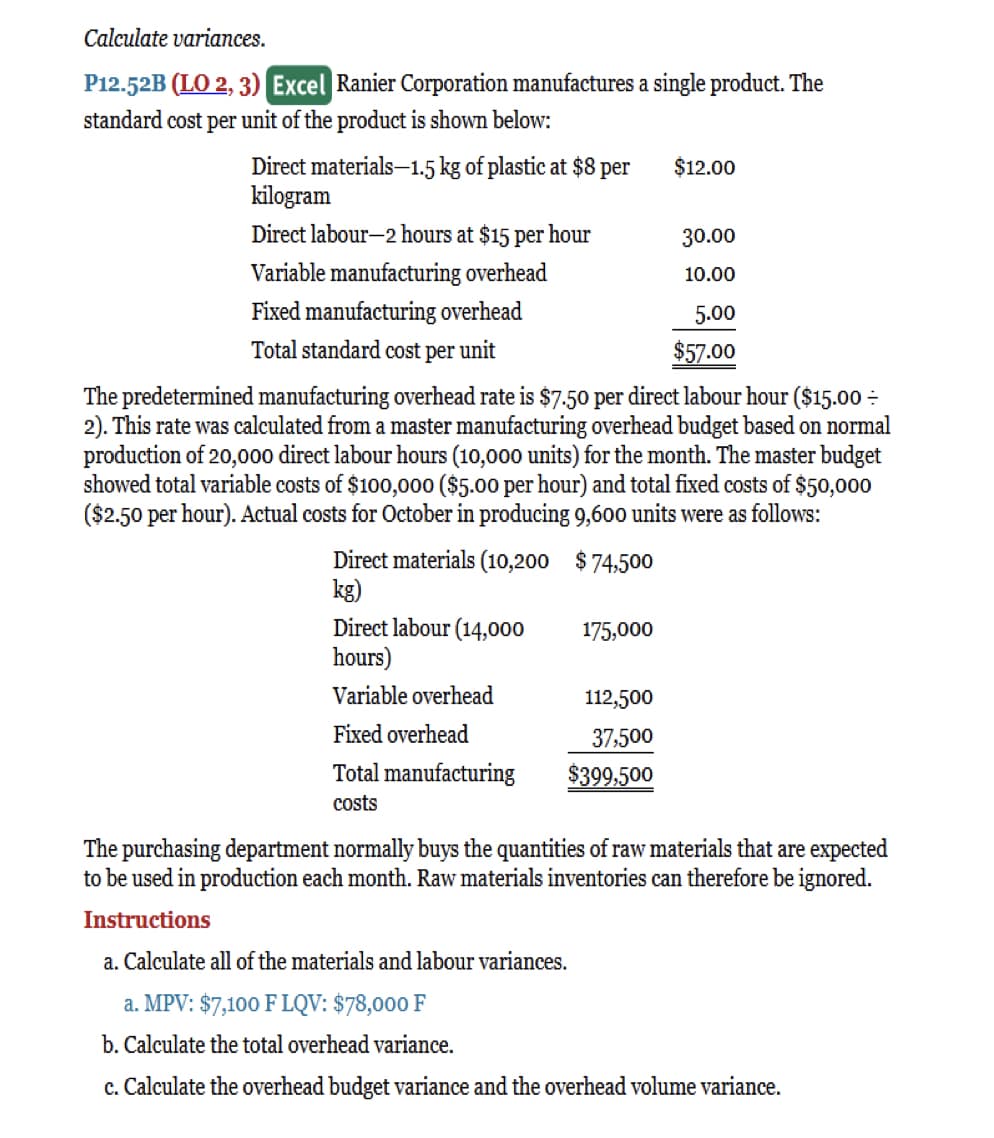

Calculate variances. P12.52B (LO 2, 3) Excel Ranier Corporation manufactures a single product. The standard cost per unit of the product is shown below: Direct materials-1.5 kg of plastic at $8 per kilogram Direct labour-2 hours at $15 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit Direct materials (10,200 $74,500 kg) Direct labour (14,000 hours) Variable overhead The predetermined manufacturing overhead rate is $7.50 per direct labour hour ($15.00 = 2). This rate was calculated from a master manufacturing overhead budget based on normal production of 20,000 direct labour hours (10,000 units) for the month. The master budget showed total variable costs of $100,000 ($5.00 per hour) and total fixed costs of $50,000 ($2.50 per hour). Actual costs for October in producing 9,600 units were as follows: Fixed overhead Total manufacturing costs 175,000 $12.00 112,500 37,500 $399,500 30.00 10.00 5.00 $57.00 The purchasing department normally buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories can therefore be ignored. Instructions a. Calculate all of the materials and labour variances. a. MPV: $7,100 F LQV: $78,000 F b. Calculate the total overhead variance. c. Calculate the overhead budget variance and the overhead volume variance.

Calculate variances. P12.52B (LO 2, 3) Excel Ranier Corporation manufactures a single product. The standard cost per unit of the product is shown below: Direct materials-1.5 kg of plastic at $8 per kilogram Direct labour-2 hours at $15 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit Direct materials (10,200 $74,500 kg) Direct labour (14,000 hours) Variable overhead The predetermined manufacturing overhead rate is $7.50 per direct labour hour ($15.00 = 2). This rate was calculated from a master manufacturing overhead budget based on normal production of 20,000 direct labour hours (10,000 units) for the month. The master budget showed total variable costs of $100,000 ($5.00 per hour) and total fixed costs of $50,000 ($2.50 per hour). Actual costs for October in producing 9,600 units were as follows: Fixed overhead Total manufacturing costs 175,000 $12.00 112,500 37,500 $399,500 30.00 10.00 5.00 $57.00 The purchasing department normally buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories can therefore be ignored. Instructions a. Calculate all of the materials and labour variances. a. MPV: $7,100 F LQV: $78,000 F b. Calculate the total overhead variance. c. Calculate the overhead budget variance and the overhead volume variance.

Chapter8: Standard Costs And Variances

Section: Chapter Questions

Problem 11EB: Fitzgerald Company manufactures sewing machines, and they produced 2,500 this past month. The...

Related questions

Question

Please complete the following question thanks.

Transcribed Image Text:Calculate variances.

P12.52B (LO 2, 3) Excel Ranier Corporation manufactures a single product. The

standard cost per unit of the product is shown below:

Direct materials-1.5 kg of plastic at $8 per

kilogram

Direct labour-2 hours at $15 per hour

Variable manufacturing overhead

Fixed manufacturing overhead

Total standard cost per unit

Direct materials (10,200 $74,500

kg)

Direct labour (14,000

hours)

Variable overhead

The predetermined manufacturing overhead rate is $7.50 per direct labour hour ($15.00 =

2). This rate was calculated from a master manufacturing overhead budget based on normal

production of 20,000 direct labour hours (10,000 units) for the month. The master budget

showed total variable costs of $100,000 ($5.00 per hour) and total fixed costs of $50,000

($2.50 per hour). Actual costs for October in producing 9,600 units were as follows:

Fixed overhead

Total manufacturing

costs

175,000

$12.00

112,500

37,500

$399,500

30.00

10.00

5.00

$57.00

The purchasing department normally buys the quantities of raw materials that are expected

to be used in production each month. Raw materials inventories can therefore be ignored.

Instructions

a. Calculate all of the materials and labour variances.

a. MPV: $7,100 F LQV: $78,000 F

b. Calculate the total overhead variance.

c. Calculate the overhead budget variance and the overhead volume variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning