Calculate Gross profit ratio

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.26EX: Comprehensive Income Anson Industries, Inc. reported the following information on its 20Y1 income...

Related questions

Question

Calculate Gross profit ratio

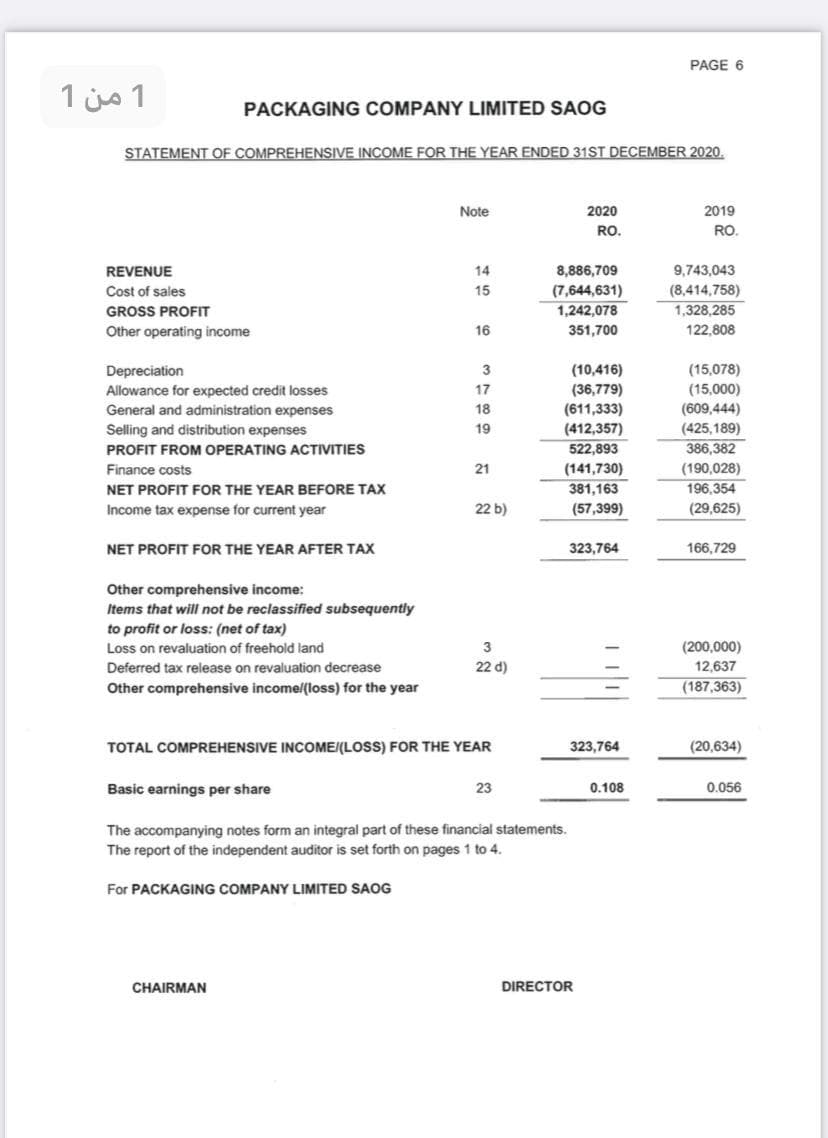

Transcribed Image Text:PAGE 6

1 js 1

PACKAGING COMPANY LIMITED SAOG

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31ST DECEMBER 2020.

Note

2020

2019

RO.

RO.

REVENUE

14

8,886,709

9,743,043

Cost of sales

(8,414,758)

1,328,285

15

(7,644,631)

1,242,078

GROSS PROFIT

Other operating income

16

351,700

122,808

(10,416)

(36,779)

(611,333)

(412,357)

522,893

(141,730)

381,163

(57,399)

Depreciation

(15,078)

17

(15,000)

Allowance for expected credit losses

General and administration expenses

(609,444)

(425,189)

386,382

18

Selling and distribution expenses

19

PROFIT FROM OPERATING ACTIVITIES

Finance costs

21

(190,028)

NET PROFIT FOR THE YEAR BEFORE TAX

196,354

Income tax expense for current year

22 b)

(29,625)

NET PROFIT FOR THE YEAR AFTER TAX

323,764

166,729

Other comprehensive income:

Items that will not be reclassified subsequently

to profit or loss: (net of tax)

Loss on revaluation of freehold land

(200,000)

Deferred tax release on revaluation decrease

22 d)

12,637

Other comprehensive income/(loss) for the year

(187,363)

TOTAL COMPREHENSIVE INCOME/(LOSS) FOR THE YEAR

323,764

(20,634)

Basic earnings per share

23

0.108

0.056

The accompanying notes form an integral part of these financial statements.

The report of the independent auditor is set forth on pages 1 to 4.

For PACKAGING COMPANY LIMITED SAOG

CHAIRMAN

DIRECTOR

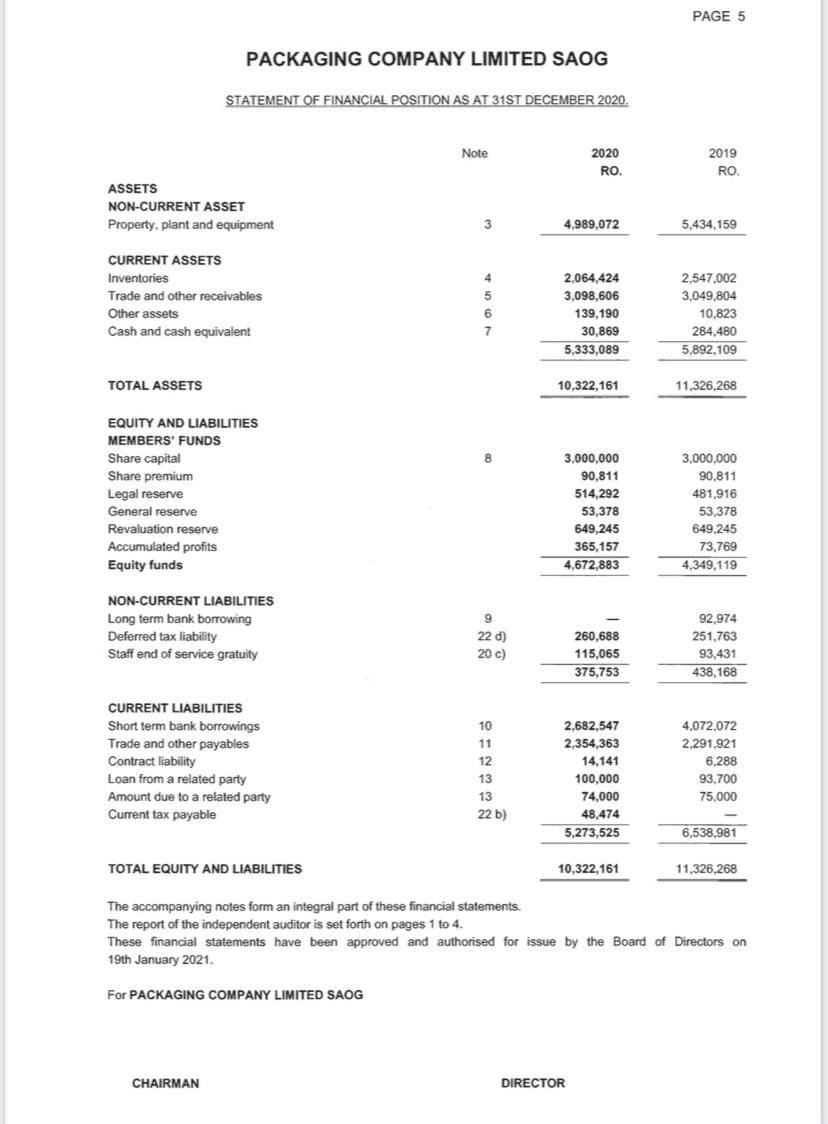

Transcribed Image Text:PAGE 5

PACKAGING COMPANY LIMITED SAOG

STATEMENT OF FINANCIAL POSITION AS AT 31ST DECEMBER 2020.

Note

2020

2019

RO.

RO.

ASSETS

NON-CURRENT ASSET

Property, plant and equipment

3

4,989,072

5,434,159

CURRENT ASSETS

Inventories

4.

2,064,424

2,547,002

Trade and other receivables

3,098,606

3,049,804

Other assets

6

139,190

10,823

Cash and cash equivalent

7

30,869

284,480

5,333,089

5,892,109

TOTAL ASSETS

10,322,161

11,326,268

EQUITY AND LIABILITIES

MEMBERS' FUNDS

Share capital

8.

3,000,000

3,000,000

90,811

Share premium

Legal reserve

General reserve

90,811

514.292

481,916

53,378

53,378

Revaluation reserve

649,245

649,245

Accumulated profits

365,157

73,769

Equity funds

4,672,883

4,349,119

NON-CURRENT LIABILITIES

9.

Long term bank borrowing

Deferred tax liability

Staff end of service gratuity

92,974

22 d)

260,688

251,763

93,431

438,168

20 c)

115,065

375,753

CURRENT LIABILITIES

Short term bank borrowings

10

2,682,547

4,072,072

Trade and other payables

Contract liability

Loan from a related party

2,354,363

14,141

11

2,291,921

12

6,288

13

100,000

93,700

Amount due to a related party

13

74,000

75,000

Current tax payable

22 b)

48,474

5,273,525

6,538,981

TOTAL EQUITY AND LIABILITIES

10,322,161

11,326,268

The accompanying notes form an integral part of these financial statements.

The report of the independent auditor is set forth on pages 1 to 4.

These financial statements have been approved and authorised for issue by the Board of Directors on

19th January 2021.

For PACKAGING COMPANY LIMITED SAOG

CHAIRMAN

DIRECTOR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning