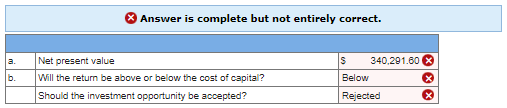

Calculate the net present value of the investment opportunity. (Round your intermediate calculations and final answer to 2 decimal places.) Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted.

Monterey Company is considering investing in two new vans that are expected to generate combined

Required

-

Calculate the

net present value of the investment opportunity. (Round your intermediate calculations and final answer to 2 decimal places.) -

Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images