nad the follovwing data for his Inco year: Php 490, 000 150, 000 200, 000 120, 000 70, 000 320,000 Sales Personal Exemption Cost of Sales Administrative and Selling Expenses Personal Expenses Professional Income Graduated Income Tax Rate Effective January 1, 2018 Initial Basis 0-250,000 Over 250, 000 but not over 400, 000 Over 400,000 but not over 800,000 Over 800, 000 but not over 2,000, 000 Over 2, 000, 000 but not over 8, 000, 000 Over 8, 000, 000 Tax due In Excess -0- -0- -0- +20% of the excess over 30,000 130,000 490, 000 2, 410, 000 +25% of the excess over +30% of the excess over +32% of the excess over +35% of the excess over How much is the income tax due is he uses itemized deduction?

nad the follovwing data for his Inco year: Php 490, 000 150, 000 200, 000 120, 000 70, 000 320,000 Sales Personal Exemption Cost of Sales Administrative and Selling Expenses Personal Expenses Professional Income Graduated Income Tax Rate Effective January 1, 2018 Initial Basis 0-250,000 Over 250, 000 but not over 400, 000 Over 400,000 but not over 800,000 Over 800, 000 but not over 2,000, 000 Over 2, 000, 000 but not over 8, 000, 000 Over 8, 000, 000 Tax due In Excess -0- -0- -0- +20% of the excess over 30,000 130,000 490, 000 2, 410, 000 +25% of the excess over +30% of the excess over +32% of the excess over +35% of the excess over How much is the income tax due is he uses itemized deduction?

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 31P

Related questions

Question

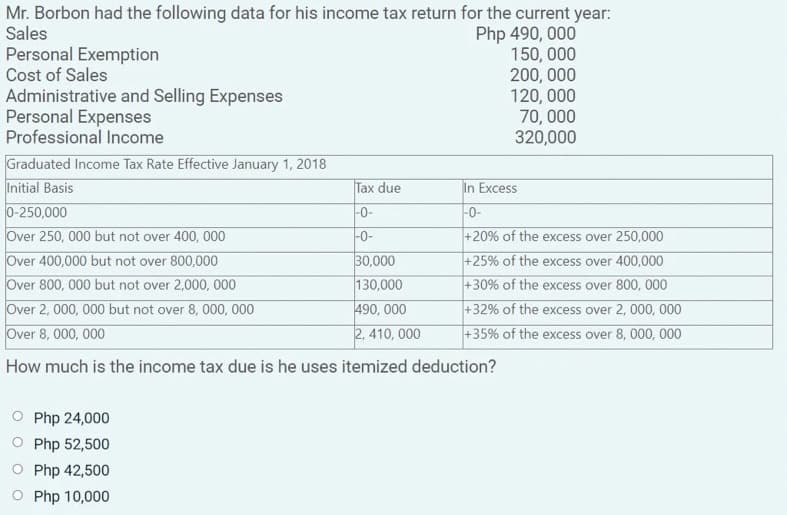

Transcribed Image Text:Mr. Borbon had the following data for his income tax return for the current year:

Php 490, 000

150, 000

200, 000

120, 000

70, 000

320,000

Sales

Personal Exemption

Cost of Sales

Administrative and Selling Expenses

Personal Expenses

Professional Income

Graduated Income Tax Rate Effective January 1, 2018

Initial Basis

0-250,000

Over 250, 000 but not over 400, 000

Over 400,000 but not over 800,000

Over 800, 000 but not over 2,000, 000

Over 2, 000, 000 but not over 8, 000, 000

Over 8, 000, 000

Tax due

In Excess

-0-

-0-

|-0-

+20% of the excess over 250,000

30,000

130,000

490, 000

2, 410, 000

+25% of the excess over 400,000

+30% of the excess over 800, 000

+32% of the excess over 2, 000, 000

+35% of the excess over 8, 000, 000

How much is the income tax due is he uses itemized deduction?

O Php 24,000

O Php 52,500

O Php 42,500

O Php 10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT