Calculator chapter 8 eBook The following June 30 bank reconciliation was prepared for Poway Co. Poway Co. Bank Reconciliation For the Month Ended June 30 $16,185 Cash balance according to bank statement Add outstanding checks: $575 No. 1067 470 1106 1.050 1110 910 3,005 1113 $19,190 6,600 Deduct deposit of June 30, not recorded by bank 512,590 Adjusted balance $8,985 Cash balance according to company's records Addı Proceeds of note collected by banki Principal $6,000 Interest 300 $6,300 Service charges 15 6,315 $15.300 0685 5,400 Deduct: Check returned because of Insufficient funds Error in recording June 17 deposit of S7.150 as 31,750 6,290 s 9,010 Adjusted belance a. Identfy the errors in the above bank reconci lation. Check My Work Assignment Score: 45.08% Type here to search

Calculator chapter 8 eBook The following June 30 bank reconciliation was prepared for Poway Co. Poway Co. Bank Reconciliation For the Month Ended June 30 $16,185 Cash balance according to bank statement Add outstanding checks: $575 No. 1067 470 1106 1.050 1110 910 3,005 1113 $19,190 6,600 Deduct deposit of June 30, not recorded by bank 512,590 Adjusted balance $8,985 Cash balance according to company's records Addı Proceeds of note collected by banki Principal $6,000 Interest 300 $6,300 Service charges 15 6,315 $15.300 0685 5,400 Deduct: Check returned because of Insufficient funds Error in recording June 17 deposit of S7.150 as 31,750 6,290 s 9,010 Adjusted belance a. Identfy the errors in the above bank reconci lation. Check My Work Assignment Score: 45.08% Type here to search

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.18EX

Related questions

Question

Transcribed Image Text:Calculator

chapter 8

eBook

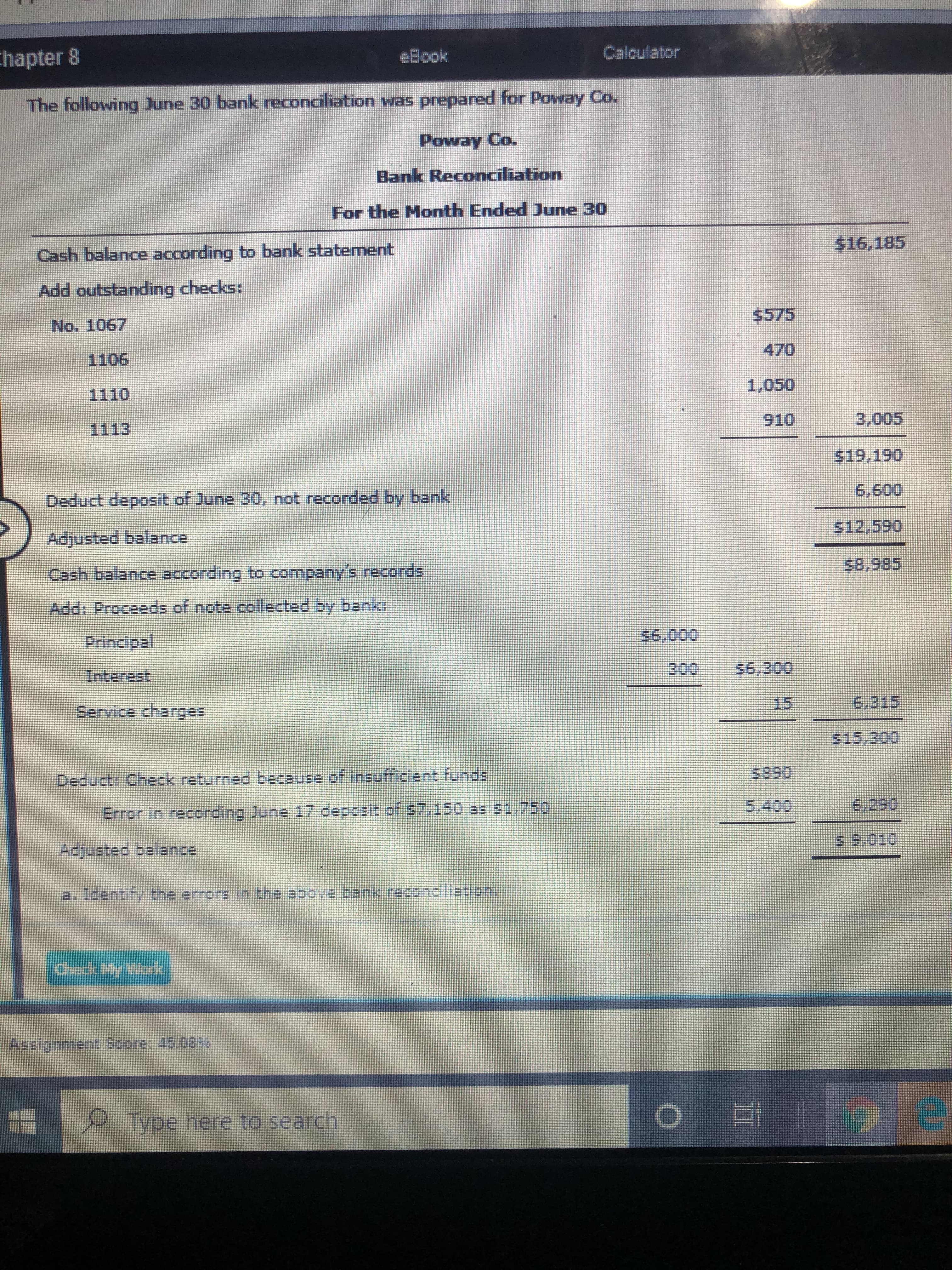

The following June 30 bank reconciliation was prepared for Poway Co.

Poway Co.

Bank Reconciliation

For the Month Ended June 30

$16,185

Cash balance according to bank statement

Add outstanding checks:

$575

No. 1067

470

1106

1.050

1110

910

3,005

1113

$19,190

6,600

Deduct deposit of June 30, not recorded by bank

512,590

Adjusted balance

$8,985

Cash balance according to company's records

Addı Proceeds of note collected by banki

Principal

$6,000

Interest

300

$6,300

Service charges

15

6,315

$15.300

0685

5,400

Deduct: Check returned because of Insufficient funds

Error in recording June 17 deposit of S7.150 as 31,750

6,290

s 9,010

Adjusted belance

a. Identfy the errors in the above bank reconci lation.

Check My Work

Assignment Score: 45.08%

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning