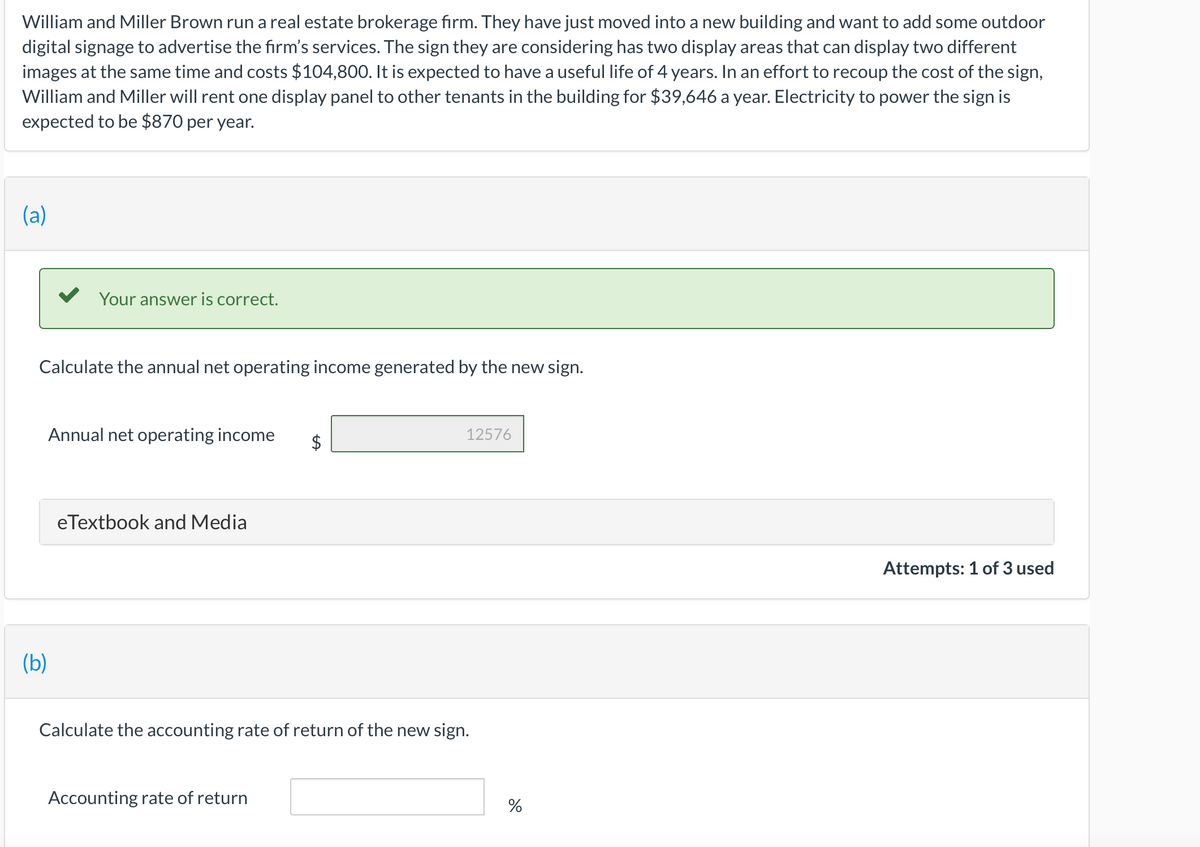

Calculate the accounting rate of return of the new sign. Accounting rate of return %

Q: Question 42 Based on the following adjusted trial balance of Lyndon Company on December 31, 200C,…

A: The owner's equity comprises of investment, retained earnings, net income, losses or withdrawal…

Q: Snyder Company produced 90,000 units during its first year of operations and sold 86,100 at $19.92…

A: Absorption costing allocates fixed overhead costs across all units produced for the period. Variable…

Q: 1) A monthly depreciation expense of $600 is recorded on a truck that was purchased for $27 000 and…

A: Formula: Depreciation rate = ( Annual Depreciation expense / depreciable value ) x 100

Q: less cost of disposal. What is the impairment loss to be allocated to property, plant and equipment?…

A: IAS 36 deals with impairment of assets. When the market value or the current cost of the asset is…

Q: P5,000 UF P5,000 F P2,000 UF P2,000 F а. C. b. d.

A: Introduction:- First we need to calculate standard rate as follows:- Direct Labor Efficiency…

Q: Word Problem Question 4: (You have to submit an image of your FULL sólütioh to the question in…

A:

Q: a) Determine the equation that models this population. b) Calculate the number of people after year…

A: Valuation of Property with help of appreciation rate Formulation of equation to calculated…

Q: On 1 July 2021, Mozart Ltd purchased three machines each used in a different production process in…

A: *As per the bartleby guidelines in case of different queestions answer first only Calculation of…

Q: Determine if this shall result in recognition of liabilities 14.Violation of the terms of a…

A: As per IAS 37 of IFRS Provisions, contingent liabilities and continent assets A contingent liability…

Q: Based on the following post-closing trial balance of Rigodon Corporation on June 30, the end of its…

A: Lets understand the basics. As per balance sheet equation, total asset is always equal to…

Q: The following balances have been excerpted from ABC Company's balance sheets: 12/31/2017 12/31/2016…

A: insurance expense on the income statement for 2017 = Insurance premium paid during year + prepaid…

Q: Merchandise with a list prike of P 20,000 was purchased under the terms 2/10, n/30 vith trade…

A: Purchase term: 2/10, n/30 means if payment is made within 10 days from Invoice date, a discount of…

Q: FV of an ordinary annuity due 7. An annuity makes 25 annual payments of $2,000 with the first…

A: Annuity Due refers to payments that must be due at the beginning of every annuity period rather than…

Q: Absorption Costing, Value of Ending Inventory, Operating Income Pattison Products, Inc., began…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: 9) Which of the following statements about normal costing is true? A) Direct costs and indirect…

A: Introduction:- Under the normal costing :- It assign costs to products based on the materials,…

Q: Absorption and Variable Costing with Over- and Underapplied Overhead Flaherty, Inc., has just…

A: An income report is a statement that details a company's revenue and expenses. It also shows if a…

Q: Claude leased a facility from ML partnership in January 1, 2018. Terms of the lease were as follows:…

A: given Claude leased a facility from ML partnership in January 1, 2018. Terms of the lease were…

Q: 4. JPIA Company incurred P298, 350 of research and development cost to develop a product for which a…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Calculate the net operating income for the year.

A: Gross profit: the gross profit is the profit earned by the company after subtracting the…

Q: 1. Assume expenses are 40% of revenue. If we trend Revenue growth at 3% per year for 5 YEARS, AND…

A: Answer:- 1 13.97 % higher is Net Operating Income in Year 5 vs Year 1. Notes:- Lets' assume…

Q: Consider an asset with a cost of SR500,000, useful life of 8 years and salvage value zero. If you…

A:

Q: Why are complementary assets essential for ensuring that information systems investment provide…

A: An information system is a collection of interconnected components that work together to gather,…

Q: The Components Division produces a part that is used by the Goods Division. The cost of…

A: These divisional costs of capital reflect both the differential required returns of equity…

Q: On January 1, 2022, Alma Company showed land with carrying amount of P10,000,000 and building with…

A: Revaluation of assets and liabilities can be gone through on the time of, when there is a admission…

Q: Selected ratios for the current year for three companies in the office furniture industry follow:…

A: GIVEN Based on the above ratios which company do investors favour for future growth and investment…

Q: efense of the pat colete.

A: A patent is legal right to use the use the intangible asset. The cost of the patent is amortized…

Q: Which of the following statements is CORRECT? Select one: a. Stock splits create more administrative…

A: Stock Split- In a stock split, existing shares split but the underlying cost remains the same. As…

Q: The Addy Corporation purchased a new oven for its commercial kitchen on August 1st for $14,000 and…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: chinery and equipment (seven-year property) with a basis of $3,464,500 on June 6, 2020. Assume that…

A: As per Section 179, the maximum allowable deduction expense for 2020 is $1,040,000

Q: 23 October Purchased tables and chairs for P65 750.00 paid in cash 23 October Paid rental for space…

A: Lets understand the basics. Journal entry is required to make to record event and transaction occur…

Q: The Hankin Corporation purchased new production equipment on September 1.2017 for $14.000 andexpects…

A: Formula: Straight line method depreciation = ( Asset cost - salvage value ) / Useful life years

Q: odels are Isa riable to

A: Macroeconomics is a broad field. However, there are two specific disciplines of research that…

Q: Genel Company provided the following schedule of machinery: Total Cost Residual Value Useful Life…

A: Composite Life of the assets indicating the average life expectancy of a group of assets based on…

Q: I. Compensation and business income are returnable income that are subject to final income tax. II.…

A: Taxable income A taxable income refers to the income on which the tax has been imposed. It is the…

Q: Vilna Ltd., during the year ended December 31, 2021, had the following transactions related to…

A: Money market instruments are the one in which amounts are invested to receive benefits within the…

Q: 6.4 Minority interests in PQR were30% when the parent paid five times NAV amount to acquire. If…

A: Purchase Consideration: Purchase Consideration is the amount given by an holding company to the…

Q: When from among the choices available only one is possible, the obligation in effect ceases to be…

A: Answer:- True Explanation:- When from the choices available only one of the choice is possible, the…

Q: low-cost range for multiple alternatives. variable cost/unit location fixed cost elm 125 01 ferry 50…

A: Cost accounting is one of the important branch of accounting. Under this branch, various type of…

Q: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what…

A: Variable costing income statement is the statement in which the cost of goods which has been sold by…

Q: Ozone Products provided the following information for 2004: Materials: Materials inventory, January…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Standards 12 pounds per pot at a cost of $5.00 per . pound Direct materials (resin) Direct labor 3.0…

A:

Q: Based on the following audited financial statements of Fast Truckers at the end of December 31,…

A: Net income is calculated as gross receipts less total expense

Q: David Davis died in 2019 and left an estate valued at $13,900,000 after the payment of his debts.…

A: Given : David Davis died in 2019 and left an estate valued at $13,900,000 after the payment of his…

Q: In January 2021, Tawatinaw Group paid $650,000 for 60,000 shares of Neerlandia Inc. giving Tawatinaw…

A: given In January 2021, Tawatinaw Group paid $650,000 for 60,000 shares of Neerlandia Inc., giving…

Q: Determine if this shall result in recognition of liabilities 11. withholding of taxes on employees'…

A: The employer will need to pay the amount of tax withhold on employees compensation to government.

Q: Why an INTERNATIONAL BUSINESS AND TRADE ORGANISATION is crucial in different countries.

A: International Business An international business refers to the carrying out of business activities…

Q: 1. Should SS upgrade its production line or replace it? Show your calculations 2. Suppose the…

A: Introduction: A production line is a conventional practice associated with manufacturing. The…

Q: 1. James Company showed the following balances in its balance sheet as at year-end: Current Assets…

A: Replacement value is the amount at which assets of the company would be replaced. Given that,…

Q: ENCHANTRESS CORP. is applying overhead with direct labor hours as its basis. Four direct labor hours…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 2003, Black…

A: In case of Consolidation, when there is a transfer of asset between the parent and the subsidiary…

Step by step

Solved in 2 steps

- Ken Owens Construction specializes in small additions and repairs. His normal charge is $400/day plus materials. Due to his physical condition, David, an elderly gentleman, needs a downstairs room converted to a bathroom. Ken has produced a bid for $5000 to complete the bathroom. He did not provide David with the details of the bid. However, they are shown here. The towns social services has asked Ken if he could reduce his bid to $4000. Should Ken accept the counter offer? B. How much would his income be reduced? C. If the towns social services guaranteed him another job next month at his normal price, could he accept this job at $4000?Mary's job position is being transferred to Lexington, Kentucky from Orlando, Florida. She andher husband George are currently renting their home in Orlando, but they have decided that they want to purchase a home in Lexington. Mary's annual salary is $48,500. George has also beenable to find employment in Lexington at a factory making $39,000 per year. Mary is a planner and has saved $6200 that she can use towards the down payment on the new house. Use the above information to answer the following questions. Round all answers to 2 decimal places. 1. To save the down payment, Mary deposited monthly in a savings account earning 2.5% compounded monthly. If it took Mary 5 years to save up the down payment,how much money was Mary depositing each month? 2. If Mary and George don't want to spend more than 15% of theirmonthly income on their house payment, what is the maximum monthly payment they can afford?Maria is a wedding planner. She purchases a laserjet printer for invitations, save-the-date postcards, etc. The laserjet costs $799 and can be expected to print 200,000 pages. At the end of its useful life, Maria will receive a rebate of $60 when she turns in her old laserjet and purchases a new one. Maria uses the units-of-production method of depreciation.What is the depreciation per unit? If necessary, round to the nearest tenth of a cent.$What is the book value of the laserjet at the end of the first year if 34,000 pages are printed?$In the second year, Maria uses the laserjet to print 56,000 pages. What is the annual depreciation for year 2?$

- Brooke is evaluating two alternatives for improving the exterior appearance of her Victorian-style house that she is remodeling inside. She plans to keep this as her home for 20 more years. The house can be completely painted at a cost of $16,000. The paint is expected to remain attractive for 5 years, at which time repainting will be necessary. Every time the building is repainted (i.e., in years 5, 10, and 15), the cost will increase by 20% over the previous time. As an alternative, the exterior can be covered with a vintage-appearing vinyl-coated siding now and again 10 years from now at a cost 25% greater than the present cost of the siding. At a MARR of 10% per year, what is the maximum amount that Brooke should spend now on the siding alternative so that the two alternatives will just break even? Solve using factors. The maximum amount that Brooke should spend now on the siding alternative is $ . Note:- Do not provide handwritten solution. Maintain accuracy and quality in…Brooke is evaluating two alternatives for improving the exterior appearance of her Victorian-style house that she is remodeling inside. She plans to keep this as her home for 20 more years. The house can be completely painted at a cost of $16,000. The paint is expected to remain attractive for 5 years, at which time repainting will be necessary. Every time the building is repainted (i.e., in years 5, 10, and 15), the cost will increase by 20% over the previous time. As an alternative, the exterior can be covered with a vintage-appearing vinyl-coated siding now and again 10 years from now at a cost 25% greater than the present cost of the siding. At a MARR of 10% per year, what is the maximum amount that Brooke should spend now on the siding alternative so that the two alternatives will just break even? Solve using factors. The maximum amount that Brooke should spend now on the siding alternative is $Angus and his sister Oona operate a small charter flight service that takes tourists on sightseeing tours over the beautiful Margaree River on Cape Breton Island. At the end of 2009, they had one four-seater plane in the aircraft asset class with a UCC of $30 000. In 2010, they purchased a second plane for $50 000. Business was going well in 2011, so they sold the old plane they had in 2009 for $15 000 and bought a newer version for $64 000. What was the UCC balance in the aircraft asset class at the end of 2012? The CCA rate for aircraft is 25 percent.

- Natalie is thinking of buying a van that will be used only for business. The cost of the van is estimated at $36,500. Natalie would spend an additional $2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mixer inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at $1,500. She expects the van to last about 5 years, and she expects to drive it for 200,000 miles. The annual cost of vehicle insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van will sell for $7,500. Assume that she will buy the van on August 15, 2023, and it will be ready for use on September 1, 2023. Natalie is concerned about the impact of the van’s cost on her income statement and balance sheet. She has come to you for advice on calculating the van’s depreciation. Instructions (a) Determine the cost of the van. (b) Prepare…Natalie is thinking of buying a van that will be used only for business. The cost of the van is estimated at $36,500. Natalie would spend an additional $2,500 to have the van painted. In addition, she wants the back seat of the van removed so that she will have lots of room to transport her mixer inventory as well as her baking supplies. The cost of taking out the back seat and installing shelving units is estimated at $1,500. She expects the van to last about 5 years, and she expects to drive it for 200,000 miles. The annual cost of vehicle insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van will sell for $7,500. Assume that she will buy the van on August 15, 2023, and it will be ready for use on September 1, 2023. Natalie is concerned about the impact of the van’s cost on her income statement and balance sheet. She has come to you for advice on calculating the van’s depreciation. Instructions (a) Determine the cost of the van. (b) Prepare…A university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer. (Both items belong to Class 9 and have a 25% CCA rate). These two new items cost $12,000 and have a useful life of four years, at which time they can be sold for $1,600. The old paint sprayer can be sold for $500 and could be scrapped for $250 in four years. The student believes that operating revenues will increase annually by $8,000. Should the purchase be made? The tax rate is 22% and the required rate of return is 15%.. please Show me the steps don't copy from cheggs .

- Lee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors. After one year, he submitted the following data to his accountant. • He stopped renting out his cottage for P35,000 a year and used it as his factory. • The market value of the cottage increased from P700,000 to P710,000. • He spent P50,000 on materials, phone, utilities, etc. • He leased machines for P100,000 a year. • He paid P150,000 in wages. • He used P100,000 from his savings account, which pays five 5% interest a year. • He borrowed P400,000 at 10% a year from the bank. • He sold P1,600,000 worth of monitors. • Normal profit is P250,000 a year. Compute for the following: * Lee’s explicit costs * Lee’s implicit cost * Lee’s economic profitLee, a programmer, earned P350,000 in 2010, but in 2011, he began to manufacture computer monitors. After one year, he submitted the following data to his accountant. • He stopped renting out his cottage for P35,000 a year and used it as his factory. • The market value of the cottage increased from P700,000 to P710,000. • He spent P50,000 on materials, phone, utilities, etc. • He leased machines for P100,000 a year. • He paid P150,000 in wages. • He used P100,000 from his savings account, which pays five 5% interest a year. • He borrowed P400,000 at 10% a year from the bank. • He sold P1,600,000 worth of monitors. • Normal profit is P250,000 a year. Compute for the following: * Lee’s explicit costsTony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $12,000. They expect to use the Suburban for five years and then sell the vehicle for $4,500. The following expenditures related to the vehicle were also made on July 1, 2022:• The company pays $1,800 to GEICO for a one-year insurance policy.• The company spends an extra $3,000 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides.• An additional $2,000 is spent on a deluxe roof rack and a trailer hitch.The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022, the company pays $400 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter.Required:1. Record the expenditures related to the vehicle on July…