The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a used delivery truck for $28,000, paying cash. Nov. 2. Paid garage $675 for miscellaneous repairs to the truck. Dec. 31. Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,000 for the truck. Year 2 Jan. 6. Purchased a new truck for $48,000, paying cash. Apr. 1. Sold the used truck for $15,000. (Record depreciation to date in Year 2 for the truck.) June 11. Paid garage $450 for miscellaneous repairs to the truck. Dec. 31. Record depreciation for the new truck. It has an estimated residual value of $9,000 and an estimated life of five years. Year 3 July 1. Purchased a new truck for $54,000, paying cash. Oct. 2. Sold the truck purchased January 6, Year 2, for $16,750. (Record depreciation to date for Year 3 for the truck.) Dec. 31. Recorded depreciation on the remaining truck. It has an estimated residual value of $12,000 and an estimated useful life of eight years. Journalize the transactions and the adjusting entries. Refer to the Chart of Accounts for exact wording of account titles.

The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a used delivery truck for $28,000, paying cash. Nov. 2. Paid garage $675 for miscellaneous repairs to the truck. Dec. 31. Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,000 for the truck. Year 2 Jan. 6. Purchased a new truck for $48,000, paying cash. Apr. 1. Sold the used truck for $15,000. (Record depreciation to date in Year 2 for the truck.) June 11. Paid garage $450 for miscellaneous repairs to the truck. Dec. 31. Record depreciation for the new truck. It has an estimated residual value of $9,000 and an estimated life of five years. Year 3 July 1. Purchased a new truck for $54,000, paying cash. Oct. 2. Sold the truck purchased January 6, Year 2, for $16,750. (Record depreciation to date for Year 3 for the truck.) Dec. 31. Recorded depreciation on the remaining truck. It has an estimated residual value of $12,000 and an estimated useful life of eight years. Journalize the transactions and the adjusting entries. Refer to the Chart of Accounts for exact wording of account titles.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 6E: Adjusting Entries The following partial list of accounts and account balances has been taken from...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used.

| Year 1 | |

| Jan. 4. | Purchased a used delivery truck for $28,000, paying cash. |

| Nov. 2. | Paid garage $675 for miscellaneous repairs to the truck. |

| Dec. 31. | Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,000 for the truck. |

| Year 2 | |

| Jan. 6. | Purchased a new truck for $48,000, paying cash. |

| Apr. 1. | Sold the used truck for $15,000. (Record depreciation to date in Year 2 for the truck.) |

| June 11. | Paid garage $450 for miscellaneous repairs to the truck. |

| Dec. 31. | Record depreciation for the new truck. It has an estimated residual value of $9,000 and an estimated life of five years. |

| Year 3 | |

| July 1. | Purchased a new truck for $54,000, paying cash. |

| Oct. 2. | Sold the truck purchased January 6, Year 2, for $16,750. (Record depreciation to date for Year 3 for the truck.) |

| Dec. 31. | Recorded depreciation on the remaining truck. It has an estimated residual value of $12,000 and an estimated useful life of eight years. |

Journalize the transactions and the adjusting entries. Refer to the Chart of Accounts for exact wording of account titles.

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legacy Furniture Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Transcribed Image Text:Adjusting Entries

11

11

13

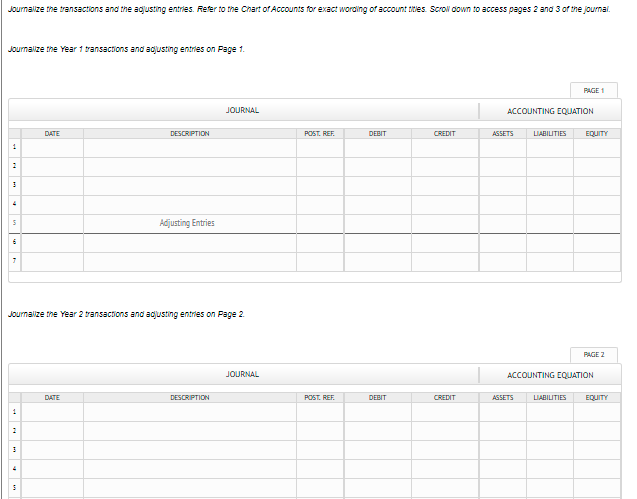

Journalize the Year 3 transactions and acjusting entries on Page 3.

PAGE 3

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

Adjusting Entries

11

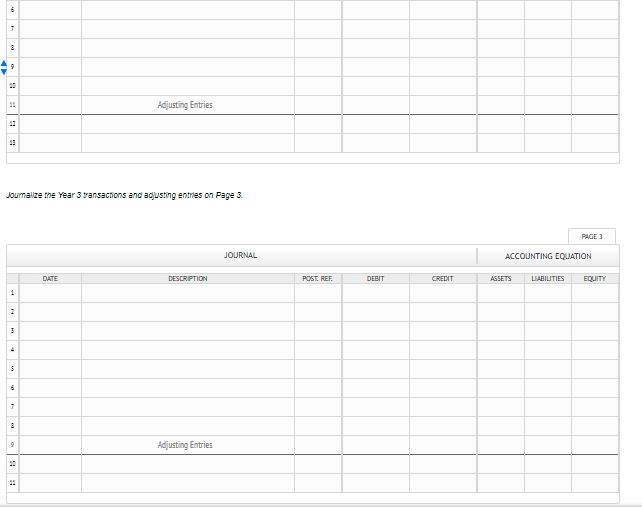

Transcribed Image Text:Journalize the transactions and the aojusting entries. Refer to the Chart of Accounts for exact wording of account ttes Scrol down to access pages 2 and 3 of the journal.

Journalize the Year 1 transactions and adjusting entries on Page 1.

PAGE 1

JOURNAL

ACCOUNTING EQUJATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

Adjusting Entries

Journalize the Year 2 transactions and adjusting entries on Page 2.

PAGE 2

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,