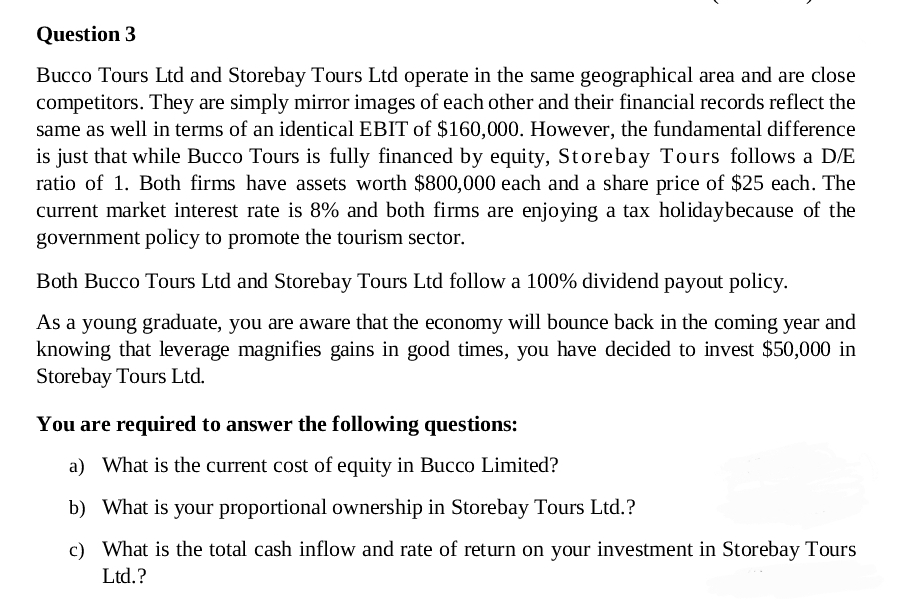

Bucco Tours Ltd and Storebay Tours Ltd operate in the same geographical area and are close competitors. They are simply mirror images of each other and their financial records reflect the same as well in terms of an identical EBIT of $160,000. However, the fundamental difference is just that while Bucco Tours is fully financed by equity, Storebay Tours follows a D/E ratio of 1. Both firms have assets worth $800,000 each and a share price of $25 each. The current market interest rate is 8% and both firms are enjoying a tax holidaybecause of the government policy to promote the tourism sector. Both Bucco Tours Ltd and Storebay Tours Ltd follow a 100% dividend payout policy. As a young graduate, you are aware that the economy will bounce back in the coming year and knowing that leverage magnifies gains in good times, you have decided to invest $50,000 in Storebay Tours Ltd. You are required to answer the following questions: a) What is the current cost of equity in Bucco Limited? b) What is your proportional ownership in Storebay Tours Ltd.? c) What is the total cash inflow and rate of return on your investment in Storebay Tours Ltd.?

Bucco Tours Ltd and Storebay Tours Ltd operate in the same geographical area and are close competitors. They are simply mirror images of each other and their financial records reflect the same as well in terms of an identical EBIT of $160,000. However, the fundamental difference is just that while Bucco Tours is fully financed by equity, Storebay Tours follows a D/E ratio of 1. Both firms have assets worth $800,000 each and a share price of $25 each. The current market interest rate is 8% and both firms are enjoying a tax holidaybecause of the government policy to promote the tourism sector. Both Bucco Tours Ltd and Storebay Tours Ltd follow a 100% dividend payout policy. As a young graduate, you are aware that the economy will bounce back in the coming year and knowing that leverage magnifies gains in good times, you have decided to invest $50,000 in Storebay Tours Ltd. You are required to answer the following questions: a) What is the current cost of equity in Bucco Limited? b) What is your proportional ownership in Storebay Tours Ltd.? c) What is the total cash inflow and rate of return on your investment in Storebay Tours Ltd.?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 5RP

Related questions

Question

Transcribed Image Text:Question 3

Bucco Tours Ltd and Storebay Tours Ltd operate in the same geographical area and are close

competitors. They are simply mirror images of each other and their financial records reflect the

same as well in terms of an identical EBIT of $160,000. However, the fundamental difference

is just that while Bucco Tours is fully financed by equity, Storebay Tours follows a D/E

ratio of 1. Both firms have assets worth $800,000 each and a share price of $25 each. The

current market interest rate is 8% and both firms are enjoying a tax holiday because of the

government policy to promote the tourism sector.

Both Bucco Tours Ltd and Storebay Tours Ltd follow a 100% dividend payout policy.

As a young graduate, you are aware that the economy will bounce back in the coming year and

knowing that leverage magnifies gains in good times, you have decided to invest $50,000 in

Storebay Tours Ltd.

You are required to answer the following questions:

a) What is the current cost of equity in Bucco Limited?

b) What is your proportional ownership in Storebay Tours Ltd.?

c) What is the total cash inflow and rate of return on your investment in Storebay Tours

Ltd.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning