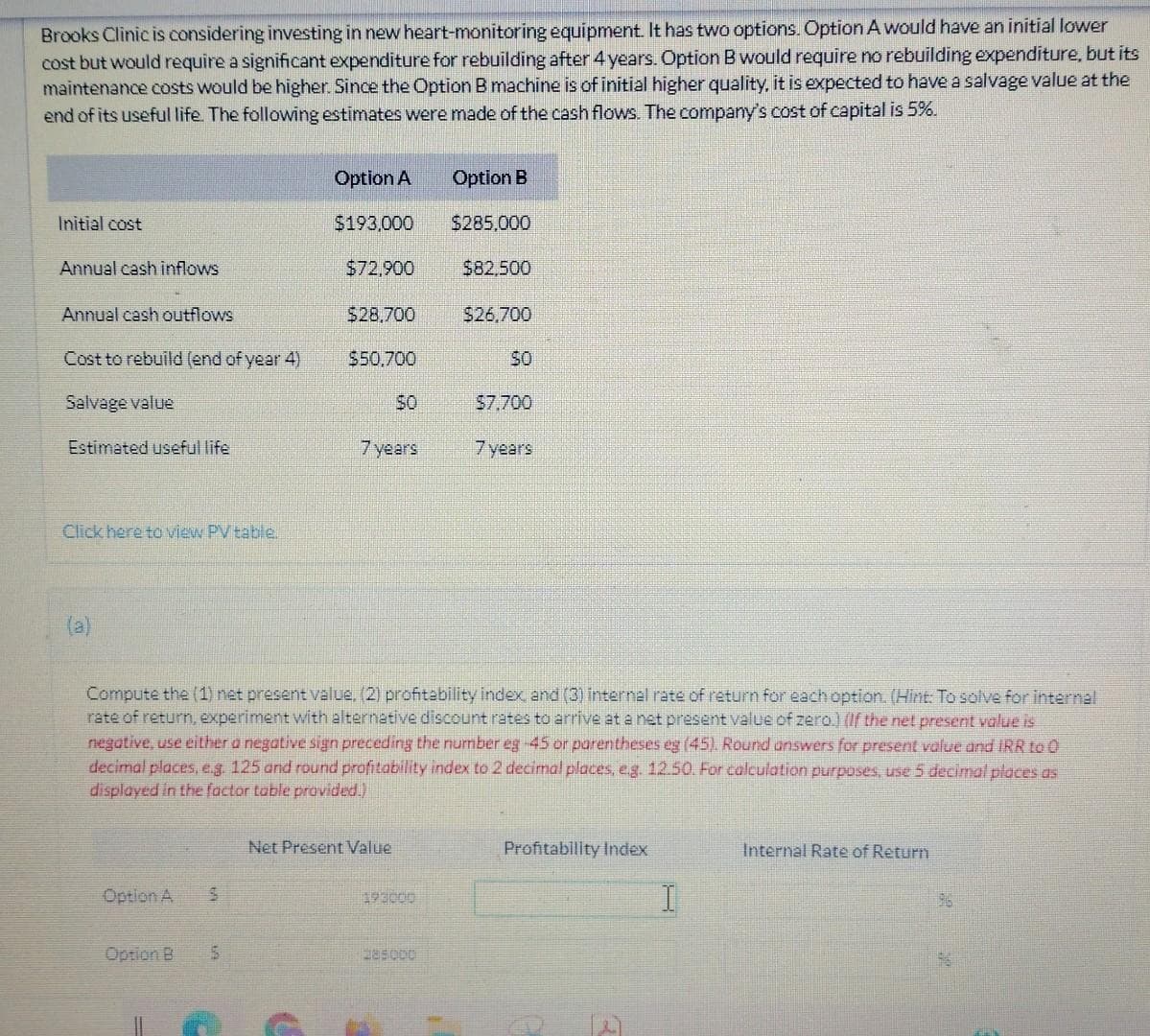

Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost $193,000 $285.000 Annual cash inflows $72,900 $82,500 Annual cash outflows $28,700 $26,700 Cost to rebuild (end of year 4) $50.700 SO Salvage value SO $7.700 Estimated useful life 7 years 7 years

Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost $193,000 $285.000 Annual cash inflows $72,900 $82,500 Annual cash outflows $28,700 $26,700 Cost to rebuild (end of year 4) $50.700 SO Salvage value SO $7.700 Estimated useful life 7 years 7 years

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower

cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its

maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the

end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%.

Option A

Option B

Initial cost

$193.000

$285,000

Annual cash inflows

$72,900

$82.500

Annual cash outflows

$28,700

$26,700

Cost to rebuild (end of year 4)

$50.700

S0

Salvage value

SO

$7.700

Estimated useful life

7 years

7 years

Click here to view PV table.

(a)

Compute the (1) net present value, (2) profitability index and (3) Internal rate of return for each option. (HintE To solve for internal

rate of return, experiment with alternative discount rates to arrive at a net present value of zero) (If the net present value is

negative, use either a negative sign preceding the nurmber eg -45 or parentheses eg (45). Rournd answers for present value and IRR to 0

decimal places, e.g. 125 and round profitability index to 2 decimal places, e.g. 12.50. For calculation purposes, use 5 decimal places as

displayed in the factor table provided.)

Net Present Value

Profitability Index

Internal Rate of Return

Option A

Option B

285000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub