Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

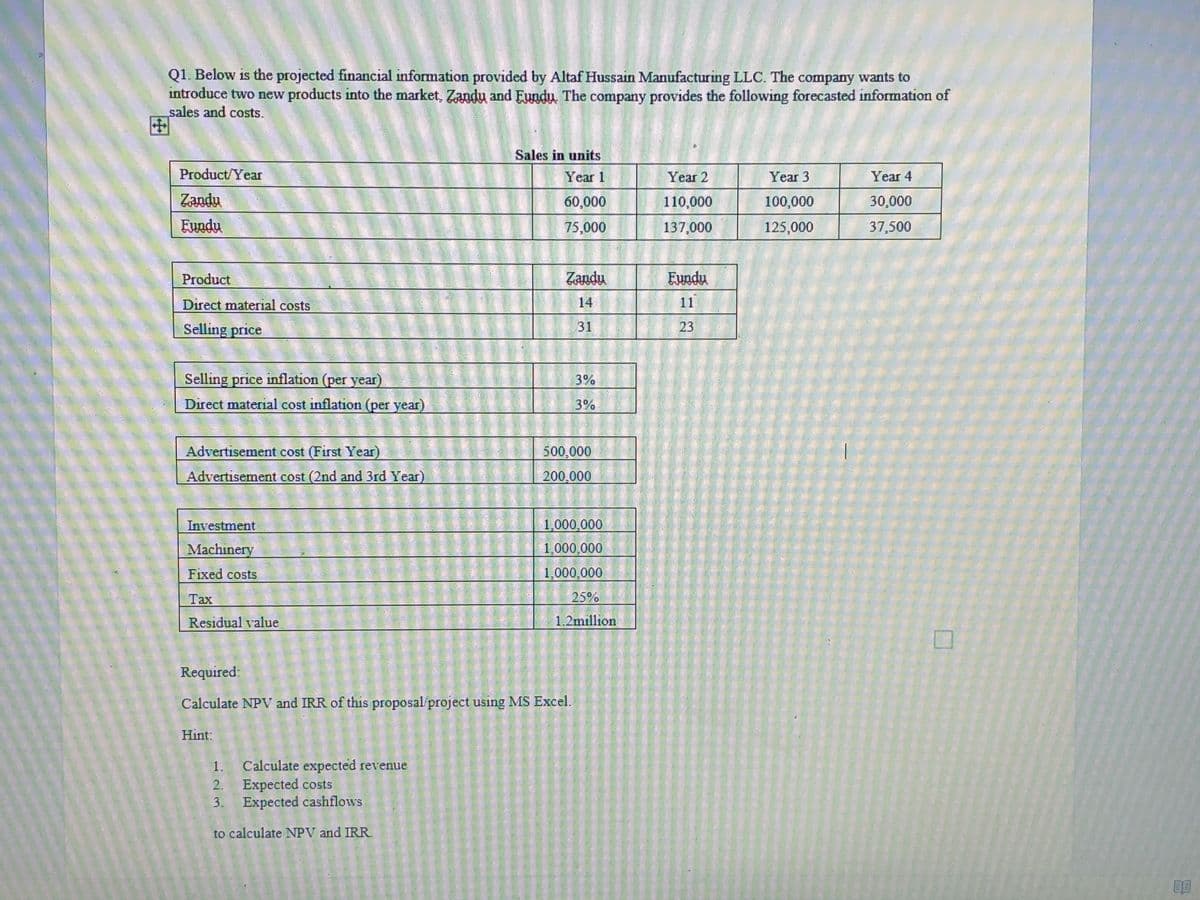

Transcribed Image Text:Q1. Below is the projected financial information provided by Altaf Hussain Manufacturing LLC. The company wants to

introduce two new products into the market, Zandu and Eundu. The company provides the following forecasted information of

sales and costs.

Sales in units

Product/Year

Year 1

Year 2

Year 3

Year 4

Zandu

60,000

110,000

100,000

30,000

Eundu

75,000

137,000

125,000

37,500

Product

Zandu

Eundu

Direct material costs

14

11

Selling price

31

23

Selling price inflation (per year).

3%

Direct material cost inflation (per year)

3%

Advertisement cost (First Year)

500,000

Advertisement cost (2nd and 3rd Year)

200,000

Investment

1,000,000

Machinery

1,000,000

Fixed costs

1,000,000

Таx

25%

Residual value

1.2million

Required:

Calculate NPV and IRR of this proposal project using MS Excel.

Hint:

Calculate expected revenue

2. Expected costs

3. Expected cashflows

1.

to calculate NPV and IRR

MTEES

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning