Calculate EPS after stock dividend is paid and what impact would the stock dividend have on Gordong manufactures on Balance Sheet.

Calculate EPS after stock dividend is paid and what impact would the stock dividend have on Gordong manufactures on Balance Sheet.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 24BEA: During 20X2, Norton Company had the following transactions: a. Cash dividends of 20,000 were paid....

Related questions

Question

Net Income for the year is $ 45 Million.Calculate EPS after stock dividend is paid and what impact would the stock dividend have on Gordong manufactures on Balance Sheet.

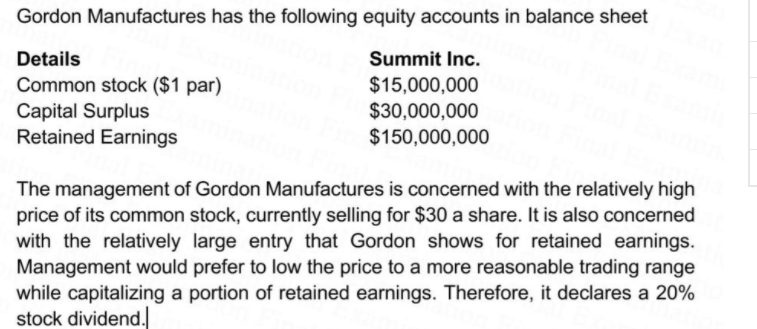

Transcribed Image Text:Gordon Manufactures has the following equity accounts in balance sheet

Details

Summit Inc.

Common stock ($1 par)

Capital Surplus

Retained Earnings

$15,000,000

$30,000,000

$150,000,000

The management of Gordon Manufactures is concerned with the relatively high

price of its common stock, currently selling for $30 a share. It is also concerned

with the relatively large entry that Gordon shows for retained earnings.

Management would prefer to low the price to a more reasonable trading range

while capitalizing a portion of retained earnings. Therefore, it declares a 20%

stock dividend.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT