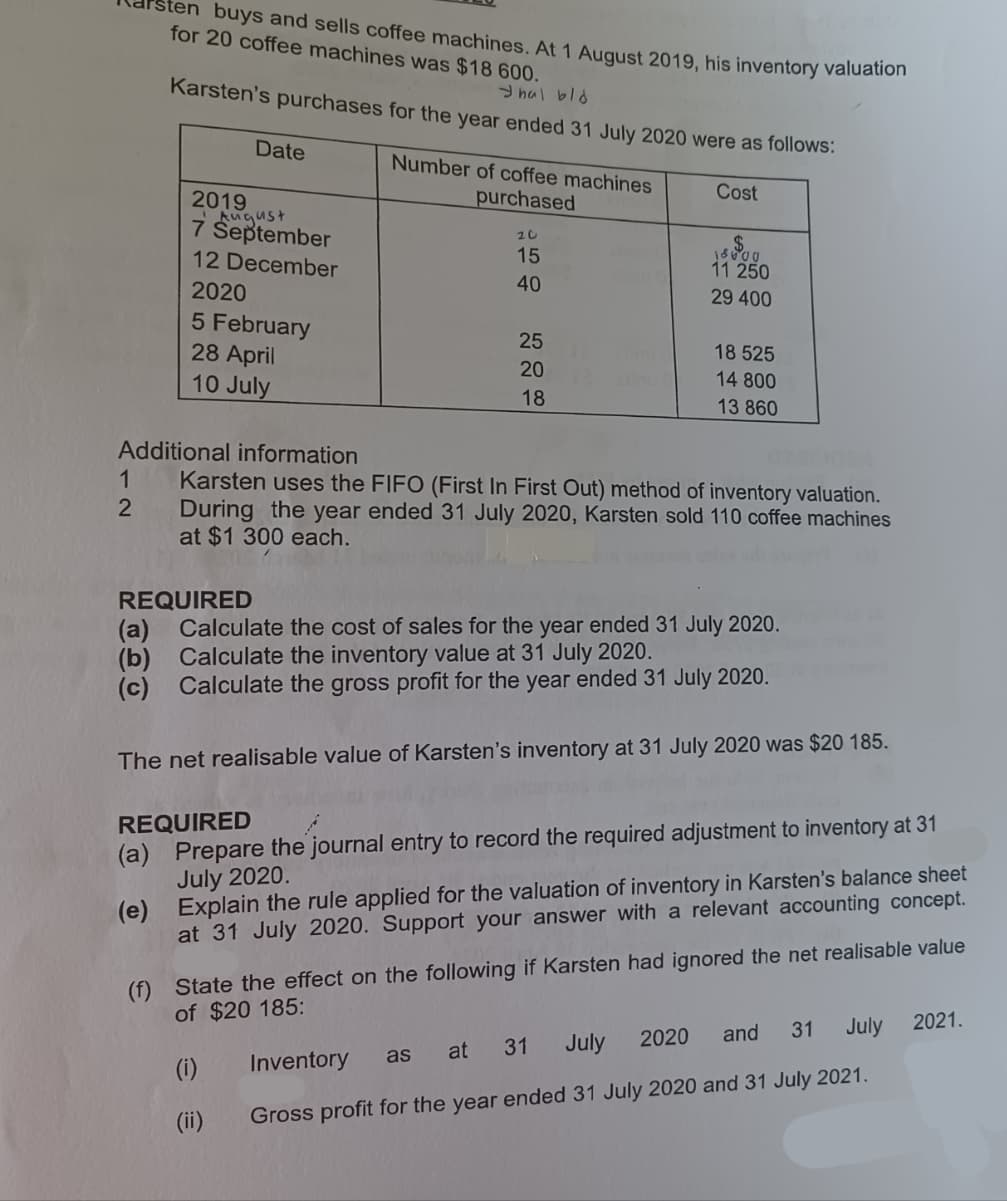

buys and sells coffee machines. At 1 August 2019, his inventory valuation for 20 coffee machines was $18 600. 1 2 hal blo Karsten's purchases for the year ended 31 July 2020 were as follows: Cost Date 2019 August 7 September 12 December 2020 5 February 28 April 10 July Number of coffee machines purchased 20 15 40 25 20 18 $ 18000 11 250 29 400 18 525 14 800 13 860 Additional information Karsten uses the FIFO (First In First Out) method of inventory valuation. During the year ended 31 July 2020, Karsten sold 110 coffee machines at $1 300 each. REQUIRED (a) Calculate the cost of sales for the year ended 31 July 2020. (b) Calculate the inventory value at 31 July 2020. (c) Calculate the gross profit for the year ended 31 July 2020. The net realisable value of Karsten's inventory at 31 July 2020 was $20 185.

buys and sells coffee machines. At 1 August 2019, his inventory valuation for 20 coffee machines was $18 600. 1 2 hal blo Karsten's purchases for the year ended 31 July 2020 were as follows: Cost Date 2019 August 7 September 12 December 2020 5 February 28 April 10 July Number of coffee machines purchased 20 15 40 25 20 18 $ 18000 11 250 29 400 18 525 14 800 13 860 Additional information Karsten uses the FIFO (First In First Out) method of inventory valuation. During the year ended 31 July 2020, Karsten sold 110 coffee machines at $1 300 each. REQUIRED (a) Calculate the cost of sales for the year ended 31 July 2020. (b) Calculate the inventory value at 31 July 2020. (c) Calculate the gross profit for the year ended 31 July 2020. The net realisable value of Karsten's inventory at 31 July 2020 was $20 185.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 13P: Webster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X,...

Related questions

Question

Transcribed Image Text:1

2

ten buys and sells coffee machines. At 1 August 2019, his inventory valuation

for 20 coffee machines was $18 600.

(a)

(b)

hal blo

Karsten's purchases for the year ended 31 July 2020 were as follows:

Cost

Date

2019

August

7 September

12 December

2020

5 February

28 April

10 July

(a)

(e)

Number of coffee machines

purchased

20

15

40

Additional information

Karsten uses the FIFO (First In First Out) method of inventory valuation.

During the year ended 31 July 2020, Karsten sold 110 coffee machines

at $1 300 each.

25

20

18

REQUIRED

Calculate the cost of sales for the year ended 31 July 2020.

Calculate the inventory value at 31 July 2020.

(c) Calculate the gross profit for the year ended 31 July 2020.

18000

11 250

29 400

18 525

14 800

13 860

The net realisable value of Karsten's inventory at 31 July 2020 was $20 185.

as

REQUIRED

Prepare the journal entry to record the required adjustment to inventory at 31

July 2020.

Explain the rule applied for the valuation of inventory in Karsten's balance sheet

at 31 July 2020. Support your answer with a relevant accounting concept.

(f) State the effect on the following if Karsten had ignored the net realisable value

of $20 185:

(i)

(ii)

2020

and 31 July 2021.

Inventory

at 31 July

Gross profit for the year ended 31 July 2020 and 31 July 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning