C. The July 31 inventory balance is budgeted at P40,000. d. Operating expenses for July are budgeted at P51,000, exclusive oi depreciation. These expenses will be paid in cash. Depreciation is budgeted at P2,000 for the month. e. The note payable on the June 30 balance sheet will be paid during July. The company's interest expense for July (on all borrowing) will be P500, which will be paid in cash. I. New warehouse equipment costing P9,000 will be purchased for cash during July. g. During July, the company will borrow P18,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year. Required. 1. Prepare a cash budget for July. Support your budget with schedules showing budgeted cash receipts from sales and budgeted cash payments for inventory purchases. Please present your solution in good form below.

C. The July 31 inventory balance is budgeted at P40,000. d. Operating expenses for July are budgeted at P51,000, exclusive oi depreciation. These expenses will be paid in cash. Depreciation is budgeted at P2,000 for the month. e. The note payable on the June 30 balance sheet will be paid during July. The company's interest expense for July (on all borrowing) will be P500, which will be paid in cash. I. New warehouse equipment costing P9,000 will be purchased for cash during July. g. During July, the company will borrow P18,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year. Required. 1. Prepare a cash budget for July. Support your budget with schedules showing budgeted cash receipts from sales and budgeted cash payments for inventory purchases. Please present your solution in good form below.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 18CE: CORNERSTONE 2.1 Four statements are given below. Pewterschmidt Company values its inventory reported...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

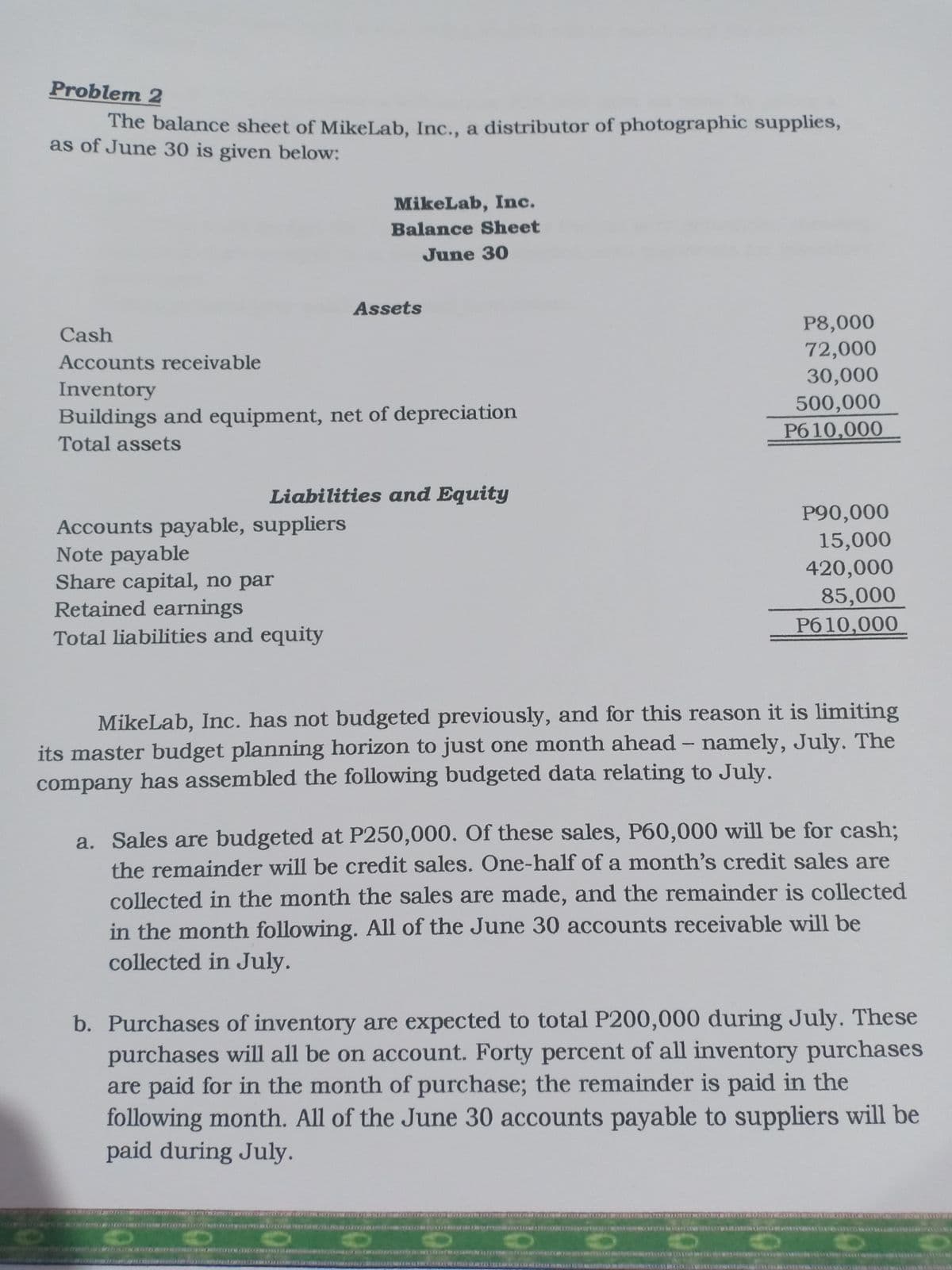

Transcribed Image Text:Problem 2

The balance sheet of MikeLab, Inc., a distributor of photographic supplies,

as of June 30 is given below:

MikeLab, Inc.

Balance Sheet

June 30

Assets

P8,000

72,000

30,000

Cash

Accounts receivable

Inventory

500,000

Buildings and equipment, net of depreciation

P610,000

Total assets

Liabilities and Equity

P90,000

Accounts payable, suppliers

Note payable

Share capital, no par

Retained earnings

Total liabilities and equity

15,000

420,000

85,000

P610,000

MikeLab, Inc. has not budgeted previously, and for this reason it is limiting

its master budget planning horizon to just one month ahead - namely, July. The

company has assembled the following budgeted data relating to July.

a. Sales are budgeted at P250,000. Of these sales, P60,000 will be for cash;

the remainder will be credit sales. One-half of a month's credit sales are

collected in the month the sales are made, and the remainder is collected

in the month following. All of the June 30 accounts receivable will be

collected in July.

b. Purchases of inventory are expected to total P200,000 during July. These

purchases will all be on account. Forty percent of all inventory purchases

are paid for in the month of purchase; the remainder is paid in the

following month. All of the June 30 accounts payable to suppliers will be

paid during July.

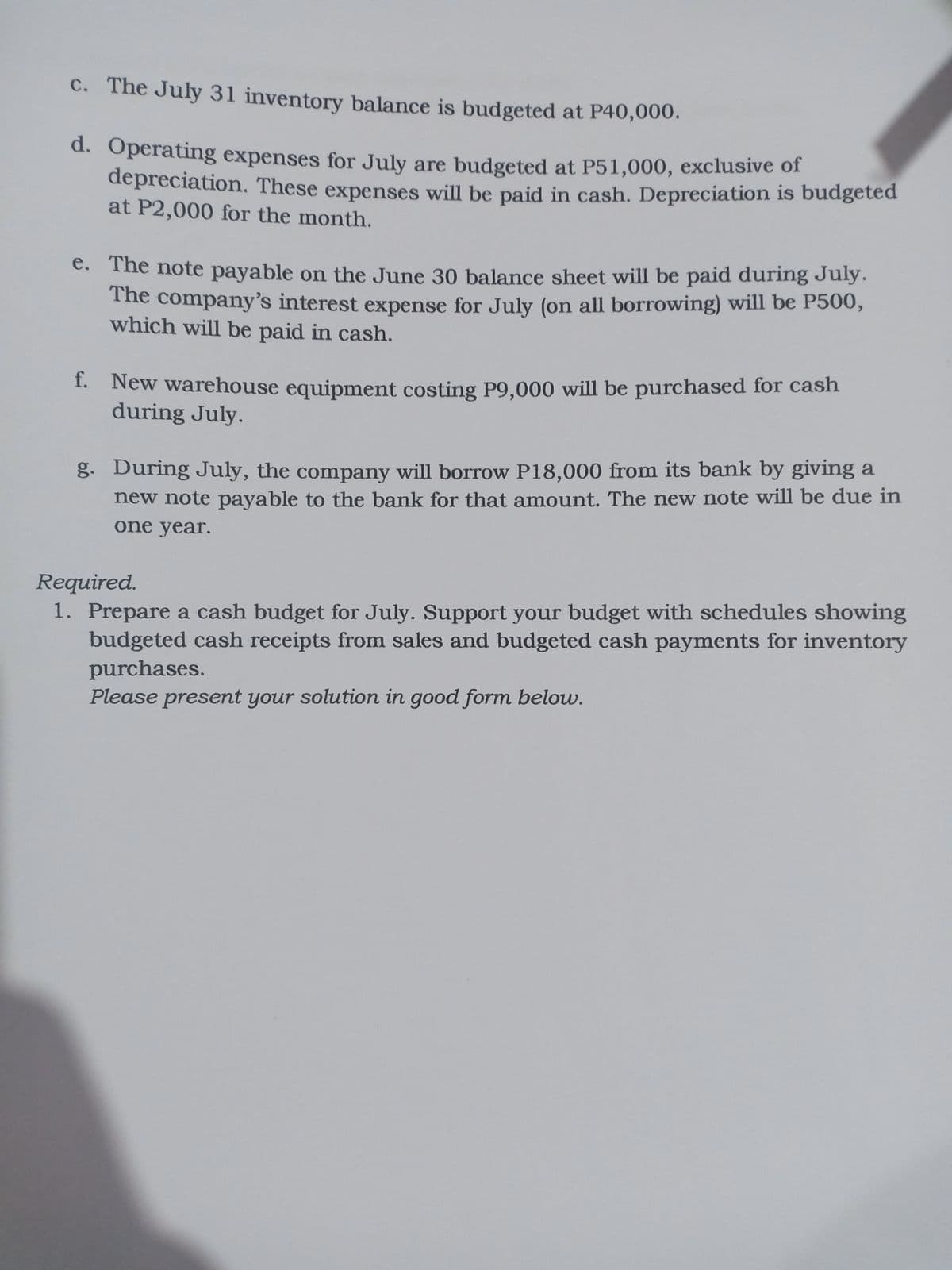

Transcribed Image Text:c. The July 31 inventory balance is budgeted at P40,000.

d. Operating expenses for July are budgeted at P51,000, exclusive of

depreciation. These expenses will be paid in cash. Depreciation is budgeted

at P2,000 for the month.

e. The note payable on the June 30 balance sheet will be paid during July.

The company's interest expense for July (on all borrowing) will be P500,

which will be paid in cash.

f. New warehouse equipment costing P9,000 will be purchased for cash

during July.

g. During July, the company will borrow P18,000 from its bank by giving a

new note payable to the bank for that amount. The new note will be due in

one year.

Required.

1. Prepare a cash budget for July. Support your budget with schedules showing

budgeted cash receipts from sales and budgeted cash payments for inventory

purchases.

Please present your solution in good form below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning