Calculating and Journalizing Depreciation Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. Purchase Salvage Date Asset Price Useful Life Value Purchased Truck #1 $19,050 8 years $3,930 January 1 Truck #2 24,320 4,000 April 10 Tractor #1 18,010 3,010 May 1 Tractor #2 13,200 6 2,100 June 18 Forklift 38,410 10 3,910 September 1 Required: 1. Calculate the depreciation expense for Johnson Machine as of December 31, 20-. 2. Prepare the entry for depreciation expense using a general journal. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1 Dec. 31 2 2

Calculating and Journalizing Depreciation Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. Purchase Salvage Date Asset Price Useful Life Value Purchased Truck #1 $19,050 8 years $3,930 January 1 Truck #2 24,320 4,000 April 10 Tractor #1 18,010 3,010 May 1 Tractor #2 13,200 6 2,100 June 18 Forklift 38,410 10 3,910 September 1 Required: 1. Calculate the depreciation expense for Johnson Machine as of December 31, 20-. 2. Prepare the entry for depreciation expense using a general journal. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1 Dec. 31 2 2

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 9SPA: CALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Johnson Machine Co. for the year...

Related questions

Question

Transcribed Image Text:Calculating and Journalizing Depreciation

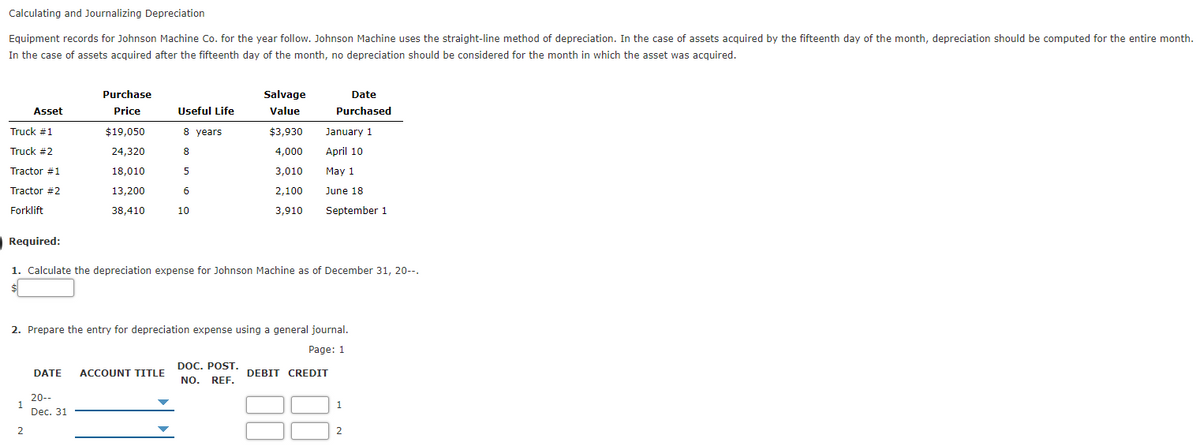

Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month.

In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired.

Purchase

Salvage

Date

Asset

Price

Useful Life

Value

Purchased

Truck #1

$19,050

8 years

$3,930

January 1

Truck #2

24,320

8

4,000

April 10

Tractor #1

18,010

5

3,010

May 1

Tractor #2

13,200

6

2,100

June 18

Forklift

38,410

10

3,910

September 1

Required:

1. Calculate the depreciation expense for Johnson Machine as of December 31, 20--.

2. Prepare the entry for depreciation expense using a general journal.

Page: 1

DOC. POST.

DATE

ACCOUNT TITLE

DEBIT CREDIT

NO. REF.

20--

1

Dec. 31

1

2

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning