Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase? Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Machine A Machine B Esquire should purchase PV

Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase? Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Machine A Machine B Esquire should purchase PV

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 17P: The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will...

Related questions

Question

Hiren

Add explanation

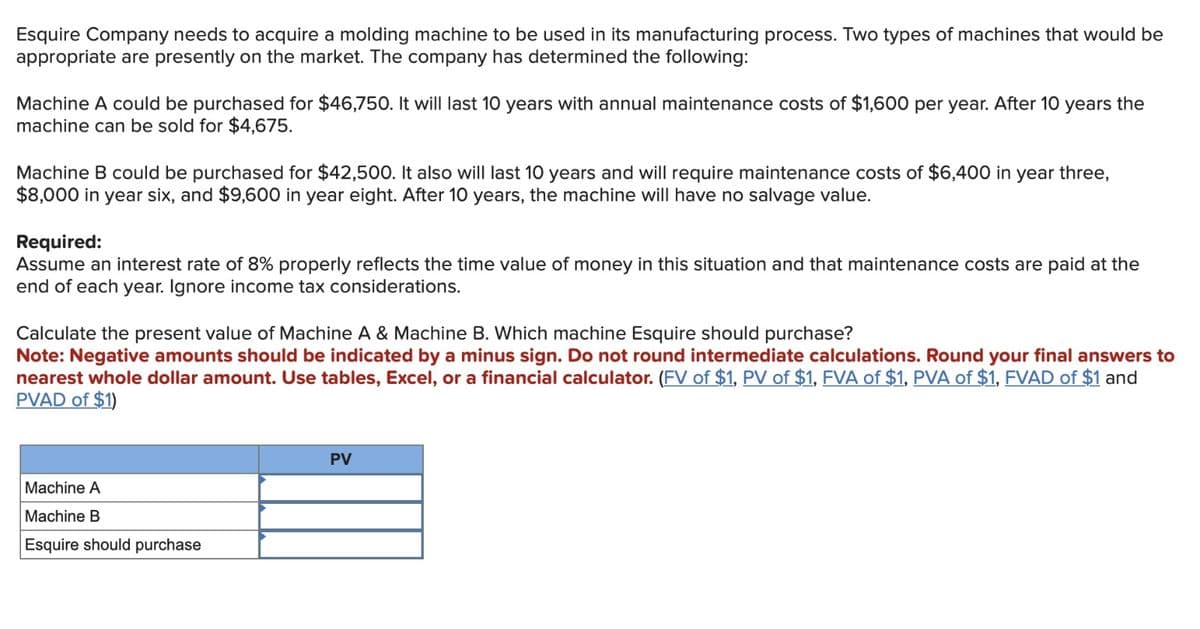

Transcribed Image Text:Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be

appropriate are presently on the market. The company has determined the following:

Machine A could be purchased for $46,750. It will last 10 years with annual maintenance costs of $1,600 per year. After 10 years the

machine can be sold for $4,675.

Machine B could be purchased for $42,500. It also will last 10 years and will require maintenance costs of $6,400 in year three,

$8,000 in year six, and $9,600 in year eight. After 10 years, the machine will have no salvage value.

Required:

Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the

end of each year. Ignore income tax considerations.

Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase?

Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to

nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and

PVAD of $1)

Machine A

Machine B

Esquire should purchase

PV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning