C Ltd has two departments A & B. Overhead is applied based on direct labour department A and machine hours in department B. The following additional information is available: Budgeted Overheads Budgeted direct labour hours Budgeted direct labour cost Budgeted machine hours Department A Department B $300,000 50,000 $240,000 68,000 $360,000 40,000 $330,000 80,000 i) Compute the overhead rate for Department A. ii) Compute the overhead rate for Department B. iii) Given that the actual overheads were as follows Dept. A 45,000 $60,000 25,000 $285.000 Dept. B Direct labour hours Direct labour cost Machine hours Actual overhends 35,000 $50,000 75,000 $320,000 Calculate the under- or over-applied overhcads for each departmeni and for the organization as a whole.

C Ltd has two departments A & B. Overhead is applied based on direct labour department A and machine hours in department B. The following additional information is available: Budgeted Overheads Budgeted direct labour hours Budgeted direct labour cost Budgeted machine hours Department A Department B $300,000 50,000 $240,000 68,000 $360,000 40,000 $330,000 80,000 i) Compute the overhead rate for Department A. ii) Compute the overhead rate for Department B. iii) Given that the actual overheads were as follows Dept. A 45,000 $60,000 25,000 $285.000 Dept. B Direct labour hours Direct labour cost Machine hours Actual overhends 35,000 $50,000 75,000 $320,000 Calculate the under- or over-applied overhcads for each departmeni and for the organization as a whole.

Chapter5: Process Costing

Section: Chapter Questions

Problem 13PA: Selected information from Skylar Studios shows the following: Prepare journal entries to record the...

Related questions

Question

100%

Transcribed Image Text:organization as a whole.

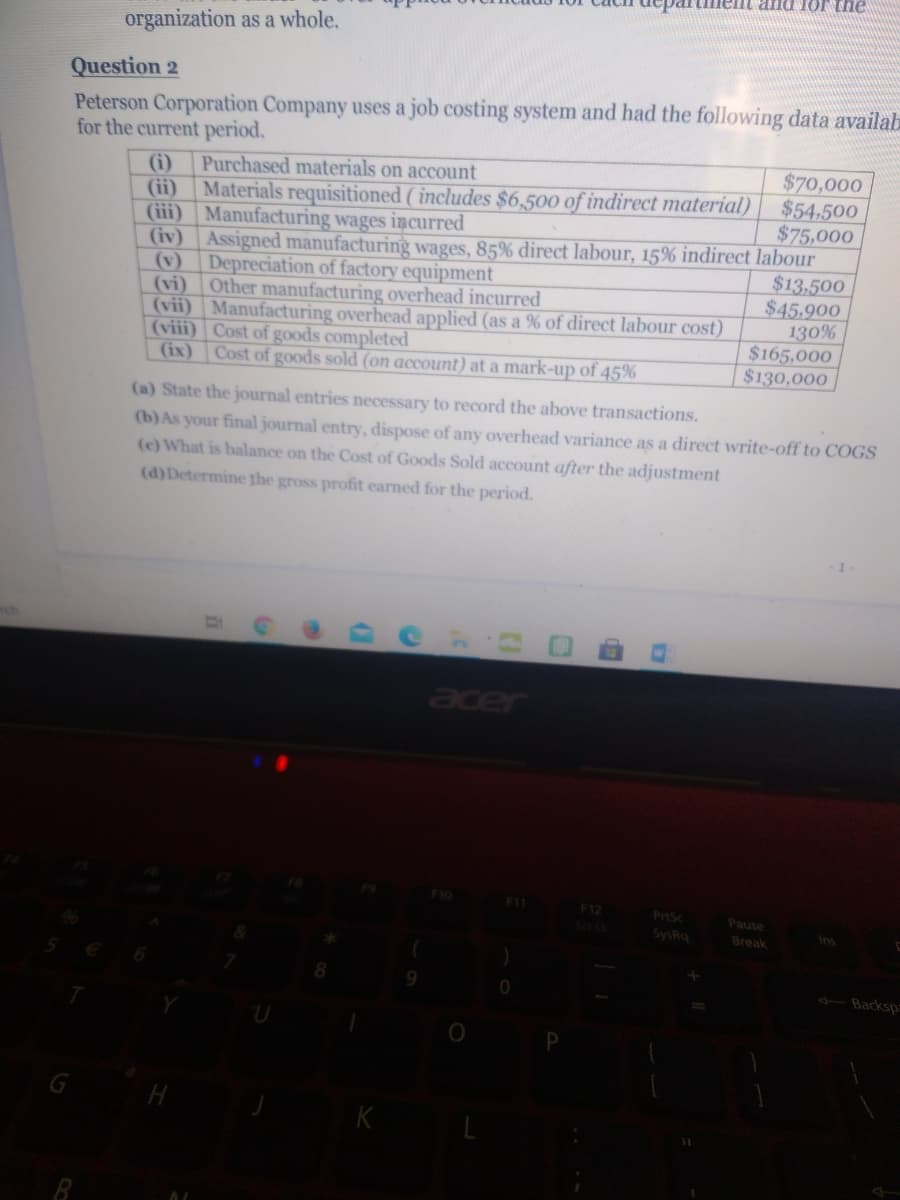

Question 2

Peterson Corporation Company uses a job costing system and had the following data availab

for the current period.

$70,000

$54,500

$75,000

(i)

Purchased materials on account

(ii) Materials requisitioned ( includes $6,500 of indirect material)

(ii) Manufacturing wages incurred

(iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour

(v)

Depreciation of factory equipment

(vi)

Other manufacturing overhead incurred

(vii) Manufacturing overhead applied (as a % of direct labour cost)

(viii) Cost of goods completed

(ix) Cost of goods sold (on account) at a mark-up of 45%

$13,500

$45.900

130%

$165,000

$130,000

(a) State the journal entries necessary to record the above transactions.

(b) As your final journal entry, dispose of any overhead variance as a direct write-off to COGS

(c) What is balance on the Cost of Goods Sold account after the adjustment

(d)Determine the gross profit earned for the period.

Jeer

F11

F12

PrtSc

SysRq

Pause

Break

Ins

- Backsp

H

K

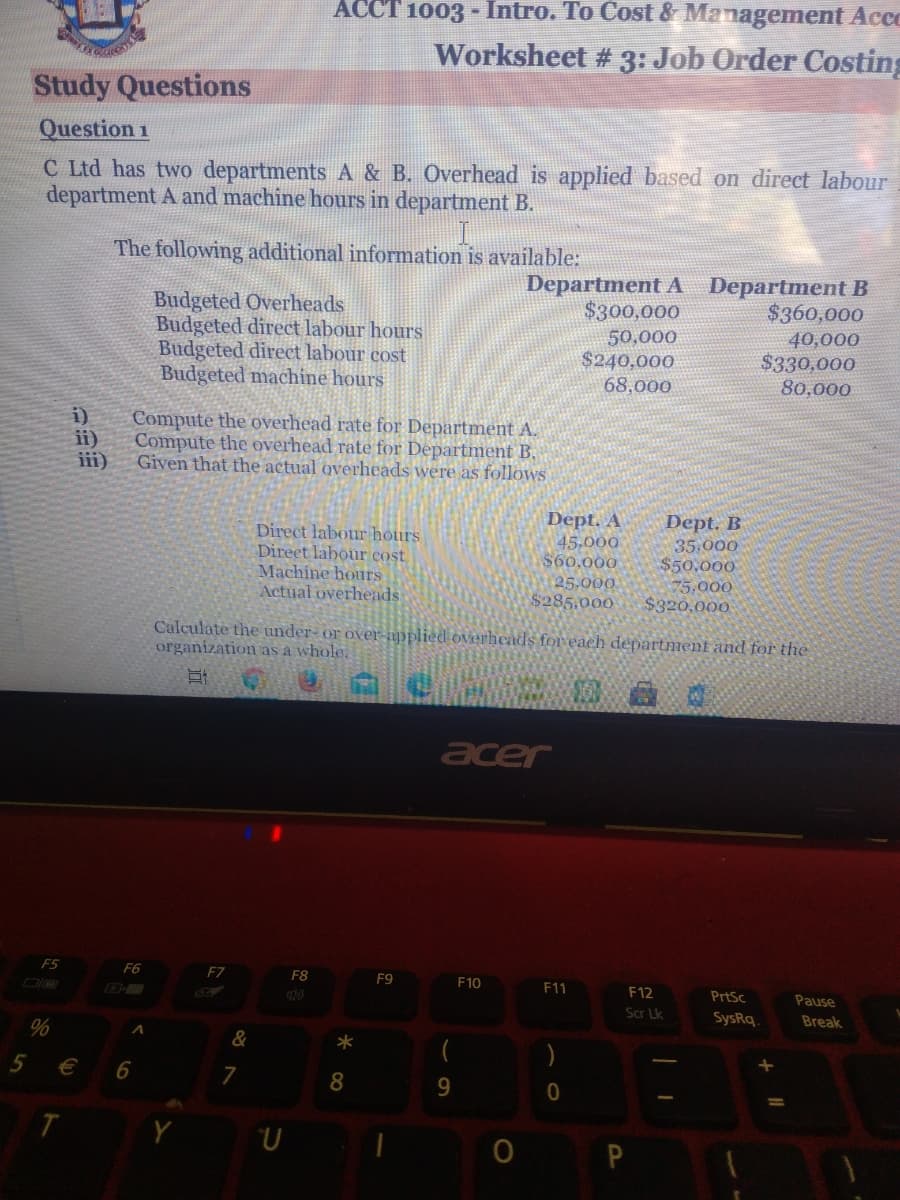

Transcribed Image Text:ACCT 1003 - Intro. To Cost & Management Ac

Worksheet # 3: Job Order Costing

Study Questions

Question 1

C Ltd has two departments A & B. Overhead is applied based on direct labour

department A and machine hours in department B.

The following additional information is available:

Department A

$300,000

Department B

$360,000

Budgeted Overheads

Budgeted direct labour hours

Budgeted direct labour cost

Budgeted machine hours

50,000

$240,000

68,000

40,000

$330,000

80,000

i)

Compute the overhead rate for Department A.

ii)

Compute the overhead rate for Department B.

iii)

Given that the actual overheads were as follows

Dept. A

Dept. B

Direct labour hours

Direet labour cost

Machine hours

Actual overheads

45,000

$60.000

35,000

$50,000

75,000

$320,000

25,000

$285.000

Calculate the under- or over-applied overheads for each departmenf and for the

organization as a whole.

acer

F5

F6

FZ

F8

F9

F10

F11

F12

PrtSc

Pause

Scr Lk

SysRq.

Break

%

&

*

€

7

9.

Y

P.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning