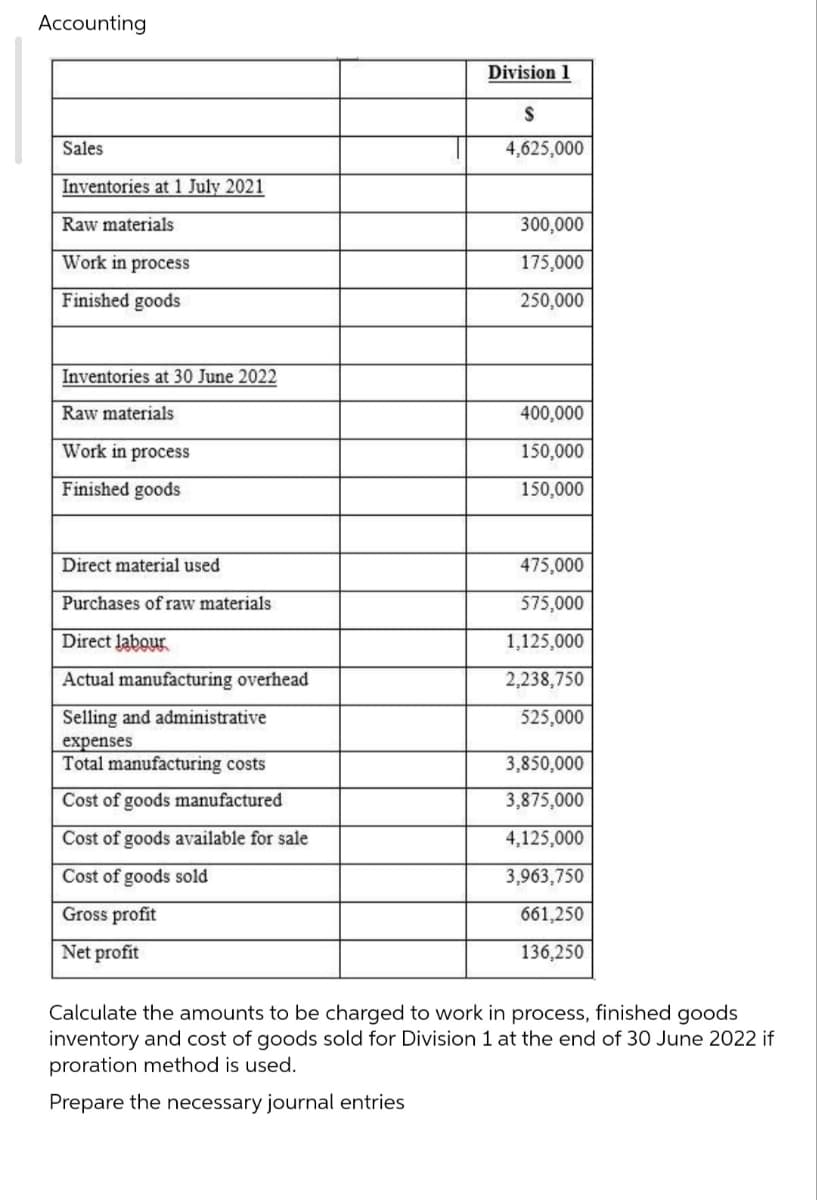

Calculate the amounts to be charged to work in process, finished goods inventory and cost of goods sold for Division 1 at the end of 30 June 2022 if proration method is used. Prepare the necessary journal entries

Q: the suspense figure. Prepare the Income Statement for the year ended 31st December, 2020 and a…

A: Redrafted trail balance as below fallow the attachment There is difference in trail balance…

Q: First National Bank of Conway is considering installing two ATMs in its Southside branch. The new…

A: Net present value (NPV) is the value of all the cash flow of the investment (positive and negative)…

Q: A tract of land is expected to net $45 per acre from now into the foreseeable future. Assume that…

A: Initial investment is $250000 A Tract of land is expected to be $45 r(real)=0.06 i(real)=0.05 NP=30…

Q: Flounder Corporation reports the following information: Correction of understatement of depreciation…

A: Note: When any expense is understated or overstated in the prior year's, the adjustment is made from…

Q: Arthur owns a tract of undeveloped land with an adjusted basis of $80,000. He sells the land to his…

A: Assets - A corporation has a lot of resources, both financial and non-financial. However, an asset…

Q: Morganton Company makes one product and it provided the following information to help prepare the…

A: calculation of cost of raw material to be purchase for july

Q: Analyze the risks associated with auditing accounts payable. Explain the process of auditing…

A: Auditing refers to the procedure of examining or investigation of the financial statements of the…

Q: Bradford Company had sales of $700,000 for a year. The total assets at the beginning of the year…

A: The assets turnover ratio indicates the company's working efficiency in generating sales by using…

Q: 10. Seghen's car was destroyed by a tornado in a Federally declared disaster area in the current…

A: Natural disasters like fire, earthquake, floods, accidents, landslides, etc. if a taxpayer's…

Q: On May 1, 2021, Legal Corporation sold $250,000 of its 15%, five-year bonds dated January 1, 2021,…

A: Introduction: Accrued Interest is the interest on a debt that has been earned but not yet paid. If…

Q: On its 2020 Balance Sheet, Liddle Inc. reported Currents Assets of $215,000, Net Fixed Assets of…

A: The taxes are the charge over the profit or income of the firm earned during the tax year. The…

Q: In reviewing Smith's assessments and conclusions, has he proposed the optimal recommendations?…

A: Question -3 Costing System - A costing system is created to keep track of the costs incurred as a…

Q: The following partially completed T-accounts summarize transactions for Faaberg Corporation during…

A: Introduction: Manufacturing overhead is any expense that is not directly tied to a facility's…

Q: Match each of the voluntary deductions listed with the correct definition. 1: Match each of the…

A: 1. State disability insurance- Provides short-term benefits to employees who are unable to work as a…

Q: Prepare your answers using excel or clearly written computations. Show your work for maximum points.…

A: Current gain=Fair market value of the property-Basis of qualified property Basis=Original basis of…

Q: Ben City maintains its books and records in a manner that facilitates the preparation of fund…

A: The entries for part b and c are similar, hence are classified together. The estimated…

Q: Jaden (single) has a traditional IRA to which he has made only deductible contributions. At the end…

A: The required minimum distribution seems to be the sum that the taxpayer is entitled to take away…

Q: On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year…

A: Journal Entry :— It is an act of recording transaction in books of account when it is occurred.…

Q: ou are an audit supervisor of Ali & Babs partners and you are planning the audit of Little Angel…

A: Audit Risk When financial statements are materially misstated, that is, when they are not presented…

Q: 33. Compute MACRS depreciation for the following qualified assets for the calendar mo years 2022 and…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Purchases of an inventory item during last month were as follows: Number of items Unit price $5.00…

A: Inventory valuation method includes: FIFO Method LIFO Method Weighted average method FIFO Method-…

Q: Safa is paid a base salary of $1500 per month and a commission of 6% on all sales over $75,000. Last…

A: As per the guidelines we can provide the answer for one question, first one ( as the question are…

Q: Which of the following accounts is an example of a contra-asset? A) Cost of Goods Sold B)Sales…

A: CONTRA ASSETS contra asset account is a type of asset account where the account balance may…

Q: EcoFabrics has budgeted overhead costs of $945,000. It has allocated overhead on a plantwide basis…

A: Costing is defined as a mechanism used to determine the expenses paid by the industry while…

Q: Drawing on the experience of other markets, how can the Central Bank in Zambia be made more…

A: Liquidity reflects a financial institution’s ability to fund assets and meet financial obligations.…

Q: As the level of activity increases, how will a mixed cost in total and per unit behave? In Total Per…

A: Mixed cost is the cost which is neither fully variable nor fully fixed, it is the mixture of…

Q: Calculate the following for the year ended 31 December 2021: Depreciation Dividends paid Of what…

A: Answer: please fallow the below steps to know the answer 1. CALCULATION OF DEPRECIATION To…

Q: Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has…

A: The predetermined overhead rate is based on the Estimated manufacturing overhead and the estimated…

Q: Richard placed his portfolio of income-producing stock valued at $200,000 into an irrevocable trust.…

A: Grantor-Retained Annuity Trust (GRAT) To reduce taxes on substantial financial contributions to…

Q: Summary data for September 2015 are: Work-in-process, beginning inventory (Sept. 1) Degree of…

A: FIFO Method :— It is one of the method of inventory valuation in which is first inventory is used…

Q: Mahon Corporation has two production departments, Casting and Customizing. The company uses a…

A: Costs associated with operating a firm that cannot be immediately linked to a particular business…

Q: On January 1, 20X4, Pierce Corporation acquired 90 percent of Sharp Company's voting stock, at…

A:

Q: Activity Capacity Management Uchdorf Manufacturing just completed a study of its purchasing activity…

A: Activity capacity is indeed the rate of output of an action over a protracted period of time,…

Q: Sales Inventories at 1 July 2021 Raw materials Work in process Finished goods Inventories at 30 June…

A:

Q: Here are data on $1,000 par value bonds issued by Microsoft GE Capital, and Morgan Stanley Assume…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Compute the missing amounts in the separate income statements A, B, and C. Sales Cost of goods sold…

A: Gross profit can be calculated by deducting the cost of goods sold from sales and the net income is…

Q: Requirements: Record the following transactions for Summer Consulting. Explanations are not…

A: Please see Step 2 for the required information.

Q: The following data pertains to activity and costs for two months:

A: Production cost is the cost incurred by the company on the production process. The production is…

Q: Larker Brothers, Incorporated, used the high-low method to derive its cost formula for electrical…

A: High-low method is used to segregate the total cost into variable cost and fixed cost. It is the…

Q: PROBLEM SOLVING: (show step by step solution) Break-even and target profits. Analysis of the…

A: Break even sales point is the point where is no profit no loss situation. At this point profit is…

Q: Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments:…

A: Predetermined overhead rate is calculated on the basis of the estimated cost and estimated hours,…

Q: Required information [The following information applies to the questions displayed below.] Trio…

A: Introduction: The cost of a product is defined in accounting as the direct material, direct labor,…

Q: Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per…

A: Activity-based costing is used to distribute the unallocated overhead on the basis of activity.…

Q: . The City of Katerah maintains its books and records in a manner that facilitates the preparation…

A: Generally, an organization runs a business for profit. But some organizations are not run for profit…

Q: Apply the tax benefit rule to determine the amount of the state income tax refund included in gross…

A: Income tax: - Income tax is the tax charged upon the total earning of the individual after all…

Q: Given the following unadjusted account information for Delaney Corporation, journalize the adjusting…

A: Adjusting entries are those which are reported in the books at the end of the period in order to…

Q: Administrative expenses Depreciation of plant machinery and equipment Direct labor Direct materials…

A: Introduction:- Product cost comprises sum of all prime costs (direct labor and direct materials) and…

Q: . Contribution margin ratio (Enter as a whole number.) fill in the blank 1 % b. Unit contribution…

A: Answer to the fallowing above three parts a)Contribution Margin Ratio: 32% b)Unit Contribution…

Q: Leon is opening their hair salon and is working on some projections for their sales and expenses.…

A: Cost Volume Analysis :— It is the analysis which is based on marginal costing. This analysis shows…

Q: Karl borrows $200,000 and agrees to pay the principal and interest by making equal payments at the…

A: The equal semi-annual installment is the amount paid by the borrower to the lender every 6 months…

Step by step

Solved in 3 steps

- Statement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Shanika Company for 20Y6: Instructions 1. Prepare the 20Y6 statement of cost of goods manufactured. 2. Prepare the 20Y6 income statement.Bubba Manufacturing Company provided the following information for the fiscal year toJune 30, 2020:Inventories 01/07/2019 30/06/2020Direct MaterialsWork-in-ProcessFinished Goods$72,000107,000149,500$65,000128,000141,700Other information:Office cleaner’s wages 4,500Sales Revenue 1,031,000Raw materials purchased 235,000Factory wages 239,700Indirect materials 23,500Delivery truck driver’s wages 15,400Indirect labor 9,500Depreciation on factory plant & equipment 32,000Insurance 1 60,000Depreciation on delivery truck 7,250Utilities 2 118,750Administrative salaries 41,250Special Design Costs 5,000Selling expenses 9,000Sales Commission 2% of gross profit1 Of the total insurance, 66⅔% relates to the factory facilities & 33⅓% relates to general& administrative costs.2 Of the total utilities, 80% relates to the manufacturing facilities & 20% relates to theoffice area.Requirements:a) What was the amount of direct materials used in production?b) What was the amount of manufacturing…4.The following were taken from accounting records of Bella Company in December 2020.Prime cost, P301,000Gross profit rate on sales, 20%Cost of goods available for sale, P460,000Direct materials purchased, P170,000Work in process, December 1, 2020, P34,000Direct Materials, December 1, 2020, P16,000Finished goods, December 1, 2020, P30,000Factory overhead, 40% of conversion cost.Sales, P500,000Direct labor, P180,000Compute for December 31, 2020: (1) Direct materials inventory; (2) Work in process inventory; (3) Finished goodsinventory: A.(1) P6,000 ; (2) P25,400 ; (3) P30,000B. (1) P49,000 ; (2) P25,000 ; (3) P30,000C. (1) P65,000 ; (2) P25,400 ; (3) P60,000D. (1) P65,000 ; (2) P25,000 ; (3) P60,000

- Raw material purchased OMR150000, opening stock raw material OMR 53000, Paid freight charges OMR 7000, wages paid to labor OMR 40000, closing stock finished goods OMR 15000 and factory overhead is OMR 58000. The cost of goods Manufacturing is:An incomplete cost of goods manufactured schedule is presented here.Complete the cost of goods manufactured schedule for Splish Brothers Company. (Assume that all raw materials used were direct materials.) SPLISH BROTHERS COMPANYCost of Goods Manufactured ScheduleFor the Year Ended December 31, 2022 Work in process, January 1 $243,600 Direct materials Raw materials inventory, January 1 $enter a dollar amount Raw materials purchases 184,000 Total raw materials available for use enter a total of the two previous amounts Less: Raw materials inventory, December 31 27,000 Direct materials used $208,800 Direct labor enter a dollar amount Manufacturing overhead Indirect labor 21,600 Factory depreciation 41,400 Factory utilities 79,600 Total manufacturing overhead 142,600 Total…Account Dollar amount Beginning Materials Inventory $74,323 Purchases ? Materials available for use 151,644 Ending inventory ? Materials used in production 78,413 Work In Process Inventory Beginning inventory 253,210 Materials used in production ? Direct labor 125,900 Overhead applied 94,425 Manufacturing costs incurred ? Ending inventory 242,932 Cost of goods manufactured ? Finished Goods Inventory Beginning inventory 333,149 Cost of goods manufactured ? Goods available for sale ? Ending inventory 354,235 Cost of goods sold ? Prepare the journal entries to record the following events: The purchase of materials The completion of work in process The sale of finished goods (omit the revenue side of the sale)

- Prepare the Income statement of Cambridge Manufacturers for the year ended 31 March 2021using the absorption costing method. INFORMATIONThe following information was extracted from the accounting records of Cambridge Manufacturers for the year ended31 March 2021:Inventory on 01 April 2020 1 000 unitsProduction for the year 30 000 unitsSales for the year (at R240 per unit) 25 000 unitsCosts:Direct materials cost per unit R60Direct labour cost per unit R36Variable manufacturing overheads cost per unit R24Variable selling and administrative costs per unit sold R12Fixed manufacturing overhead cost R696 000Fixed selling and administrative cost R303 200 Additional information¦ The total manufacturing costs per unit for the year ended 31 March 2020 amounted to R130, comprising R110for variable manufacturing costs and R20 for fixed manufacturing costs. The total selling and administrativecosts per unit for the same period amounted to R10.¦ The first-in-first out method of inventory valuation…Marigold Manufacturing Inc.'s accounting records reflect the following inventories: Dec. 31, 2021 Dec. 31, 2022 Raw materials inventory $100400 $79900 Work in process inventory 129200 145300 Finished goods inventory 125600 114000 During 2022, Marigold purchased $949000 of raw materials, incurred direct labour costs of $124200, and incurred manufacturing overhead totalling $159300. Marigold Manufacturing’s cost of goods manufactured for 2022 amounted to $1236900. How much would it report as cost of goods sold for the year? $1361100 $1225300 $1248600 $1248500Ethel Company provided the following information asof May 31, 2020SalesP900,000Finished goods inventory, May 31300,000Work in process inventory,May 31 350,000Raw materials inventory, May 31280,000Finished goods inventory, May 1200,000Work in process inventory,May310,000Raw materials inventory, May250,000Direct labor150,000Factory overhead110,000The average historical gross profit is 30% of salesWhat is the total manufacturing cost? How much was the total raw materials used? How much was the total raw materials purchased?

- Prepare the Income statement of Cambridge Manufacturers for the year ended 31 March 2021 Using the absorption costing method. INFORMATIONThe following information was extracted from the accounting records of Cambridge Manufacturers for the year ended 31 March 2021: Inventory on 01 April 2020 1 000 unitsProduction for the year 30 000 unitsSales for the year (at R240 per unit) 25 000 unitsCosts:Direct materials cost per unit R60Direct labour cost per unit R36Variable manufacturing overheads cost per unit R24Variable selling and administrative costs per unit sold R12Fixed manufacturing overhead cost R696 000Fixed selling and administrative cost R303 200 Additional information¦ The total manufacturing costs per unit for the year ended 31 March 2020 amounted to R130, comprising R110for variable manufacturing costs and R20 for fixed manufacturing costs. The total selling and administrativecosts per unit for the same period amounted to R10.¦ The first-in-first out method of inventory…Practice: The following data are taken from the accounting records of Gregory Mfg. Co.: 2019 2018 Ending inventories: Materials $ 100,000 $80,000 Work in Process $64,000 $56,000 Finished Goods $140,000 $170,000 Manufacturing goods: Direct materials used $657,000 Direct labor costs charged to production $270,000 Manufacturing Overhead $378,000 Show All Calculations: Outline a schedule of cost of goods manufactured for 2019 in good form The company generally prices products adding 20% to the cost of goods sold. Determine the total revenue the company would have generated in 2019.Statement of Cost of Goods Manufactured and Income Statement for a Manufacturing Company The following information is available for Shanika Company for 20Y6: Inventories January 1 December 31 Materials $316,450 $386,070 Work in process 569,610 525,060 Finished goods 547,460 536,640 Advertising expense $262,140 Depreciation expense-office equipment 37,060 Depreciation expense-factory equipment 49,800 Direct labor 594,550 Heat, light, and power-factory 19,690 Indirect labor 69,490 Materials purchased 582,970 Office salaries expense 203,460 Property taxes-factory 16,210 Property taxes-headquarters building 33,590 Rent expense-factory 27,410 Sales 2,729,510 Sales salaries expense 335,110 Supplies-factory 13,510 Miscellaneous costs-factory 8,490 Required: 1. Prepare the statement of cost of goods manufactured. 2. Prepare the income statement.