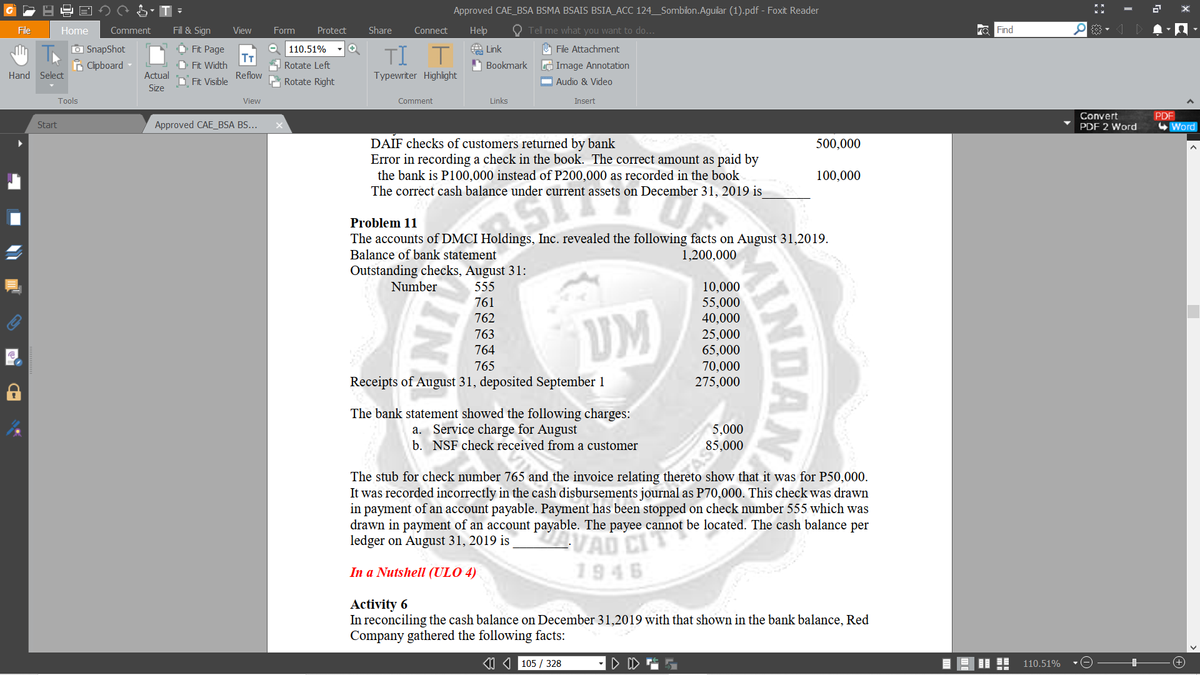

Problem 11 The accounts of DMCI Holdings, Inc. revealed the following facts on August 31,2019. 1,200,000 Balance of bank statement Outstanding checks, August 31: 555 761 762 Number 10,000 55,000 UM 40,000 25,000 65,000 70,000 275,000 763 764 765 Receipts of August 31, deposited September 1 The bank statement showed the following charges: a. Service charge for August b. NSF check received from a customer 5,000 85,000 The stub for check number 765 and the invoice relating thereto show that it was for P50,000. It was recorded incorrectly in the cash disbursements journal as P70,000. This check was drawn in payment of an account payable. Payment has been stopped on check number 555 which was drawn in payment of an account payable. The payee cannot be located. The cash balance per ledger on August 31, 2019 is VAD CI AINDAN NI

Problem 11 The accounts of DMCI Holdings, Inc. revealed the following facts on August 31,2019. 1,200,000 Balance of bank statement Outstanding checks, August 31: 555 761 762 Number 10,000 55,000 UM 40,000 25,000 65,000 70,000 275,000 763 764 765 Receipts of August 31, deposited September 1 The bank statement showed the following charges: a. Service charge for August b. NSF check received from a customer 5,000 85,000 The stub for check number 765 and the invoice relating thereto show that it was for P50,000. It was recorded incorrectly in the cash disbursements journal as P70,000. This check was drawn in payment of an account payable. Payment has been stopped on check number 555 which was drawn in payment of an account payable. The payee cannot be located. The cash balance per ledger on August 31, 2019 is VAD CI AINDAN NI

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 3.10C

Related questions

Question

Transcribed Image Text:Approved CAE_BSA BSMA BSAIS BSIA_ACC 124_Sombilon.Aguilar (1).pdf - Foxit Reader

File

Home

Comment

Fil & Sign

View

Form

Protect

Share

Connect

Help

Tell me what you want to do...

Find

O SnapShot

B Clipboard

O Fit Page

TI T

110.51%

A Link

File Attachment

D Fit Width

D Fit Visible

Rotate Left

Bookmark

Le Image Annotation

Hand Select

Actual

Reflow

Typewriter Highlight

Rotate Right

| Audio & Video

Size

Tools

View

Comment

Links

Insert

PDF

4 Word

Convert

Start

Approved CAE_BSA BS...

PDF 2 Word

DAIF checks of customers returned by bank

Error in recording a check in the book. The correct amount as paid by

the bank is P100,000 instead of P200,000 as recorded in the book

The correct cash balance under current assets on December 31, 2019 is

500,000

100,000

Problem 11

The accounts of DMCI Holdings, Inc. revealed the following facts on August 31,2019.

Balance of bank statement

1,200,000

Outstanding checks, August 31:

Number

555

10,000

55,000

40,000

25,000

65,000

70,000

275,000

761

UM

762

763

764

765

Receipts of August 31, deposited September 1

The bank statement showed the following charges:

a. Service charge for August

b. NSF check received from a customer

5,000

85,000

The stub for check number 765 and the invoice relating thereto show that it was for P50,000.

It was recorded incorrectly in the cash disbursements journal as P70,000. This check was drawn

in payment of an account payable. Payment has been stopped on check number 555 which was

drawn in payment of an account payable. The payee cannot be located. The cash balance per

ledger on August 31, 2019 is

VAD CI

In a Nutshell (ULO 4)

1946

Activity 6

In reconciling the cash balance on December 31,2019 with that shown in the bank balance, Red

Company gathered the following facts:

11 4 105 / 328

D CD

IE II E

110.51%

AINDAN

IN

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you