C. P50,000 increase d. P90,000 increase 11. Parducho had a P500,000 capital bal for four months. Burgos had a P3 P500,000 balance for seven months. Parducho receive if profits and loss average capital balances? a. P360,000 b. P387,500 C. P440,000 d. P453,200

C. P50,000 increase d. P90,000 increase 11. Parducho had a P500,000 capital bal for four months. Burgos had a P3 P500,000 balance for seven months. Parducho receive if profits and loss average capital balances? a. P360,000 b. P387,500 C. P440,000 d. P453,200

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 12P

Related questions

Question

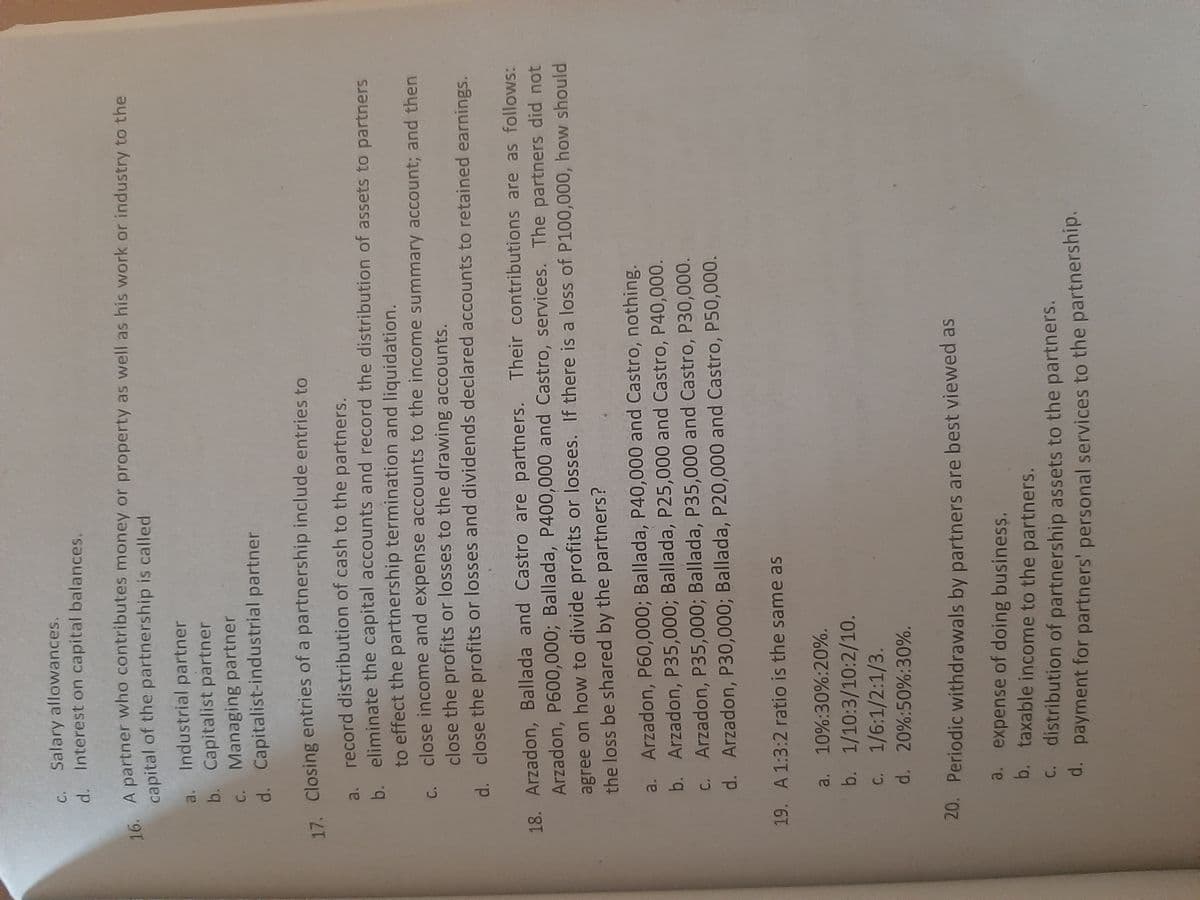

Transcribed Image Text:Salary allowances.

d. Interest on capital balances.

16 A partner who contributes money or property as well as his work or industry to the

capital of the partnership is called

Industrial partner

a.

b. Capitalist partner

c. Managing partner

d. Capitalist-industrial partner

17. Closing entries of a partnership include entries to

a, record distribution of cash to the partners.

b. eliminate the capital accounts and record the distribution of assets to partners

to effect the partnership termination and liquidation.

C. close income and expense accounts to the income summary account; and then

close the profits or losses to the drawing accounts.

d. close the profits or losses and dividends declared accounts to retained earnings.

18. Arzadon, Ballada and Castro are partners. Their contributions are as follows:

Arzadon, P600,000; Ballada, P400,000 and Castro, services. The partners did not

agree on how to divide profits or losses. If there is a loss of P100,000, how should

the loss be shared by the partners?

a. Arzadon, P60,000; Ballada, P40,000 and Castro, nothing.

b. Arzadon, P35,000; Ballada, P25,000 and Castro, P40,000.

c. Arzadon, P35,000; Ballada, P35,000 and Castro, P30,000.

d. Arzadon, P30,000; Ballada, P20,000 and Castro, P50,000.

19. A 1:3:2 ratio is the same as

a. 10%:30%:20%.

b. 1/10:3/10:2/10.

c. 1/6:1/2:1/3.

d. 20%:50%:30%.

20. Periodic withdrawals by partners are best viewed as

a. expense of doing business.

b. taxable income to the partners.

C. distribution of partnership assets to the partners.

d. payment for partners' personal services to the partnership.

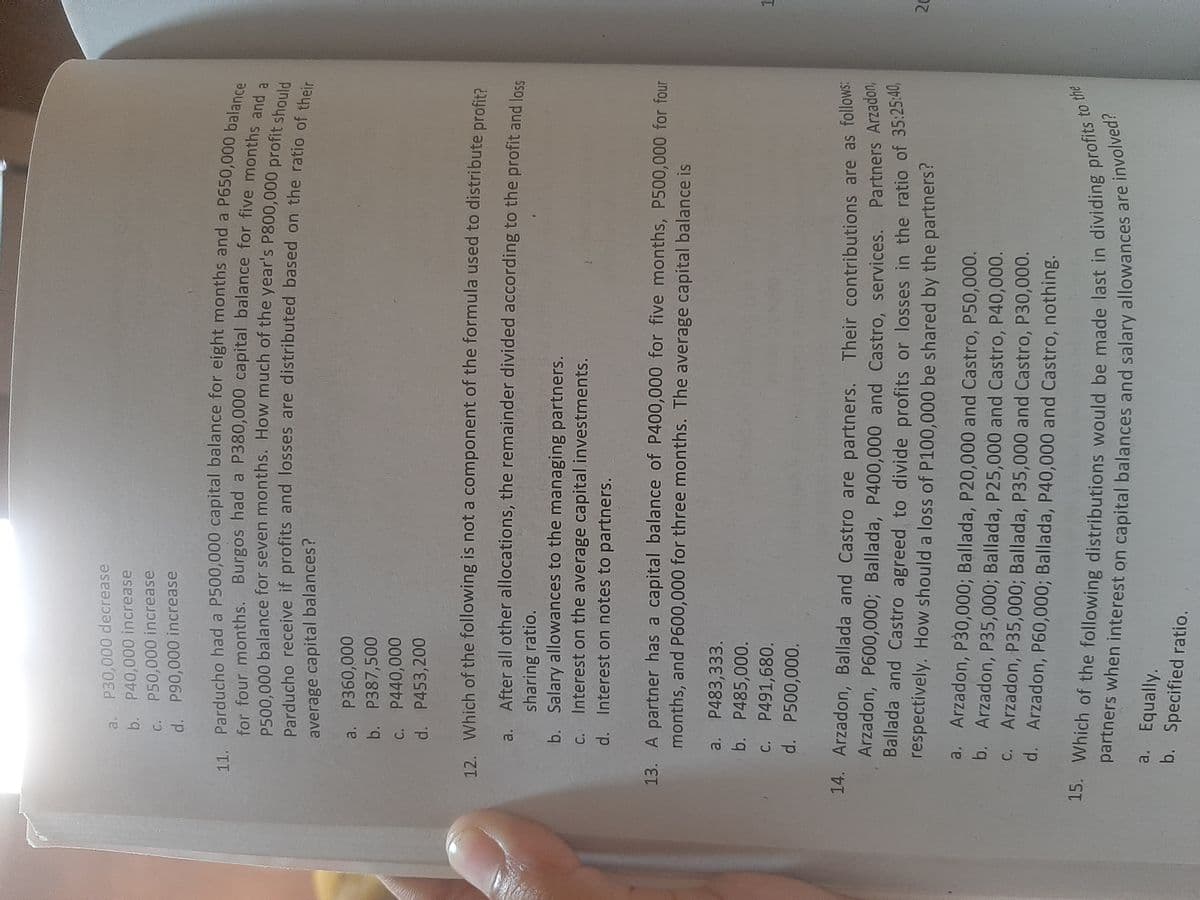

Transcribed Image Text:a. P30,000 decrease

b. P40,000 increase

C. P50,000 increase

d. P90,000 increase

Parducho receive if profits and losses are distributed based on the ratio of d

average capital balances?

a. P360,000

b. P387,500

c. P440,000

d. P453,200

12. Which of the following is not a component of the formula used to distribute profit?

a. After all other allocations, the remainder divided according to the profit and loss

sharing ratio.

b. Salary allowances to the managing partners.

Interest on the average capital investments.

C.

d. Interest on notes to partners.

13. A partner has a capital balance of P400,000 for five months, P500,000 for four

months, and P600,000 for three months. The average capital balance is

a. P483,333.

b. P485,000.

C. P491,680.

d. P500,000.

14. Arzadon, Ballada and Castro are partners. Their contributions are as follows:

Arzadon, P600,000; Ballada, P400,000 and Castro, services. Partners Arzadon,

Ballada and Castro agreed to divide profits or losses in the ratio of 35:25:40,

respectively. How should a loss of P100,000 be shared by the partners?

20

a. Arzadon, P30,000; Ballada, P20,000 and Castro, P50,000.

b. Arzadon, P35,000; Ballada, P25,000 and Castro, P40,000.

C. Arzadon, P35,000; Ballada, P35,000 and Castro, P30,000.

d. Arzadon, P60,000; Ballada, P40,000 and Castro, nothing.

a. Equally.

b. Specified ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning